Spreads

Full ‘postmortem’ on QE yet to be written – Klaas Knot

Former DNB governor expects Fed to continue international monetary diplomacy under Warsh

Yield spreads of bonds held by mutual funds decline in QE – ECB paper

Bond purchase programmes compress risk premia and boost demand, research finds

The battle for the future of central banks

Inflation-targeting institutions must not simply defend against overt interference, they must also resist a sly erosion of their authority, writes Biagio Bossone

Tobias Adrian on the integrated policy framework amid tariff shocks

The IMF’s financial counsellor speaks about policy reaction functions to supply and demand shocks, scenario-based analyses, Treasury market dynamics and emerging market resilience

Reflections on the international financial situation

Former IMF head Jacques de Larosière writes that markets are blind to Trump's policy shocks that are fragmenting the monetary ‘system’, causing strain in the eurozone and may result in stagflation

Maurice Obstfeld on the trade war’s damage to the monetary system

The former IMF chief economist speaks about Trump’s chaotic economic policies, the erosion of Fed independence and dollar stability, difficult policy trade-offs for central banks, and the threat to the Bretton Woods institutions

Inside the week that shook the US Treasury market

Rates traders on the “scary” moves that almost broke the world’s safest and most liquid investment

US Treasury volatility highlights repo market risks

Yields spiked overnight as tariffs came into effect, piling pressure on heavily leveraged hedge funds

Can Bessent lower 10-year yields? Investors have their doubts

Unconventional tools won’t sway bond markets, say buy-siders, with yields as likely to go higher as lower

Beyond the benchmark: redesigning emerging market debt allocations

Franklin Templeton analysis shows popular EMD indexes are limited by their focus on the largest and most developed countries in the world, resulting in unattractive spreads and limited risk diversification

Central banking amid uncertainty and Trump 2.0

Deglobalisation set to challenge the central banking orthodoxy of the past 40 years

Vix spike in August not driven by actual volatility – BIS

Latest bulletin explains how widening bid-ask spreads drove up the index

Lending spreads may dampen monetary policy – research

Rate hikes appear to have been muffled and cuts might be too, say Kansas City Fed authors

Full-scale war with Hezbollah is a tail-end event – Bank of Israel deputy

Andrew Abir says central bank has advised government to ensure adequate fiscal space as it expects war to last longer and revises its growth and inflation forecasts

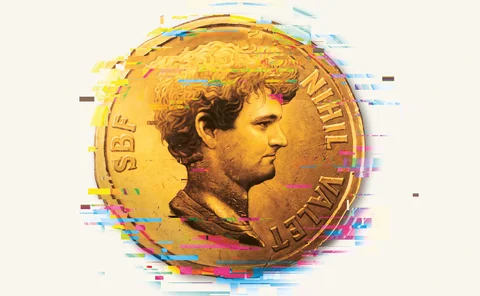

Book notes: Number go up: inside crypto’s wild rise and staggering fall, by Zeke Faux

The book would be a great, comic obituary of crypto, if only crypto were dead

Ghana’s Ernest Addison on the chain of events that led to a loss of $5 billion

The Bank of Ghana governor speaks with Christopher Jeffery about what necessitated monetary financing, the boundaries of ‘independence’ and the results of offline tests of the e-cedi

Asian bond spreads with US not widening, BIS research finds

Central banks’ actions have decoupled EME bonds from stronger dollar, researchers say

Joachim Nagel on the ECB’s terminal rate, fiscal policy, model relevance and the digital euro

The Deutsche Bundesbank president speaks about compromise on the Governing Council, rolling back PEPP, the need to implement Basel III and the chances of a revised Stability and Growth Pact

Ecuador approves contingent credit line

Flar offers up to $230 million to Central Bank of Ecuador

The rise of non-SDR currency reserves

New Cofer data release may show an overall fall in FX reserves, writes Gary Smith

The ECB’s collateral conundrum

A lack of high-quality collateral in the eurozone has resulted in money market rates lagging ECB policy rates, hampering monetary policy transmission