Regulation

Supervisors widely use suptech tools for data collection and validation

AI use is growing but remains much less widespread than suptech

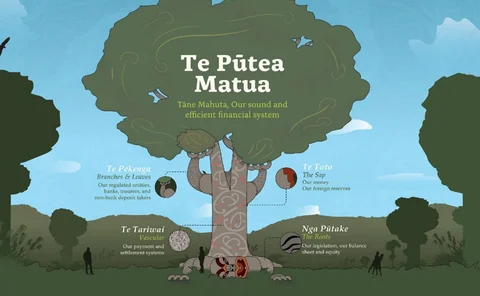

RBNZ pushes back implementation of deposit-taker regulations

Central bank says rules will now come on line in December, rather than July, of 2028

Resolution framework update planned by 56% of supervisors

Non-central bank supervisory authorities less likely to have bail-in powers

BoE delays implementing new market risk framework until 2028

Finalising it could be “tenuous dream”, says expert

Taiwan asks foreign traders to improve FX compliance

Central bank says it is considering new regulations amid currency speculation concerns

Collateral pre-positioning reported in half of jurisdictions

Most supervisors believe banks are ready to access emergency central bank liquidity

CBI’s approval of Israel bond prospectus was illegal – Irish lawmaker

Gary Gannon claims bank’s actions misled investors about risks and were in breach of country's Genocide Act

Supervisors report low adoption of newer global standards

High income supervisors more likely to have regulations in place

Former OCC chief on the sting of peeling the Basel III ‘onion’

Michael Hsu warns successors not to cut bank capital or neglect rate risks that destroyed SVB

Tobias Adrian on the integrated policy framework amid tariff shocks

The IMF’s financial counsellor speaks about policy reaction functions to supply and demand shocks, scenario-based analyses, Treasury market dynamics and emerging market resilience

Book notes: Central banking at the frontier, by Thammarak Moenjak

This well-structured book provides a comprehensive overview of the challenges digitalisation poses for finance and includes possible actions for central banks

Three in five supervisory authorities publish oversight outcomes

Majority of respondents release supervision details in annual report

Digitalisation is top strategic priority for supervisors

Majority of supervisors have a strategy document but only half make them public

Fed succession planning: will Trump stick to the script?

The race to succeed Jerome Powell as head of the world’s most powerful central bank has already begun

Supervisors review banks’ asset quality at varied frequencies

Middle income supervisors tend to review assets more often than high income counterparts

Singapore fines financial firms $21.5 million for AML breaches

MAS punishes nine institutions, including Credit Suisse and UBS, and 18 individuals over 2023 case

Boris Vujčić on Croatia’s economic journey, the digital euro and the Governing Council

The Croatian National Bank (HNB) governor speaks with Christopher Jeffery about managing financial risks, the pros and cons of euro adoption, payment system reform and the use of real-time data

Systemic banks prioritised in onsite inspections

Supervisors’ activities commonly include interviews, reviews and verifications

HKMA taps GenAI to monitor shadow banking risk

News headlines, social media and bank earnings calls all followed using in-house tools

Onsite inspection frequency tailored to individual firms’ risk profiles

All authorities in high and middle income countries engage in risk-based exercises

Book notes: Our dollar, your problem, by Kenneth Rogoff

An excellent overview of the evolution of the world economy during the last seven decades, and a warning against complacency

Pillar 2 supervisory requirements broadly decided at national level

Only 15% of authorities operate regional supervision offices

Basel III not holding back development finance – Thedéen

Regulations should not be viewed as “scapegoat” for lack of investment, says committee chair

People: RBNZ announces board appointments

Grant Spencer joins while Goldman alum Byron Pepper is reappointed