Digital currencies

BNM selects firms for tokenisation and stablecoin pilots

Malaysian institutions to test wholesale payments and tokenised asset settlement

Renato Gomes on Pix, Drex and digital asset regulation

Brazil’s deputy governor speaks with Christopher Jeffery about pros and pitfalls of open finance, financial inclusion and crime on Pix, and the need to sideline DLT for Drex phase 3

Book notes: Money in crisis, by Ignazio Angeloni and Daniel Gros

This book should be essential reading for policy-makers at a time of uncertainty and technological change

The prospects for retail CBDCs

Open instant payments systems offer a quicker route to financial deepening, for now

IIF says China’s CBDC irrelevant to renminbi internationalisation

Economists say yuan’s use for payments growing, though it remains “stagnant” as reserve currency

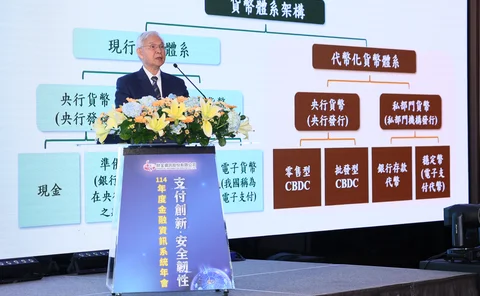

Taiwan’s Yang says central bank money remains global ‘anchor’

Governor says it is still ‘ultimate settlement asset’, notwithstanding development of tokenisation

Bowman and Hill say stablecoin rules are on their way

FDIC acting chair says regulation to establish application framework should come this month

PBoC emphasises stablecoins are illegal in China

Bank reiterates virtual currency ban and says pegged assets fail to meet identity and AML requirements

Gold and bitcoin buys triggered Tether downgrade, says S&P

Agency explains why it gave world’s largest stablecoin its lowest rating for stability

BSP remains cautious about stablecoins as proposals roll in

Deputy governor says most submissions are for dollar-backed assets focused on retail use

Japan will not implement Basel crypto regs by 2026, says FSA

Regulator cites country’s limited exposure to digital assets as reason for not meeting deadline

MAS to issue tokenised bills and draft stablecoin law

MD says Singaporean banks completed first CBDC interbank overnight lending settlement

CBDC technical design has little impact on demand – BoK study

Working paper also finds that interest-bearing retail instruments attract more interest

Stablecoins should be tightly regulated – HSBC exec

John O’Neill says lender’s views on the assets are aligned with those of central banks

Why Europe cannot afford to delay the digital euro

CBDC would counter the erosion of sovereignty as cash recedes, substitution by foreign digital monies and weaponisation of access, argue Biagio Bossone and Céu Pereira

Prioritise CBDCs over stablecoins, RBI’s Malhotra tells central banks

Indian central bank governor says CBDC collaboration needed to boost cross-border payments

Digitisation of money brings more regulatory risks – IMF head

Georgieva says crypto regs are in early stages and not yet coherent internationally

CNB joins Europe’s bank regulators to warn of crypto risks

Consumer interest driven partly by ‘aggressive’ promotion on social media, say authorities

South Korea planning to revive paused CBDC programme

Bank of Korea’s Rhee says CBDC may be used to distribute government subsidies

China to discuss stablecoins at cabinet level – report

Experts say allowing stablecoin issuance in mainland China unlikely to speed up yuan internationalisation

BoK governor expresses confidence in finance minister

Rhee’s comments follow apparent discord between bank and government over digital assets policy