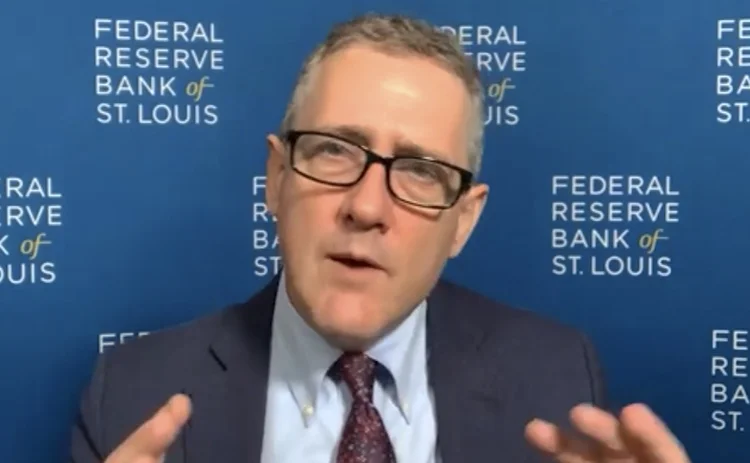

James Bullard on Fed policy, action and governance

St Louis president calls for tapering, quantifies AIT and details Congress’s role in Fed ethics

How would you assess the pros and cons of the introduction of flexible – or, as some might call, asymmetric, informal – average inflation targeting (AIT) by the Fed, so far?

I think it’s been a success so far – and I think it will ultimately be successful. It’s a new programme that has many dimensions to it. And I think will be an improvement on where we were before we did the framework review. This is a situation where the United States is leading the central banking community with a new approach to inflation targeting. If you recall, in the 1990s when inflation targeting was first adopted, it was adopted by New Zealand, and then other countries followed, and the US was a kind of a laggard on actual official implementation – although I would say, post-1995, we were pretty close to having an inflation target and doing inflation targeting. So, this time around, we’re leading. I think that is interesting and different. I think another thing that happened is that we were planning to get the flexible average inflation targeting in place beginning in January of 2020. That timeline got delayed some, and then this big pandemic shock came along. The chair announced it at Jackson Hole in 2020 amidst the pandemic. Unfortunately, that muddied up the waters a little bit from what it would have been if we could have focused on the announcement without having to deal with being in the middle of a crisis. But that’s the nature of this world – you can’t always control events.

Post-1995, [the US was] pretty close to having an inflation target and doing inflation targeting. So, this time around, we’re leading

The other thing has been very surprising, I think, is that this framework is being tested right away in the first year of implementation. One of the things I was worried about after the Jackson Hole announcement, given the fact we were in the middle of this pandemic and a big crisis, is that we would not see inflation above target for many years. And so, the whole idea of allowing an overshoot of inflation would be kind of a moot point and then it may not go very well. But that isn’t what happened. Instead, in 2021, beginning in the spring, we’ve had this big inflation shock. So, now we have actual meat on the bones where we can test the new framework, and we can see how it works. And, I think, it ultimately is going to be successful, but I do think that it’s challenging to have the first implementation be right away in the first year and during a lingering crisis with the pandemic. So, it is all very interesting.

I do think, now, that inflation will overshoot the committee’s target in 2021, and again in 2022 and will slowly converge to 2% from above our inflation target in out years of the forecast horizon. That’s exactly how it’s supposed to work. You’re allowing some overshoot of the inflation target to make up for past misses to the low side. I do think that’s going to happen. But there is a lot of uncertainty around that, and it could go in various directions. It could be that we get too much inflation, too much of an overshoot. But it could also be that, once the pandemic is over, inflation moves sharply back down, and we have to remain aggressive just to keep inflation at 2%. The general theme that the committee is going to be less pre-emptive and less concerned about an overshoot of inflation in an environment where you’ve had undershoots of inflation in the past, I think that part is successful. And the question is: how well can we control that inflationary process over the next three or four years? I think that’s the central question. But as far as getting the overshoot, and getting inflation to actually average 2%, which is a core part of the new framework, I think we are going to get that, and we are going to be successful on that dimension.

In an era of transparency, there appears to be plenty of ‘constructive ambiguity’ around the new framework. What is your understanding of what constitutes an ‘acceptable overshoot’, in terms of both magnitude and duration? For example, between 2012 and 2019, core inflation was averaging 1.4% per year – about 4.2 percentage points under target over the seven years. Is that the approximate amount that inflation could run above target?

People have often asked me “why didn’t you specify the time period?” and “why didn’t you specify the amount of the overshoot?”, and so on. I think the answer to that is that it’s a big policy committee. You’re trying to get unanimous agreement, which we did get around the new framework, and you have to have ‘big tent language’ that allows for different interpretations. So, it is a committee, and it is a committee judgement, and you have to allow for that.

Also, I think pinning things down to precise numerical implementations can get you into trouble. In macroeconomics, we probably just can’t be that precise. We know that new things may develop in the economy that are surprising, and we need to be able to adapt to that. So, I think the idea of laying down some general principles about what we’re trying to do and then let the committee debate that out, kind of jointly with financial markets and constituents across the US and the world, that’s probably the best approach.

As a practical matter, I think you have to have some window over which you think inflation should average 2%, and an index of the price level and the inflation rate that you think is the right one to use. Measurement is a key issue. But the committee has in the past already said that personal consumption expenditures [PCE] inflation is the key measure of inflation. And that the core measure, which throws out food and energy, is one that we’re going to use. I myself have debated whether that’s really the right measure. But I think for the purposes of trying to push this flexible average inflation target framework forward, you have to stick with where the committee is. We could revisit that in the future. But for now, I think we have to very much say: “OK, it’s going to be PCE inflation.”

As to what the window would be? I’ve suggested that a five-year window is realistic: I do think a central bank can control inflation over that long of a time period. And even if you made it seven years or something, you basically get similar answers, anyway. So, I think a rough-and-ready way to look at inflation averaging 2% is just to take your favourite five-year window. Now, that window, you could have it be trailing, you could have it be including the current year and trailing years, you could have it be centred, so that you take the current year as the middle of a centred five-year moving average – all of those might be useful in various ways. The point is to get some management attention on what we are actually averaging over time, and to be able to turn around to our constituents and say: “We really are trying to hit the 2% inflation target, we are really trying to maintain credibility around hitting that over any reasonable window, and we know that shocks come around and that we can’t control it day to day, but over a longer time period, we really do intend to hit 2% inflation.” And then markets can go ahead and price everything accordingly. And, if all works out well, policy will have that much more credibility, and we’ll get that much better of an equilibrium for the economy. So, that might be kind of a rosy scenario, but I do think that this five-year window is at least a starting point for how to think about this.

What additional work needs to be done to ensure there are appropriate metrics for the evaluation of flexible average inflation targeting?

I do think that’s just starting. I would expect a literature to develop on this on the academic side. Then we have lots of research inside the Fed that is starting to think about this issue, and what the perils and the pitfalls might be of targeting this average, instead of inflation expectations in and of themselves. I would say one other thing about flexible average inflation targeting: I think it’s a step toward price level targeting. We were unwilling, I think, to go all the way to price level targeting or to nominal GDP targeting, which I’ve advocated. But it’s a step in that direction. And many models say that what you want to do is really stay on a price level path, and that that will give you a better equilibrium outcome than inflation targeting, because inflation targeting lets bad things happen in the past and just ignores them, and tries to get it right going forward. Whereas price level targeting makes up for past misses. So, that works in a lot of different frameworks. That’s been encouraging to me that this sort of logic is not specific to just some particular model, but is a more general proposition about how to do central banking well. So, we’ll see. But, I think, overall, the idea that we’ve been able to test this right away is interesting and, I hope, will prove successful. And then we might see more across other central banks in the world, if the US experiment is successful.

If you talk to business leaders about their pricing policies, they very much intend to pass on [rising input costs] to consumers in the form of higher prices

You have said that your ‘risk management approach’ to monetary policy indicates the Fed should take current inflation risk seriously – that there is a risk that while inflation may moderate (from around 3.5% core inflation this year), it might not moderate as much as some hope. What are the dynamics here? Can you explain how your risk management approach ties in with AIT?

Our core personal consumption expenditures inflation measured from a year ago is 3.6% right now in the US – that’s the highest we’ve seen in 30 years. So that’s a measure that already throws out food and energy prices, and does some smoothing, because you’re looking over the past year. That’s one that is in the summary of economic projections. So, I’ve been citing that number. The consumer price index numbers are actually somewhat higher, and the headline [PCE] numbers are higher as well, partly because of energy prices. So, we’re seeing quite a bit of inflation compared to what we’re used to over the last decade or more. And I think the mindset is that – among everybody that’s involved in policy and financial markets, and businesses and consumers – that everyone’s kind of struggling because the environment has changed very quickly here in the US, just in the last six months.

It does look like it’s going to be more persistent than some might have expected. Initially, I think some expected, after the March and April numbers in 2021, that “oh, well, this is going to be just a couple of months and then this will all go away”. But that doesn’t seem to be what’s happening. I think you’re seeing input costs rising, basically, for all businesses across the board. And if you talk to business leaders about their pricing policies, they very much intend to pass that on to consumers in the form of higher prices. And, so far, they have not indicated much hesitancy or inability to do that. You had this earlier era when people running businesses were very hesitant to raise prices, because they thought they would immediately lose market share – they’d have one of their competitors swoop into their market and take their market away from them. But that mentality has changed very quickly. I found that somewhat alarming that a new dynamic could be in place where, yes, input costs are going up, including labour costs, but firms are still making a lot of money because they can just pass that on in the form of higher prices. So, I hope we don’t get into that kind of dynamic. But I do think it’s a risk.

And so, the risk management approach to me would be to try to assess once the taper gets done in the US, sometime in the second quarter of next year, where will the economy be? And what kind of position does monetary policy have to be in at that point, in order to run a good monetary policy. And if inflation moderates and goes back down to 2%, I think we’re well positioned for that. We’ve got our policy rate, you know, at the effective lower bound, and expected to remain there until we decide to go ahead with a lift-off and a moderate increase in rates. I think we’re in great position in the scenario where inflation naturally moderates by next spring. What we’re not in good position for is if inflation doesn’t moderate as much as expected, or we get a new shock – let’s say, in the first quarter of next year – and inflation actually goes higher. Those would be scenarios in which we’d be not in very good shape. And I wanted to push the committee to get in better position in case that occurs. I don’t want to put 100% probability on the possibility that inflation will just come down naturally. I’m willing to put maybe 50% of the probability on that scenario. But I want to put some probability on another scenario where inflation is higher than expected next year and seems to be more persistent, and then we have to start doing something to keep inflation under control. So, to me, that’s the risk management approach. Instead of putting 100% probability on inflation moderating, this will only put some on that and some on this other scenario, and then let’s position monetary policy so that if this other scenario does occur, we don’t have to be disruptive to the global economy and to the US economy, because we have to move very quickly to get inflation under control.

Is that what you mean when you’ve been talking about ‘optionality’ – to taper now and get it done by the end of the first quarter of next year, and then figure out how inflation stands: is it moderating or not?

There’s a presumption that we wouldn’t raise the policy rate while the tapering is going on, and I think we certainly had that view the last time around during the recovery from the global financial crisis. So, I think you want to get done with the taper and the asset purchases. At that point, you can assess what the situation is, and you can talk about the date of lift-off, which will become the key policy variable at that point. Again, if inflation has moderated, then we’d have optionality to say: “OK, we don’t need to lift-off, and we won’t lift off for quite a while.” But if we get the other scenario, then we could say “OK, we’re going to pull the date of lift-off sooner, and possibly move faster”, to make sure we don’t let this inflation process get away from us, and to make sure that we get inflation moving back toward 2% at the appropriate pace. So, to me, that’s the ‘optionality’.

What impact is fiscal policy having on Fed thinking? Former US Treasury secretary Larry Summers estimated the US output gap was about $30 billion a month this year and that current stimulus has injected the equivalent of about $200 billion a month. The implication is that there is a high likelihood the economy is running too hot. What is your assessment, and does it factor into decisions?

National income in the US is higher than the pre-pandemic level – and this is in an environment where the pandemic isn’t even over yet. Going into the pandemic, many people would not have believed that that was possible. But that’s the situation that we’re in. And not only that, but output and national income are poised to go above the trend line that you would have drawn from 2018–2019. So, we’re going to have a better economy in output and national income terms than we would have had if they just continued on the trend line and not had a pandemic at all. So that’s a bit of a ‘head-scratcher’, as to how we are assessing the state of affairs for the US economy, given that observation. That’s going to happen just in the next couple of quarters here in the US, given current estimates of future GDP growth.

One of the things that has happened – and has been in some ways very successful – during the pandemic is fiscal policy. And I think the best indication of this is personal income. So, let me just back up a minute for people that aren’t following the US economy as closely during the pandemic, but the fiscal policy, especially in March and April of 2020 at the beginning of the pandemic, was – people didn’t use this phrase, but my phrase is – ‘to keep households whole’. So, you wanted to make sure that all these disrupted households, because of the pandemic, were able to pay their bills and rent, and were able to put food on the table during the pandemic, while we’re asking them to go home and not work, so that we can get the public health situation under control. We’ve estimated at the St Louis Fed at the beginning of the pandemic, anywhere between 30 to 50 million jobs were in that kind of category. It was a very, very large group of people. But, lo and behold, despite dysfunctional politics in the US, the fiscal package was passed, it got out there to households very rapidly, and if you look at personal income, which is the income households actually get, it’s above the 2018–2019 trendline. Again, households are more ‘flush’ than they would have been had there been no pandemic at all. This is what has allowed the US economy to perform so well, in the face of all this human tragedy around the pandemic.

Because households have had enough resources to consume and to save – and they’ve saved a lot of this, some people cite a $3-trillion number compared with US annual GDP of about $20 trillion. This is a lot of cash sitting around in bank accounts around the country. So, this has all been very successful, and was just the right thing to do to get us through the pandemic part. But it also means that you have this fiscal impetus going forward. And that’s what’s driving a lot of the ideas about why the economy’s going to continue to boom through 2021 and into 2022 – all of that’s despite the third quarter of this year that just completed I think being a weak quarter because of the Delta variant in the US. But the big picture is that we’re expecting to have lots of growth going forward as the economy continues to grow. This fiscal impetus is very strong. Monetary policy, despite tapering and everything, is actually quite easy, and it’s going to be quite easy for some time. I’ve got growth for 2022 pencilled in at 4.5%, which is more than double the potential growth rate of the US economy. So, lots of good things on the horizon, as we expect the pandemic to come under better and better control going forward.

The natural thing to predict for 2022 is that you’ll have a very strong economy, and I think that’s the right way to view where we are in this pandemic

You touched on those latest US figures: so, you’re attributing the economic weakness to the spread of the Delta variant. But it sounds like you think it is a fairly temporary phenomenon – is that correct?

On Delta and the pandemic itself, I have a couple of observations. It is a crisis, and it remains a crisis. But this is the post-vaccine era of the crisis. And vaccines are readily available across the country in the US. Anyone that wants one can get it fairly easily. I think in the spring, we would have thought that we would get to higher levels of vaccination than we have. But it’s a big country, and there are lots and lots of people. It was probably unrealistic to think that you can get everybody vaccinated quickly. What has happened is that the Delta variant has spread. We do have a core measure of the intensity of the pandemic – deaths per day per million. During the initial part of the crisis, in the spring of 2020, that was about a seven. In the winter of 2021, it was a 10 – so it was more intense at that point. And this latest wave has turned out to be a 6 on that scale. That’s pretty high: that’s more intense than I and many would have expected, given that vaccines were readily available during the third quarter. This is waning now, confirmed cases are falling in the US, hospitalisations are falling, and ICU beds used are falling. The fact that this Delta wave has hit has caused more people to want to get vaccinated. So, that’s picking up. And then I would emphasise to readers that the technology to control the pandemic is not stopping: it’s instead going to be accelerating going forward. There are going to be more and more things that are going to bring this pandemic under better and better control in the US. Pills seem to be on the horizon. You’ve got vaccines for children, which seem to be on the horizon. You’ve got booster shots, which are being administered today, and will surely pick up even more in the future. You’ve probably got some rising natural immunity going on. There are a lot of factors, at least from a macroeconomic perspective, that would suggest this is going to come under better and better control. That’s going to allow the economy to do even better – it’s actually doing very well, but it’s going to do even better going forward. So this seems like the natural thing to predict for 2022 is that you’ll have a very strong economy, and I think that’s the right way to view where we are in this pandemic.

What would be the likely impact on unemployment of an easing of loosening measures – now that the Fed, following the strategy review, is committed to reducing ‘shortfalls’, rather than ‘deviations’?

The criteria for the taper was that we made substantial further progress from December of last year. I think unemployment was 6.7% last December and now, after today’s jobs report, it’s 4.8%. That is a really substantial decline in unemployment over that kind of time horizon. On average, before this jobs report – it’s actually gone up a little bit – but unemployment was falling about two-tenths per jobs report in the US, now even a little bit faster. If that continues through next spring, you’ll be at a very low unemployment rate, certainly with a three-handle, by the time you get to the end of the first half of next year, certainly below the pre-pandemic unemployment rate of 3.5%, which was itself one of the lowest unemployment rates observed in decades in the US. You just have to say this is a very strong labour market in the US. I’ve been emphasising the unemployment-to-vacancies ratio, which is at an all-time low in the US: so, lower than the late 1990s market, which was one of the best we ever had; lower than the 2006/2007 jobs market; and lower than the values even in 2018/2019. If you’re in the US and drive around, you see huge banners on businesses, warehouses and factories saying “we’re hiring”, “[offering] hiring bonuses, click on this”. You’re certainly seeing businesses really struggling to hire workers. They always say it’s hard to hire workers, and you kind of get sick of that in this business, but this is fundamentally different. They really are scrambling. A lot of businesses have to cut back on hours or services because they just don’t have enough workers. So, I really think it’s a very hot jobs market. You’re seeing that in signing bonuses, retention bonuses and just outright increases in wages. All of that’s occurring right now. And I would also encourage anybody that’s reading this to think about their wider circle of friends and family – you probably have somebody there that has had trouble in the job market or who has not been able to get into the job that they want. I would encourage you to talk to them and say: “Hey, go get vaccinated, and go get a job right now because now is the time when you can get paid well, and you can get matched up with an employer that’s right for you and set yourself up for the next couple of years.” It’s really, I think, an exceptional job market for workers that are searching for work right now.

The St Louis Fed’s real-time labour indicators were highly accurate during the initial Covid shock. How have they performed since?

Early in the crisis, we started to look at real-time data from other sources to try to predict what would happen with jobs reports. And, in the spring of 2020, there was a historic moment when Wall Street was expecting about a 10-million decline in jobs, and instead it was a 3-million increase in jobs. Our forecast got that right. There’s a funny story around that. It was presented here ahead of that jobs report at a little briefing seminar, and it said: “We’re looking at some new data, and looking at what it predicts about the jobs report.” It said “we’re going to predict plus 3 million”, and Wall Street was at a minus 10 million. And we said: “Well, I guess this isn’t working very well.” But it turned out to be exactly right. After that, we got a lot of attention on that and on other real time measures.

Now, since then, that accuracy has tailed off. There are issues with exactly what you’re tracking. A lot of the reason that worked is because it was tracking smaller trends in smaller institutions, smaller businesses, and so on. But since then, you’ve had big business coming back on and you’re not tracking that part as well with this data. So, I think it was helpful for a while, but maybe not a panacea. I would say the general trend toward a wider set of data, taking advantage of the internet and the big data world that we live in to get more continuous measures of the economy, that’s been a general trend, and a good one that has come out of this pandemic. It could really help us going forward. A lot of the measurements that we use are dated and it’s been done the same way for decades. But in this new world, you should be able to really get more real-time data on the economy, be able to track it better in real time, make adjustments in real time, so that you’re not getting caught by some big miss or some misconception that’s going on at some point in time. That’s been a little bit of a silver lining, I think, that the pandemic has pushed us more, as macroeconomists, in that direction.

You provided your current forecast for GDP growth for this year. What are your growth expectations for 2022 and 2023, and your inflation predictions for this year, 2022 and 2023?

Real GDP of 4.5% for next year, and then declining after that back to the trend growth rate. But I would say growth would still be above the trend growth rate for several years after that – maybe not a lot above, sort of the low-2% range or something in the out years, but still above the trend growth rate. And I would say on the real [economy] side that I’m encouraged by the possibility that productivity growth will pick up in the US because of better diffusion of technology during the pandemic. We saw high productivity growth in the US between 1995 and 2005. It had a tremendous impact on the US economy, especially in the late 1990s, where the US economy grew at plus 4% for many years in a row. But then productivity growth fell to a lower level, just over 1% productivity growth in the time since 2005. And that also had a big impact on the US economy, with very sluggish growth coming out of the global financial crisis. I’m now encouraged that we might be switching back to the high growth productivity regime, which would be much faster productivity growth in the US.

And there’s a good story about why that might be happening, which is that the pandemic really scrambled businesses and forced them to innovate. And it is continuing, with labour shortages and supply issues causing further innovation in US businesses. This means technology projects that probably should have been done five years ago are getting dusted off and implemented rapidly. That should lead to better productivity improvement. That’s part of the reason why I think the real side of the economy can continue to grow rapidly for several years. This is really looking like a boom period for the US economy. Even though we’re at a speed bump right now, coming off the third quarter of 2021, but still the outlook is very good as we continue to come out of this pandemic.

Now, on the inflation side, as I said before, the core PCE inflation is about 3.6%, measured from a year ago right now. I think we put down 3.8% for all of 2021 on core PCE inflation, and then we had that declining to 2.8% in 2022, and then declining further from there down to 2%. The idea is that you’re overshooting right now, probably more than pretty much anybody expected, but that with appropriate monetary policy, we’ll be able to bring that back down to 2%. Now, over a five-year window, that probably means we’d average somewhat more than 2% if that scenario really pans out. So, you could ask questions about how that fits in with the average inflation targeting framework. But I just think that that’s probably the more realistic forecast, at this point.

If you look at the history of inflation shocks in the US, you get the big shock, and then it dissipates slowly. You don’t usually get the big shock and then it just goes right back down. The other point I would like to emphasise is that people say: “Well, this is a supply shock, and therefore, once lumber prices start to fall, or something, this is all going to go away.” But you can’t get inflation just because one price goes up. Inflation is when all the prices go up. If just one price goes up, then firms and households will substitute away from that particular good or service, toward all other goods and services. The expenditure shares will change, and the overall price level won’t change because of that. So, it’s really that there’s a supply shock in combination with a very accommodative monetary policy – that can cause inflation. And in the past, when we’ve had supply shocks and they’ve led to inflation, it’s because of that process. And that seems to be exactly what we have here. We have a supply shock coming out of the pandemic, coupled with very aggressively easy monetary policy by design that was intended to allow inflation to go above target and was intended to try to help as much as we could during the pandemic, and has been successful. But you’ve got the big supply shock and you’ve got the easy monetary policy combined. That’s what causes the inflation. It is not just the supply shock by itself. I think that will only dissipate slowly. That’s my outlook for inflation over the forecast horizon.

How comfortable are you that the Fed will be able to remove McChesney Martin’s ‘punchbowl’ when needed, given it could struggle to find new buyers of Treasuries, higher interest rate may put pressure on the government’s ability to pay off record-high peacetime debt, and there could be changes in the composition of the members that will vote on the Federal Open Market Committee?

Well, of course, I’m perfectly confident that we’ll be able to do this in a smooth way that does not disrupt US or global financial markets. And part of that process is to be thinking ahead, debating as we go, and getting all viewpoints, and talking to a wide variety of constituents, from financial market participants and bankers to small businesses and minority communities – those who have been disenfranchised, I think, in the past. We want to do the best we can across the whole spectrum of the US economy. And I think the transparency and constant communication that has been the hallmark of the Fed in the last 15 years or so is the best way to approach that. I do think we’ll be able to execute things very well. One thing about having a big committee is that you do have new members coming on from time to time, but you also have people that have been around for quite a while, and you have an excellent staff that does fantastic analysis for us. So, you get a lot of discussion, a lot of analysis and a lot of management attention. I think, overall, that leads to quite good policy over time. I expect that process to continue going forward. You know, we’re always shading our positions a little bit, depending on how data is coming in, and so on. I think that is an excellent process, and we’ll continue that going forward.

We talked last year about former Fed chair Janet Yellen highlighting shortcomings in the regulation and supervision of the non-bank sector. Now she is Treasury secretary and chairs the Financial Stability Oversight Council, have any improvements been made? Is the FSOC becoming more effective?

I would agree with the Treasury secretary very much that we need to focus in the US on non-bank financial regulation. The rule of thumb that you hear about the US, depending on how you measure it, is that the banks are only doing about 20% of the intermediation in the US economy, and 80% is occurring through other channels, which are less regulated or not regulated at all. The other thing to always emphasise in this discussion is that we did have a financial crisis in 2007–09, but that originated in the non-bank financial sector. Probably, whatever financial crisis lies out there in the future is going to come from the unregulated sector, not from the regulated part of the intermediation services businesses. You’ve also got Silicon Valley broadly speaking, innovating as they do – and that’s a wonderful thing – but they’re innovating in a space that is essentially regulatory arbitrage, getting around the rules and regulations that have been set up over the decades. I don’t think Congress has been fast to react to that. I think that secretary Yellen has exactly the right intuition about this, that we really have to do better, and focus more and think more about regulating the non-bank financial sector. Part of this is: what’s the future of cryptocurrency?; what’s the future of decentralised finance?; and even ‘how could you go about setting up things before you get into some kind of crisis or some kind of very disruptive situation?’. Her analysis is very much in the right place. I think she’s the right type of person to really drive this, potentially, going forward. But I don’t have any insight into specifics about what she might be able to do.

Do you think that the US should launch a digital dollar? If so, under what sort of timeframe?

The Fed is studying this, and we’ve got initiatives at various places in the Fed. The chair has said that we’re going to release a white paper on this issue shortly. Members, including me, have given speeches about all our ideas about cryptocurrency and so on. I’ll talk a little about some of the themes that I’ve emphasised. I gave a talk to a CoinDesk conference in New York City about three years ago. The things said there are basically the same issues that we have today. First, for cryptocurrency, it’s not so much that it is electronic, but that it’s a privately issued currency and it’s going to compete with publicly issued currencies. Now, there are lots of publicly issued currencies in the world because all these different nations have their own currencies. They tend to be traded at volatile rates against one another – that’s why I called my talk ‘Non-uniform currencies and exchange rate chaos’. What’s happening is that these privately issued currencies are trying to compete with publicly issued currencies. And you’re getting very volatile exchange rates between the privately issued and the publicly issued. So that’s very consistent with our historical experience about currency competition. Historically, the biggest economy has the strongest currency. That was certainly true with the British Empire, and before that with the Netherlands. That’s the historical experience. I would think that the dollar would continue to be dominant. But the cryptocurrencies can trade because they can facilitate transactions that would be hard to execute with a publicly issued currency. There are places where you may have regulatory arbitrage going on, you may have illegal goods, and I think a simple example that everyone understands is cross-border transactions, which tend to be very difficult to execute. You can arbitrage around regulations that exist by using these cryptocurrencies. So, it makes sense that these currencies are circulating. They are providing some new channels to complete transactions. You may not like some of the transactions, or you may feel like those transactions are evading laws that are in place. But that explains why some of these currencies are trading and why these exchange rates are so volatile. I think that this is a major issue for central banks to be considering. It’s not clear to me that central bank digital currency, which would not have the anonymity features of a privately issued currency, is going to really change this equilibrium that I’ve just described. But that’s being studied, and we’ll come up with a good plan in the future.

There have been some questions around governance regarding the Fed recently. The recent resignations and speculation around some of the trading activity of vice-chair Richard Clarida. I am wondering what you make of it all. Has the Fed changed any of its rules for trading activities ever since large-scale asset purchases came into play? Have you, yourself, been asked to change your disclosures in any way recently?

The way this works is that Congress is a big policy-making organisation, and they have to set the ethics standard for themselves. Of course, they’re considering tax changes and regulatory changes all the time. So, they set the ethics standard. Then, whatever standard they set, that spreads out to all the other agencies in Washington out to the reserve banks. What we’re doing today is giving statements on finances, according to these rules. Then, ethics officers are looking at those and checking them against the standard set by Congress. One of the things that happened here is that the things that were in question had been signed off on by ethics officers – so, we are meeting the standard that’s been set by Congress. What Congress could do is raise the standard for themselves. Then that would spread out to all of us, and we would have to take that on board and we would take it on board. I don’t know if that’s going to happen or not. But I would look to leadership from Congress to, if they want to change the ethics standards, to go ahead and change it for themselves. Now, they have visited this many times over the years, and so maybe now is the time that they would change it, I don’t know. But I think it’s up to us to definitely meet that standard and do all we can.

Are there any changes personally that you would advocate seeing during this period of review of the Fed’s ethics guidelines? Are there certain extra restrictions that would make sense for officials who are voting at the Fed?

I love input, and I love a review. And I think the Office of Inspector General at the Board of Governors will be responsible for conducting a review. I’m sure good things can come out of that process. But this basic dynamic has to be what it is: it’s whatever Congress thinks the ethics should be for themselves, and then that has to go out to all the creatures of Congress – we’re a creature of Congress. And you’re going to have to have this process where ethics officers are looking at financial statements and they’re saying: “OK, this meets the standard or not.” I don’t think you can have something that is a ‘grey standard’, which isn’t the official standard. All you can do is say: “Well, this is what Congress said, we’re going to meet the official standard, and that’s going to be that.” If Congress wants to change it, then they should change it. And that would be great. And then we’ll meet that standard.

Biography – James Bullard

James Bullard is president and CEO of the Federal Reserve Bank of St Louis. He oversees all activities of the 8th Federal Reserve District. Bullard has run the St Louis Fed, which he joined as an economist in 1990, for more than a decade. This year, he is an alternate member of the Federal Open Market Committee and will be a full voting member in 2022.

The text version of the interview with James Bullard on October 8 contains some light editing

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com