Micro-prudential

BoE to ‘streamline’ supervision as part of growth push

PRA has been easing some regulations as government looks to cut cost of compliance

ECB looks to simplify bank regs, supervision and reporting

Recommendations include merged buffers, lesser reporting burdens and an easier life for smaller banks

BoE lowers capital requirements for banks

Governor says move reflects sector’s evolution as institution publishes latest fin stab report

BoT seeks more oversight of gold trade to prevent baht volatility

Vitai says bank is working to boost supervision of institutions and dealers involved in precious metal

ECB’s Elderson welcomes debate on simplification

Vice-chair of supervisory board points to expanding proportionality and cutting capital stacks

ECB fines Spanish bank for not complying with climate rules

Supervisor imposes first-ever financial penalty over environmental prudential requirements

ECB does not have rule-making power – Elderson

Binding decisions are based on existing regulations and not supervisory expectations, board member says

San Marino blocks bank sale, looks to quell instability

Central bank says financial system is “solid and resilient”

BoE’s Woods rejects call to exempt gilts from leverage rule

Bank capital regime must account for sovereign bonds’ interest rate risks, PRA chief says

EBA’s Campa on simplifying EU regulations and supervising stablecoins

The departing pan-European supervision chief speaks about advancing the banking union, streamlining the implantation of new rules, financial resilience and why he is stepping down early

AI ‘explainability’ a growing problem for supervisors – paper

Better guidance may be needed on model risk management, Basel-based FSI says

Belize clarifies moneylender annual fees cap at 144%

Central bank says it is striving to reduce overall fees, improve transparency and cut predatory lending

ECB study points out unevenness in EU capital rules

Current prudential framework generates “unwarranted heterogeneity” in banking union, authors argue

European banks resilient to shocks, EBA says after test

Lenders’ greatest vulnerability is credit risk but they can withstand adverse scenarios, regulator says

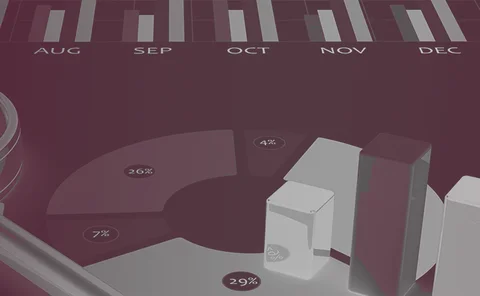

Supervision Benchmarks 2025 – model banks analysis

Data breakdowns reveal patterns in staffing, supervisory strategy and inspections

Supervision Benchmarks 2025 – executive summary

Data reveals focus on digitalisation and widespread use of suptech tools

Book notes: Making money work, by Matt Sekerke and Steve H Hanke

This book provides a critique of the post-crisis monetary and financial system, proposing changes that deserve to be broadly read

Supervision Benchmarks 2025 report – digital oversight

Benchmarking data reveals how supervisors structure their organisations, as well as their top strategic priorities and technology adoption

Consolidation likely among Nigerian lenders – analyst

Small lenders unlikely to meet CBN’s recapitalisation demands, says investment bank’s research head

Scrapping UK ring-fencing regime ‘not sensible’ – Bailey

BoE governor finds no fundamental issue with rule separating retail and investment banking activities

BoE delays implementing new market risk framework until 2028

Finalising it could be “tenuous dream”, says expert