Christopher Jeffery

Editor-in-chief, Central Banking Publications

Christopher Jeffery is Editor-in-chief of Central Banking. He has a global role and is responsible for Central Banking’s editorial content and teams, which includes the Benchmarking Service and Central Banking Journal. He has more than 20 years of journalistic experience covering asset management, banking, central banking, derivatives, economics, finance, fintech, payments, public policy, risk management and strategy. Now based in London, Chris has previously worked in both the Americas and Asia. Chris is Co-founder of the Central Banking Benchmarking Service and Founder of the Central Banking Awards. He was previously Editor of Asia Risk; Deputy Editor, European Editor and News Editor of Risk.net; and Managing Editor at Lafferty Publications.

Follow Christopher

Articles by Christopher Jeffery

Alpana Killawala on communications under six governors at the RBI

The former RBI comms chief speaks about the importance of strategic communications, courting the media, open mouth operations and altering a governor’s ‘rock star’ image

Campos Neto on inflation targeting, independence and the future of financial intermediation

The Brazilian governor speaks with Christopher Jeffery about tackling inflation, the need for financial autonomy, and redefining the financial landscape with open finance, programmable Pix, deposit tokenisation and sound cross-border payments governance

BNM’s Rasheed on inflation, growth and currency performance in emerging markets

Bank Negara Malaysia’s governor speaks about balancing inflation and growth, supporting the ringgit, multilateral currency settlement and greening Islamic finance

Masaaki Shirakawa on his ‘unease’ about 2% inflation targets and lessons from Japan

The former Bank of Japan governor speaks with Christopher Jeffery about the need to properly understand the business of banking, making sound contingency plans and the BoJ’s current policy constraints

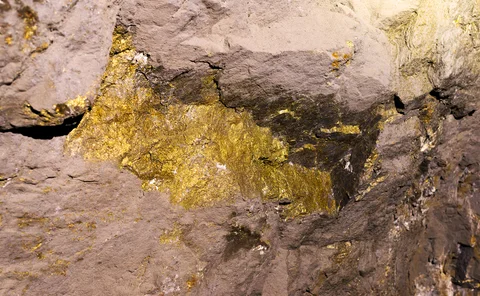

Four central banks commit to responsible artisanal gold principles

Colombia, Ecuador, Mongolia and the Philippines commit to principles aimed at guiding domestic small-scale, gold-buying schemes

Lkhagvasuren Byadran on geopolitics, gold and 100 years of central banking on the steppe

Bank of Mongolia governor Lkhagvasuren Byadran speaks about monetary and financial reform, embracing AI and fintech, and Mongolia’s new SWF

Are low-level inflation targets still fit for purpose?

Geostrategic shifts make the case for a narrow price target less compelling

BIS’s Zhang Tao on why Asian central banks favour a broader policy mix

The BIS’s Asia chief speaks with Christopher Jeffery and Jimmy Choi about supporting liquidity, financial stability and innovation in the Asia-Pacific region

A new climate of change

Central banks are warming up to address climate risks just as US interest cools

Richard Byles on Jamaica’s inflation-targeting baptism of fire

The Bank of Jamaica governor speaks with Christopher Jeffery about forex interventions, setting up digital disruptor banks and the next steps for Jam-dex

Ghana’s Ernest Addison on the chain of events that led to a loss of $5 billion

The Bank of Ghana governor speaks with Christopher Jeffery about what necessitated monetary financing, the boundaries of ‘independence’ and the results of offline tests of the e-cedi

Policy-making amid war in Gaza

Bank of Israel has implemented a textbook crisis response, but uncertainty remains

Karnit Flug on the Bank of Israel’s emergency responses and challenges ahead

The former Israeli central bank governor and current vice-president of the Israel Democracy Institute speaks with Christopher Jeffery about the BoI’s targeted emergency responses, economic uncertainties and central banking independence

The ECCB’s Timothy Antoine on currency union, cooperation and DCash 2.0

The ECCB governor speaks with Christopher Jeffery about maintaining a currency zone, addressing climate and cyber risks, the decline in correspondence banking and lessons learned from issuing a retail CBDC

IMF’s Adrian says world needs $5 trillion annual climate funding by 2030

Multilateral banks working to ‘crowd in’ private finance to meet need

Joachim Nagel on the ECB’s terminal rate, fiscal policy, model relevance and the digital euro

The Deutsche Bundesbank president speaks about compromise on the Governing Council, rolling back PEPP, the need to implement Basel III and the chances of a revised Stability and Growth Pact

A ‘unified ledger’ and the future of money

Blueprint set out by the BIS staff raises plenty of questions about the 'singleness of money'

Stefan Ingves on central bank failings on inflation and financial stability

The Riksbank veteran speaks about liquidity, interest rate and non-bank regulatory reforms, the importance of saying ‘no’, and the need for explicit legal definitions for digital money

Guillermo Avellán on BCE independence, capacity-building and dollarisation

Central Bank of Ecuador general manager speaks about the need to bolster the central bank’s legal autonomy, dollarisation challenges, payments developments and monetising local gold production

Senad Softić on governance, currency boards and EU convergence challenges

Central Bank of Bosnia and Herzegovina governor speaks about improving governance in a political vacuum, managing a currency board amid rip-sawing euro rates, resolving Gazprom’s local units, modernising payments and meeting EU convergence criteria

Ukraine’s governor on central banking in wartime

Andriy Pyshnyy talks about macroeconomic stability, running banks under missile attack, winning IMF aid and post-war reconstruction plans

RBI’s Shaktikanta Das on financial sector reform, sticking to inflation targets and the e-rupee

The Reserve Bank of India governor speaks about developing credible self-insurance and sizeable FX reserves, inter-dependence with government, non-bank and bank regulatory reforms, demonetisation, rupee internationalisation and daily UPI payments hitting…