Christopher Jeffery

Editor-in-chief, Central Banking Publications

Christopher Jeffery is Editor-in-chief of Central Banking. He has a global role and is responsible for Central Banking’s editorial content and teams, which includes the Benchmarking Service and Central Banking Journal. He has more than 20 years of journalistic experience covering asset management, banking, central banking, derivatives, economics, finance, fintech, payments, public policy, risk management and strategy. Now based in London, Chris has previously worked in both the Americas and Asia. Chris is Co-founder of the Central Banking Benchmarking Service and Founder of the Central Banking Awards. He was previously Editor of Asia Risk; Deputy Editor, European Editor and News Editor of Risk.net; and Managing Editor at Lafferty Publications.

Follow Christopher

Articles by Christopher Jeffery

Patrick Njoroge on reshaping banking and finance to work for the masses

The Central Bank of Kenya governor speaks to Christopher Jeffery and Rachael King about exchange rate intervention, food prices, banking reform and financial inclusion

Google’s Hal Varian on how technology is changing economics

Google’s chief economist talks to Christopher Jeffery about how big data and machine learning are facilitating changes in economic thinking; discusses the impact technical breakthroughs may have for central banks

Google chief economist Hal Varian offers machine-learning insights

Varian says use of single-factor equilibrium models needs to give way to dynamic state approaches; he urges central banks to experiment, even though this will result in some failures

Productivity puzzles and the neutral rate of interest

Monetary policy frameworks should be subjected to internal and external reviews to ensure they remain fit for purpose

Sponsored forum: Tapping into big data's potential

Central Banking convened a panel of experts to discuss how central banks can harness big data for their needs, hopefully without falling foul of some of the many pitfalls that await.

Investors should not be concerned about revote – Kenya’s Njoroge

Central Bank of Kenya governor is confident whoever wins presidential revote will pursue market-based policies

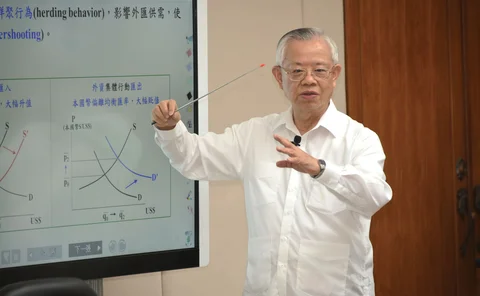

Perng Fai-nan on how Taiwan has eluded crisis for 20 years

Taiwan’s governor explains how pragmatic interventions have engendered two decades of financial stability, despite the island’s status as a small, open economy

Diversifying reserves carries major risks, warns Taiwan governor

Perng Fai-nan points to the records of Norway and Singapore’s SWFs as a warning about diversification risks; blames SWF outsourcing to asset managers for exacerbating EM volatility

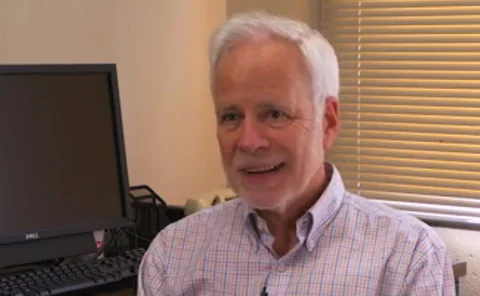

Banks ‘still groping toward’ macro-pru transparency – Eichengreen

Central bank governance expert says central bank transparency is getting better around the world, although New Zealand, Argentina and some Central American institutions could make improvements

Eichengreen supports calls for FOMC to hold more press conferences

Governance expert says Fed is one of the most transparent central banks in the world but improved consistency of format around FOMC meetings “makes sense”

John Williams on the neutral rate of interest and mandate change

The president of the Federal Reserve Bank of San Francisco speaks about the plunge in the natural rate of interest, and why it means central banks should work together to review their price stability targets

Fed’s Williams floats co-ordinated shift from 2% targets

San Francisco Fed president is concerned that extraordinary, ‘beggar-thy-neighbour’ monetary policies will be more frequent in a lower-growth world

Indonesia considers new riskier tranche for reserves – Budianto

Head of reserves says political risks are more of a worry than portfolio flows; explains how Bank Indonesia’s strategy reinforces market development in 30-minute interview

Brexit drives a wedge between BoE and markets

Market expectations of future UK interest rates appear out of line with views expressed by the Bank of England’s Monetary Policy Committee. It comes at a time when Brexit ‘news’ often trumps economic data

Bullard raises concerns about east coast dominance of the Fed

St Louis Fed president is not worried about the major shake-up of the board of governors; points to reducing the influence of the New York Fed on the FOMC

St Louis’s Bullard on the future of the Fed and its monetary policy record

St Louis Fed president James Bullard rails against east coast dominance, favours aspects of the Choice Act and says Fed monetary policy was a “factor” that fuelled crisis

Are central banks allowing markets to get a bad name?

Dispute over the role of offshore derivatives trading in Asia raises important questions about the role of financial markets in a world increasingly dominated by short-term trading

Indonesian banks will switch to reserves averaging in July

Latest move in Bank Indonesia’s major overhaul of monetary policy transmission and efforts to deepen financial markets

Indonesian deputy Perry on revolutionising monetary and financial policy

Perry Warjiyo explains the central bank’s radical overhaul of monetary policy operations, market deepening and financial inclusion in Indonesia

Tackling the ‘human agency’ problem

Central banks are readying their communication strategies to mitigate a populist backlash against their post-crisis policies

Kohn worried about weight of expectations on Federal Reserve

The weight of expectations on the US Fed may be too high; the US is not as well placed as the UK to tackle another major crisis, says the former Fed vice-chair

Former Fed vice-chair Kohn on populism, top central bankers

Donald Kohn speaks to Christopher Jeffery about his fears for the Fed amid mounting populism, why he has few policy regrets and his experiences working with some of the world’s top central bankers

Croatia’s Vujčić on tackling NPLs and home-host supervision

Croatian National Bank governor Boris Vujčić explains why dealing firmly with NPLs via a ‘provisioning clock’ does not choke growth while detailing the benefits of ‘home-host’ dialogues, such as the Vienna Initiative

Ukraine’s Gontareva on one of the toughest jobs in central banking

The outgoing National Bank of Ukraine governor speaks about transforming the central bank while engaging in wartime deficit funding and overhauling the banking sector