Central Banking Awards 2023

The winners of the 10th annual Central Banking Awards

The Central Banking Awards 2023 recognise excellence in a community that had faced significant policy and operational challenges amid heightened inflationary pressures, rapid technological change and environmental transition. Many institutions have also made significant improvements in their governance, operations, communications, economics, currency, reserves and market infrastructure capabilities.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com

Central bank of the year: National Bank of Ukraine

NBU maintained financial and macroeconomic stability in the face of extreme shocks

Central Banking Awards 2023: Gallery

See the winners from the big night, including leading figures from across the industry who came to pick up their awards

Lifetime achievement: Stefan Ingves

Modest man from the Finnish ‘boonies’ has had a major impact on international central banking

Payments and market infrastructure development: Central Bank of Somalia

Project has returned national payment system to East African country after near-30-year absence

Payments and market infrastructure initiative: National Bank of Ukraine’s BankID

The authentication tool played a critical role in helping war-hit citizens to access financial services

Transparency: Central Bank of Bosnia and Herzegovina

Central bank is pioneering whistleblowing standards in a complex country struggling against corruption

Communications initiative: Eastern Caribbean Central Bank

More than 200 educational videos have played to audiences across eight member islands

Initiative of the year: Central Bank of Ecuador’s Gold Acquisition Programme

The BCE’s gold initiative now includes environmental considerations as it bolsters Ecuador’s financial standing

Green initiative: The Netherlands Bank

DNB used innovative methods to analyse environmental impact of investment decisions

Asset manager: Invesco

US firm has grown both client numbers and asset investments, securing a $1bn multi-factor mandate

ESG services: BNP Paribas

The firm is helping reserve managers to manage their climate transitions and avoid greenwashing

Asset services provider: HSBC

UK institution has facilitated the development of lending markets in the Middle East and Asia

Financial market infrastructure services: Bloomberg

The US tech company’s drive to address local market needs drew praise from both developed and frontier clients

Asset services initiative: The World Bank

The multi-lateral body has laid the foundations for quick and easy execution of dual-renminbi mandates

Partner initiative: Norton Rose Fulbright

Law firm working with the EBRD and central banks to develop regulatory environments for crowd-based investing

Advisory services: Financial Transparency Advisors

The AML/CFT specialist is quietly helping key jurisdictions worldwide to toughen their approach to combating financial crime

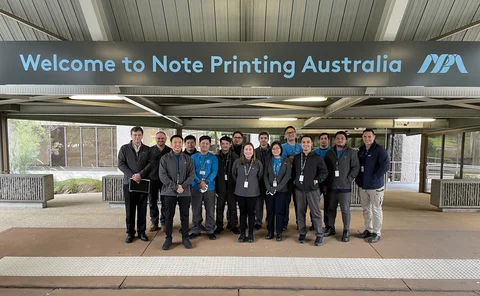

Currency services: Note Printing Australia

Alliance with Philippine central bank combines commercial and development activities

Payment services: Ion Group

US tech company has supported its customers’ ISO 20022 migration

Risk management services: KPMG

Technological and intellectual expertise assisted central bank efforts to supervise the UAE insurance sector

Technology services: SecurEyes

Indian company has offered integrated suptech/regtech services to help tackle cyber risk

Technology services – treasury: Adenza

Adenza’s move into the cloud offers cutting-edge tools for central bank collateral and liquidity management. The system frees up resources and could improve crisis management