Financial crisis

Single and dual mandates often result in same policy – Schnabel

AI productivity boom yet to show up in eurozone data, ECB board member adds

Repeat of past mistakes fuels risk of new crisis

Jesper Berg and Hans Geeroms argue that bank lobbying has succeeded in securing a dangerous softening of rules

Full ‘postmortem’ on QE yet to be written – Klaas Knot

Former DNB governor expects Fed to continue international monetary diplomacy under Warsh

US stock crash would be ‘felt across the world’ – BdF deputy

Current account imbalances cannot be solved unilaterally, argues Bénassy-Quéré

Life insurers increasingly exposed to systemic risk – BoE paper

Authors say European firms’ ‘non-traditional activities’ may call for new regulation

China could trigger Treasuries selloff to punish US – paper

Beijing might sustain short-term self-harm to undermine US assets’ safe haven reputation, authors say

Collateral velocity is disappearing behind a digital curtain

Dealers may welcome digital-era rewiring to free up collateral movement, but tokenisation will obscure metrics

Bowman’s Fed may limp on by after cuts

New vice-chair seeks efficiency, but staff clear-out could hamper functions, say former regulators

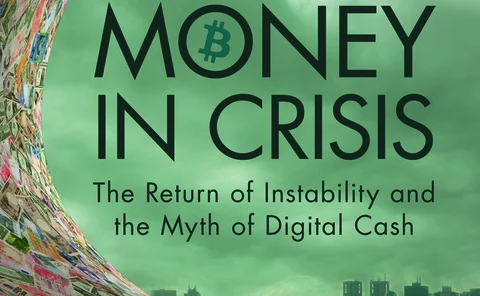

Book notes: Money in crisis, by Ignazio Angeloni and Daniel Gros

This book should be essential reading for policy-makers at a time of uncertainty and technological change

Eurozone bank uncompetitiveness a ‘myth’ – Schnabel

Regulations have made lenders better, says ECB board member

BIS points to ‘structural transformations’ in markets

Quarterly review cites higher volatility and gold losing its status as a safe haven asset

US banks hoping for end of DFAST global market shock

As Fed consults on stress-test reform, lobby group argues regulator is double-counting market risk

BIS paper proposes simpler Basel capital framework

Authors say ‘capital stack’ is too complex and does not provide enough resilience to some shocks

‘Imaginations are running wild’ – Nagel on AI

Europe is prepared for a financial downturn, Bundesbank president says

Stress-test transparency: how much is too much?

The transparency drive to disclose bank stress-test results comes with costs

Working group minutes: central banks face balance sheet challenges

Some institutions are struggling to absorb large amounts of excess liquidity

Former Kansas City Fed chief sounds alarm over banks’ leverage

Hoenig says largest lenders are not adequately capitalised for their risks

IMF to provide Sri Lanka with additional $347m in financing

Mission chief says central bank should continue to be independent and build reserves

Interest rate risk rules need more work, says Fed’s Barr

Former vice-chair for supervision also says his redraft of Basel III would have softened NMRFs

News coverage drove 2023 US bank runs – NY Fed study

Equity investors only became attuned to lenders’ weak fundamentals after mass panic began

DFAST monoculture is its own test

Drop in frequency and scope of stress test disclosures makes it hard to monitor bank mimicry of Fed models