James Bullard

Judy Shelton on gold, tariffs and where the Fed went wrong

The potential successor to Jerome Powell discusses why she thinks the Fed is too powerful, why her stance on gold is not a ‘crank’ position, and why she feels events have vindicated her and president Trump on the need for rate cuts

Banknotes: October to December 2022

A round-up of news and salient issues that have affected central bankers in the past three months

Fed raises rate as Powell hints at further rises

Data suggests Fed will need to hike higher than previously expected, chair says

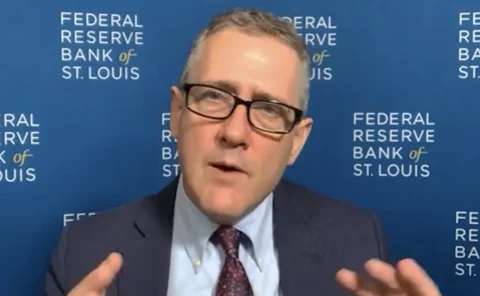

St Louis Fed president appeared at private Citigroup event

Media was not invited to October 14 talk by FOMC member Bullard

US and European policy-makers feel ‘vindicated’ over aggressive hikes

QT may deserve a slower approach than traditional policy, says Jacob Frenkel

Economy’s ‘first responders’ now in the line of fire

Forceful but late interventions to combat inflation raise the risk of central bank overreactions

Williams also expects US to avoid recession this year

Unemployment will likely rise to 4% as growth slows due to tightening process, says NY Fed head

Fed’s Evans and Bullard downplay recession risks

Both presidents looking to increase the policy rate to around 3.5% by the end of the year

Fed mulls tightening on scale not seen for decades

FOMC members now contemplating 50bp rate hikes and major asset sales

Tackling surging inflation

Central banks around the world are grappling with rapid price rises, with some taking very different routes to one another

Fed and ECB officials point to different policy directions

US officials see a rate hike in 2022 as increasingly likely, while eurozone governors rule that out

Fed’s Bullard believes a ‘five-year window’ for AIT is ‘realistic’

St Louis Fed president says “big tent language” was a reason overshoot details were not specified; “precise numerical implementations” can “get you into trouble”

James Bullard on Fed policy, action and governance

St Louis president calls for tapering amid “exceptional” job market and risk of “more persistent” inflation, quantifies ‘big tent language’ for pioneering AIT move, and details Congress’s role in Fed ethics oversight

Fed launches standing repo facilities

Facilities to be open to foreign central banks and domestic primary dealers; FOMC keeps policy on hold

James Bullard on the Fed’s policy review, FSOC and forecasting jobs data

St Louis Fed president discusses his support for average inflation targeting, his concerns about US Treasuries market function, non-bank regulatory weakness and negative rates, as well as the unexpected success in using Homebase data to predict highly…

Covid-19 policy-making and the need for high-speed data

High-frequency data holds the promise of speed and adaptability, but the rush to find alternative economic indicators has the potential to create problems

US unemployment could hit 32%, St Louis Fed says

Unemployment insurance claims see greatest ever post-war rise

FOMC members appear split as meeting nears

Rosengren says “no immediate” need to cut, while Bullard urges Fed to take “aggressive” steps

Bullard says Fed may need to cut rates ‘soon’

Market-implied probability of a cut in September now above 80%

The winners of the 2019 Central Banking Awards

MAS wins central bank of the year, Karnit Flug awarded governor of the year and Zhou Xiaochuan recognised for lifetime achievement; 23 other awards announced

Fed taking cautious stance on rate path

Incoming Fed officials signal there may be a rate-hike pause