Central bank of the year: National Bank of Ukraine

NBU maintained financial and macroeconomic stability in the face of extreme shocks

The National Bank of Ukraine’s history has been tumultuous since 2013. The country’s then-president appointed a new governor, Valeria Gontareva, following the Euromaidan uprising of that year. Gontareva reformed the NBU’s governance, changed its monetary policy framework, averted a foreign exchange crisis and cleaned up much of the banking sector, despite strong resistance. Her successor, Yakiv Smolii, came under severe pressure from oligarchs determined to reverse the NBU’s banking reforms, and was effectively dismissed by president Volodymyr Zelensky in 2020. Factional disputes continued to cause difficulties for senior management and the next governor, Kyrylo Shevchenko.

But from February 2022, when Russian president Vladimir Putin ordered the invasion of Ukraine, the NBU had to face even greater challenges. It had been preparing for war ever since Russia annexed the Crimea region and supported separatist rebels in the east in 2014. NBU staff planned for every contingency they might face in wartime, such as addressing issues related to cyber security, currency support, banking stability and the safety of staff. At the beginning of 2022, NBU officials believed Russia might take limited military action and started to get ready for a possible escalation of hostilities. The prospect of war put growing pressure on the hryvnia and, on January 20, the NBU board hiked its policy rate by 100 basis points.

Then, Russian forces invaded on February 24, with some soon reaching the outskirts of Kyiv, just kilometres from the headquarters of most Ukrainian banks. With the banks and hubs of the country’s payment system infrastructure under threat, NBU officials activated full continency planning protocols. To diversify risk and to enable the NBU leadership to continue to work in unprecedented wartime conditions, it was decided that NBU management would relocate away from the capital toward safer regions. Most of the senior NBU officials left Kyiv, although first deputy governor, Kateryna Rozhkova, stayed in the capital.

As the invasion started, the NBU board dropped inflation targeting as its main policy goal, replacing it with support of the hryvnia. It imposed tough exchange rate restrictions and focused on large interventions to support the currency’s value, while extending billions of dollars of financing to the government. But all senior NBU officials understood that these emergency policies would be unsustainable in the long run, deputy governor Sergiy Nikolaychuk tells Central Banking. As the war progressed, the NBU would have to calibrate its policy mix to the changing circumstances.

The currency needs of around eight million refugees who had fled abroad, as well as five million displaced internally, added to the strain.

Stabilising sentiment

The NBU had to maintain Ukraine’s payments system and banking system. Ukrainian banks were in good shape at the outbreak of the war, says Pervin Dadashova, the head of the NBU’s financial stability department. She attributes this to the NBU’s reforms in 2014–16: “After the banking system clean-up banks were liquid, capitalised and very efficient.” Nonetheless, officials were worried capital levels might fall. However, they remained strong throughout the invasion.

The NBU also had to ensure there was enough monetary liquidity. Before the invasion, it sent large quantities of banknotes to commercial lenders. The demand for cash at the start of the war increased because of uncertainty, and the NBU resupplied the banks with as much cash as they needed.

At the same time, the NBU established an anti-crisis communications campaign, ‘financial defence of Ukraine’, to persuade Ukrainians to trust their financial system and national currency even in wartime. A key goal of the campaign – developed by staff as they worked in bomb shelters during the earliest days of the war – was to minimise panic, including reassuring the public that there was no need to make mass withdrawals of cash from ATMs or savings from banks. The communications team also set up a new portal, so the public could easily access updated information on the operation of banks, financial services and amendments to currency regulations.

Working closely with the National Bank of Poland, an emergency hryvnia cash exchange arrangement for Ukrainian refugees was developed from March 2022, which helped more than 100,000 extremely vulnerable Ukrainian refugees to exchange cash in Poland. The bilateral development represented an important template for other agreements reached to secure cash convertibility for Ukrainian refugees across Europe. All this took place against a backdrop whereby both central banks had to deal with extremely challenging cash-distribution challenges in their respective jurisdictions.

Due to the trauma suffered by Ukrainian citizens, communications also needed to be repeated multiple times to get the messaging across and combat Russian disinformation. The NBU made all communication channels open ‘24/7’, with real-time communication established with key public authorities, international donors, other central banks, the banking community, businesses and Ukrainian regional mass media. It also included new audiences, such as volunteers that imported equipment to support the army; the IT sector, which had become the main source of FX inflows to Ukraine; and the Ukrainians who were forced to flee abroad to escape the war.

The constant outreach to banking executives and government officials ensured the banking and payments sectors kept running. NBU staff worked hard to persuade the retail sector that merchants could use the electronic payments system without fear of failure. Overall, these efforts succeeded, Rozhkova says. “The behaviour of the people for us was a surprise, because instead of withdrawing money from their bank accounts, they put money in.” The use of the NBU’s BankID authentication tool also helped facilitate electronic banking, while assisting displaced citizens to secure online access to important documents.

Cyber threats

The banks also came under direct assault. Russian hackers mounted large-scale denial-of-service attacks on Ukraine’s banks throughout February and March. The NBU co-ordinated commercial banks’ response. Russian cyber hackers are now trying to attack Ukraine’s banks with new tactics, “but, with reinforced cyber-security measures, these attacks are easier to deal with”, Dadashova says. In the early days of the war, the NBU decided it would allow commercial lenders to transfer their data operations to the cloud. PrivatBank was one of the banks to do it quickly, within 40 days. The bank was nationalised by Ukraine’s then-president in 2016 on strong central bank advice, after the NBU alleged its owners had looted billions of dollars in deposits.

In occupied areas, commercial bank staff were at risk from Russian occupiers, but many stayed on, determined to stop them taking over. The NBU faced initial problems in supplying banks near the frontline with liquidity, Rozhkova says. But after the first few weeks of the invasion, it was able to resume normal cash transfers to lenders.

Funding challenges

Well into the summer, the NBU remained the largest financer of the Ukrainian government’s surge in spending. Western countries were sending large quantities of military aid to Ukraine, but budget support was much slower in arriving. The shortfall placed increasing pressure on the hryvnia. By May, officials and government advisers were warning that hryvnia-denominated assets were at risk of a sharp fall in value. The central bank was concerned this could lead to forced dollarisation.

The NBU took the decision to tighten policy. In late spring, it began reducing its emergency liquidity supplies to banks. On June 2, it raised its policy rate by 1,500bp, more than doubling it from 10% to 25%. The new policy aimed to support the value of assets denominated in domestic currency. The NBU still had to support the government’s spending, along with refugees abroad. The government reversed some of its emergency tax cuts. Finally, in the autumn, foreign donors began to supply budget support in larger quantities, easing the pressure on the NBU.

The NBU had to withstand another shock on October 4, when governor Shevchenko resigned. He been suffering from health problems for some time and had made some influential enemies. Ukraine’s National Anti-Corruption Bureau appears to have played a key role in his resignation when it began investigating him for alleged offences during his time running a state-owned lender. Shevchenko accused the investigators of making baseless charges against him for political purposes.

In occupied areas, commercial bank staff were at risk from Russian occupiers, but many stayed on, determined to stop Russian banks taking over

President Zelensky nominated Andriy Pyshny, the former head of a state savings institution, to be governor, and he was quickly confirmed by Ukraine’s parliament. Senior NBU and other officials say the abrupt change of governor had not damaged and even strengthened the central bank’s ability to cope with the war. While Pyshny has little direct monetary policy experience, officials say he a professional who is a good manager with extensive experience in banking. They says he is well versed in public finance and has a deep intuitive understanding of the link between fiscal and monetary policies. The entire team at the central bank appears to have worked well throughout the crisis and continued to do so.

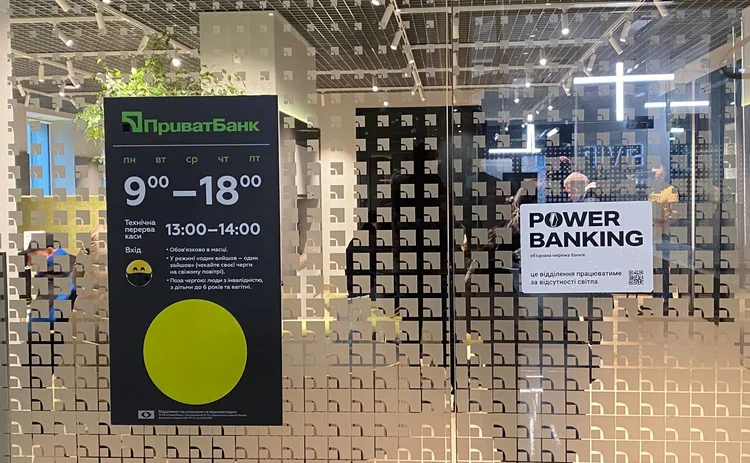

Despite Ukrainian forces regaining ground in the early autumn, the war continued to challenge the NBU. Almost at the same time as Pyshny became governor, Russian forces began massive missile strikes on Ukraine’s cities as well as its energy and communications infrastructure. Pyshny launched a project called ‘Power banking’ – a network of bank branches that can work when electricity and internet connections are broken and which now combines more than 2,000 entities. As a result, banks remained robust despite frequent power outages. Russia might attempt to knock infrastructure out for a prolonged period. But, even if it does so, the NBU can keep the banks and payments system running, first deputy governor Rozhkova says.

The NBU will face further challenges as the war continues. Ukraine’s GDP shrank by around 30% during 2022, according to several estimates. Officials say they consider the length of the war and the destructiveness of Russian attacks as they weigh their monetary policy options. Central banks often say that the outlook is uncertain: yet few have experienced as much uncertainty as the NBU does now.

But the NBU has extraordinary achievements to its credit. It played a critical role in keeping a financial system going under exceptional strains and direct, state-led cyber attacks. Despite considerable pressures, it financed Ukraine’s national defence while maintaining a large measure of macroeconomic stability. The NBU’s staff coped with the invasion of their country with resilience, teamwork and ingenuity.

The Central Banking Awards 2023 were written by Christopher Jeffery, Daniel Hinge, Dan Hardie, Joasia Popowicz, Ben Margulies, Riley Steward, Jimmy Choi and Blake Evans-Pritchard.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com