United Kingdom

Scrapping UK ring-fencing regime ‘not sensible’ – Bailey

BoE governor finds no fundamental issue with rule separating retail and investment banking activities

BoE publishes SVAR model in response to Bernanke review

Flexible model designed to provide “structural narrative” to understand forecast revisions

BoE and Treasury’s ‘productive tension’ over stablecoins

Experts say Reeves’s bullishness and Bailey’s more bearish stance on assets may be all to the good

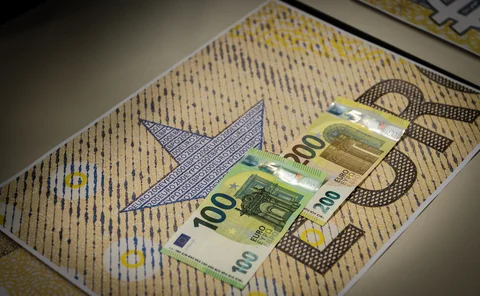

ECB opens second round of banknote design competition

Artists invited to submit ideas related to culture and the natural world

BoE delays implementing new market risk framework until 2028

Finalising it could be “tenuous dream”, says expert

Book notes: Central banking at the frontier, by Thammarak Moenjak

This well-structured book provides a comprehensive overview of the challenges digitalisation poses for finance and includes possible actions for central banks

BoE shifts focus to non-banks in sovereign bond markets

Aggregated data on leverage and positioning reveals growing gilt repo borrowing by hedge funds

BoE’s MPC should publish individual rate forecasts – Taylor

Newest committee member discusses r* and calls for greater transparency around forward guidance

No changes to Fed swap lines, Lagarde worried about ‘truth’ – panel

Fed, ECB, BoE, BoJ and BoK governors discuss tariffs, stablecoins, r*, scenario analyses and the future

Policy to remain restrictive for now, says BoE governor

Bailey says there will be “gradual and careful approach” to any further easing

BoE’s Greene defends new balance sheet strategy

Cross-border arbitrage of central bank facilities a “feature, not a bug”, says MPC member

BoE responds to criticism on interest payments

Governor defends monetary policy tools following attacks by political party

Bank of England urged to rethink HHI concentration risk add-on

Experts think overhaul of credit risk measure should be part of PRA’s ongoing Pillar 2 review

Bailey ‘remains to be convinced’ about retail CBDCs

BoE governor adds that stablecoins must “pass the test of singleness of money”

BoE holds rates, as three MPC members call for cut

Dissenting policy-makers highlight labour market weakness and lower pay growth

BoE seeks balance in regulating financial innovation

Prudential supervisor outlines hands-off approach for AI but tight rules for crypto

BoE analysis sparks debate over reuse of repo collateral

Central bank policy analyst contends reuse of collateral may amplify volatility in repo rates

Liquidity is king for risk and reserve managers – panel

Short-term market moves cannot determine asset allocation, central bankers say

Political party calls on BoE to stop paying interest on banks’ reserves

Former bank official says Reform UK’s proposal would amount to unacceptable “breach of faith”

BoE makes subtle leverage snipe at CCP cross-margining

Margin offsets might increase risk, but could also encourage more central clearing

Forecasting and narratives under uncertainty

Jagjit Chadha argues the Bank of England should deploy better analysis as the basis for clear communication under uncertainty

People: April to June 2025

A round-up of central bankers in the news and on the move during the past three months

BoE governor calls for closer ties between UK and EU

Bailey says Brexit’s negative effects on trade need to be minimised

IMF officials call for central clearing of sovereign bonds

“More work needed” to enhance structural resilience in core markets, researchers say