Christopher Jeffery

Editor-in-chief, Central Banking Publications

Christopher Jeffery is Editor-in-chief of Central Banking. He has a global role and is responsible for Central Banking’s editorial content and teams, which includes the Benchmarking Service and Central Banking Journal. He has more than 20 years of journalistic experience covering asset management, banking, central banking, derivatives, economics, finance, fintech, payments, public policy, risk management and strategy. Now based in London, Chris has previously worked in both the Americas and Asia. Chris is Co-founder of the Central Banking Benchmarking Service and Founder of the Central Banking Awards. He was previously Editor of Asia Risk; Deputy Editor, European Editor and News Editor of Risk.net; and Managing Editor at Lafferty Publications.

Follow Christopher

Articles by Christopher Jeffery

A return of the inflation monster?

There are fears that a shift in intellectual approach towards running economies ‘hot’ could herald a return of the money-eating inflation era

Benoît Cœuré on CBDCs, stablecoins and central bank fintech co-operation

BIS Innovation Hub chief voices concerns about the timing of stablecoin and CBDC roll-outs, fintech risks for supervisors and monetary policy, and details development plans for eight innovation locations

Zhang Tao on the IMF’s fintech agenda, CBDCs and big tech oversight

IMF deputy managing director speaks about the fund’s perspectives on CBDC operating frameworks, regulating big tech and macrofinancial oversight in a digital world

A bellwether moment for CBDC plans

The launch of the ‘sand dollar’ may herald a new era of CBDCs as the Fed and ECB step up their preparations

Mário Centeno on monetary-fiscal interaction in the eurozone

Bank of Portugal governor says ECB is not being overrun by former finance ministers, must improve the definition of its inflation target and has no need for yield curve control. Centeno believes NextGenerationEU fund could serve as template for a future…

Ulrich Bindseil on the launch of the digital euro

The ECB’s director-general for market infrastructure and payments speaks about the functionality, tiering approaches, privacy policies, ledger technology and ecosystem impact of the eurozone's planned CBDC

Hernández de Cos on ECB policy, crises responses and Basel reform

Spanish governor and Basel Committee chair Pablo Hernández de Cos favours a form of average inflation targeting, says ECB is willing to boost stimulus and Basel reforms not diminished by Covid-19 exceptions; stresses the need for structural reform and…

The dawn of average inflation targeting

The Fed has failed to explain how it will calculate the ‘average’ for its new AIT framework, raising new risks that central bankers would do well to reflect on

Otmar Issing on the art of central bank communications

EMU architect speaks about Draghi’s “whatever it takes” intervention, forward guidance failures, the Fed’s average inflation target ‘miscommunication’, and why the ECB may be overreaching in its strategy review

Olli Rehn on AIT, market neutrality and EU fiscal policies

The Bank of Finland governor talks about the ECB’s strategy review, market failure on climate change, lessons from the sovereign debt crisis, and the Draghi legacy effect on Covid-19 responses

Georgia’s Gvenetadze on implementing an aggressive reform agenda

The National Bank of Georgia governor speaks about efforts to improve monetary policy, financial infrastructure, financial literacy, transparency and ESG

Reserve Benchmarks 2020 report – charting new data frontiers

Perspectives on staffing and salaries, reserve coverage, portfolio construction, benchmarking, use of external parties and risk management

- Benchmarking

Central Banking’s strategic changes for a new era

New institute, benchmarks, virtual training and online event weeks launched

Klaas Knot on ECB policy-making, the FSB and central bank ‘capture’

DNB president talks about the temporary nature of unconventional policies, the importance of inflation target ‘bands’, the role of central banks as ‘circuit-breakers’ and ECB decision-making under Christine Lagarde

James Bullard on the Fed’s policy review, FSOC and forecasting jobs data

St Louis Fed president discusses his support for average inflation targeting, his concerns about US Treasuries market function, non-bank regulatory weakness and negative rates, as well as the unexpected success in using Homebase data to predict highly…

Fears rise over breakdown in Basel and IFRS standards

Bretton Woods institutions worried about growing divergence in capital and accounting standards as credit impairment tsunami looms; US and many emerging economies skirting the rules

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

Campos Neto on reforming Brazil’s economy amid Covid-19 distress

The Central Bank of Brazil governor speaks about how Brazil is managing fallout from the coronavirus pandemic, the benefit of large reserves, his plans to deploy emergency asset purchases and why he favours extending the IMF’s SDR funding

Libra’s Disparte on big tech’s move into digital currency

Libra Association vice-chair Dante Disparte speaks about the decision to abandon a multi-currency reserve, stress-testing a global payment network and how the Facebook-backed body still has 3 billion customers in its sights

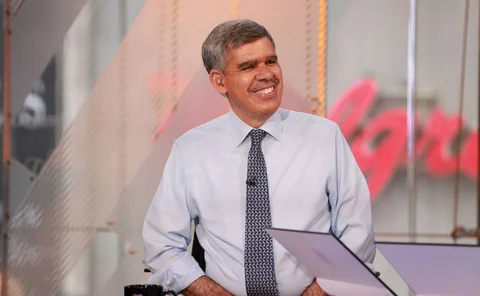

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

BoE launches package of Covid-19 response measures

UK central bank cuts policy rate and countercyclical capital buffer, and unveils measures to support lending

Inflation targets back in the spotlight

Monetary policy can do little to offset the impact of Covid-19

Ghana’s Addison on banking reform, innovation and the future of the eco

The Bank of Ghana governor speaks about the next steps in banking reform and why West Africa may need more time to start using a common currency

Paul Volcker, 1927–2019

The Fed chair made his name battling inflation, and left his mark on independence and post-crisis financial regulations