Christopher Jeffery

Editor-in-chief, Central Banking Publications

Christopher Jeffery is Editor-in-chief of Central Banking. He has a global role and is responsible for Central Banking’s editorial content and teams, which includes the Benchmarking Service and Central Banking Journal. He has more than 20 years of journalistic experience covering asset management, banking, central banking, derivatives, economics, finance, fintech, payments, public policy, risk management and strategy. Now based in London, Chris has previously worked in both the Americas and Asia. Chris is Co-founder of the Central Banking Benchmarking Service and Founder of the Central Banking Awards. He was previously Editor of Asia Risk; Deputy Editor, European Editor and News Editor of Risk.net; and Managing Editor at Lafferty Publications.

Follow Christopher

Articles by Christopher Jeffery

Rule-setters need to heed their own advice

The US risks a reputation for failing to meet standards to which it holds others

IMF’s Adrian on the systemic threat posed by a ‘weak tail’ of financial institutions

The IMF’s financial counsellor speaks to Christopher Jeffery about bank runs and emergency interventions, market and oversight failings, and the need for action on run rate assumptions, interest rate risk, deposit insurance, crypto regulation and a ‘weak…

A troubling trilemma

Central banks need to tread a fine line as they serve as the economy’s police, fire brigade and paramedics

BoT’s Sethaput on inflation dynamics, central bank mandates and multi-lateral payments

The Bank of Thailand governor speaks with Christopher Jeffery about the trend towards higher inflation, the sustainable finance challenge, experiments with CBDCs and governance issues related to multi-lateral payments

Stefan Ingves on leadership, prudential oversight and transparency

The Riksbank and Basel Committee veteran speaks about his leadership philosophy, Basel III deal-making and concerns about regulatory rollback, the value of QE and negative rates, and the need for a legal architecture for CBDCs

Gilts debacle exposes financial stability risks

Lurking leverage in liability-driven UK pension investments raises important questions for central bankers

Armenia’s Galstyan calls for a new framework to tackle uncertainty and nonlinearities

Central Bank of Armenia governor says central banks can start to regain credibility by admitting their mistakes. This could include employing a risk-management approach to monetary policy aimed at avoiding nonlinear ‘dark corners’ and placing much less…

Chile’s Costa on tackling inflation, forex interventions and nowcasting

The Central Bank of Chile governor speaks about stubbornly high prices, Fed policy spillovers, reserve buffers, retail CBDC and the need to address unconscious bias

Economy’s ‘first responders’ now in the line of fire

Forceful but late interventions to combat inflation raise the risk of central bank overreactions

Morocco’s Jouahri on inflation, forex reform, digitalisation and sustainability

The Central Bank of Morocco governor speaks with Christopher Jeffery about Covid-19 policies, Fed tightening, BIS membership, regional co-operation and financial inclusion

Fractures in the monetary system

Seizure of Bank of Russia assets likely to have long-term implications for international system

Diego Labat on policy normalisation, capital flows and tech challenges

The Central Bank of Uruguay governor speaks with Christopher Jeffery and Ben Margulies about governance, financialisation, flexible rates versus capital controls, payment upgrades and CBDCs

Pierre Wunsch on inflation, forward guidance and policy tightening

The National Bank of Belgium governor speaks about over-reliance on central bank models and forward guidance, the impact of energy costs and inflation expectations, and the need to unwind unconventional monetary policies

Tackling surging inflation

Central banks around the world are grappling with rapid price rises, with some taking very different routes to one another

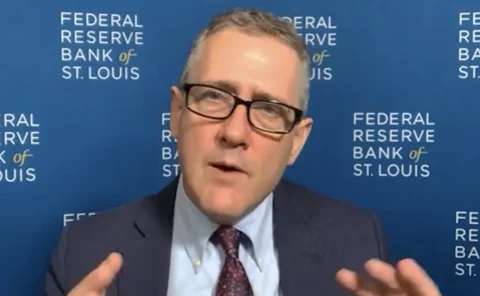

Fed’s Bullard believes a ‘five-year window’ for AIT is ‘realistic’

St Louis Fed president says “big tent language” was a reason overshoot details were not specified; “precise numerical implementations” can “get you into trouble”

James Bullard on Fed policy, action and governance

St Louis president calls for tapering amid “exceptional” job market and risk of “more persistent” inflation, quantifies ‘big tent language’ for pioneering AIT move, and details Congress’s role in Fed ethics oversight

Covid-19, crypto and climate weigh on global economy – GFSR

Central banks face difficult “intertemporal trade-offs”; poorer nations unlikely to regain pre-Covid growth levels for “many, many years”, says IMF’s financial counsellor Tobias Adrian

Crypto asset transactions hit ‘macro critical levels’ – IMF GFSR

Crypto valuations “already systemic” in “many countries”, international rules "probably some time away", says IMF’s Adrian

Larry Summers on stagflation risks, lessons from Delphi and never-ending ‘punch’

The former US Treasury secretary speaks about fiscal ‘overexpansion’, Fed/Treasury debt discord, the pitfalls of ‘unknown unknowns’ and central bankers ‘unable’ to remove the ‘punchbowl’

Agustín Carstens on BIS strategic priorities, innovation and central bank policy

The BIS general manager speaks about policy trade-offs at critical time, tackling NBFIs and the dearth of ‘green’ assets, tech collaboration, and why he favours Biden’s $3.5trn infrastructure bill

Too great expectations from the ECB’s strategy review

The review process represents operational best practice, but will fail to unify the Governing Council

Charles Goodhart on inflation targets, financial stability and the role of money

The LSE professor says inflation targets should have been 0%, the Fed’s move to AIT is a mistake, independence is under threat from inflation, big balance sheets support liquidity, AI can help supervisors and climate stress tests are unconvincing

The Belt and Road Initiative 2021 Survey – The impact of Covid‑19 on the BRI

The fourth annual Belt and Road Initiative survey reveals that the Covid‑19 pandemic has disrupted many projects despite China remaining committed to financing the initiative, which is expected to support future economic growth and environmental…