The Belt and Road Initiative 2019 Survey – A new driver for globalisation?

The Belt and Road Initiative (BRI) has been a beacon in the past five years as a China-led effort with the aim of supporting global economic growth and development. For this reason, the BRI stands out at a time when many existing multilateral efforts are facing significant problems.

The Doha Round of World Trade Organization (WTO) talks has been stalled for some time, and progress to reform the Bretton Woods Institutions – the World Bank and the International Monetary Fund (IMF) – has proven slow. Some nations – in particular the US, which established much of the existing multilateral framework – are taking unilateral actions that have the potential to undermine the decades-long drive towards global development.

Against this backdrop, the BRI has expanded the breadth of its efforts to promote inclusive international co-operation as part of President Xi Jinping’s efforts to “boost mutual understanding, mutual respect and mutual trust among different countries”, and promote a “new type of international relations featuring win-win co-operation”.

The Chinese government’s Belt and Road Portal now lists 124 countries and 29 international organisations – including recent additions Italy and Luxembourg – engaged in international co-operation on the BRI, compared with the 71 reported in last year’s survey. Many African and Caribbean nations have joined the ranks of Asian and European countries by supporting the initiative.

Most of these jurisdictions, although not all, are emerging or developing nations, with many requiring substantial development funding – something China has provided in hundreds of billions of US dollars to date. Projects range from the US$8.7 billion railway from Mombasa in Kenya to the Ugandan border, to energy deals in Nepal.

Although much discussion has centred on Chinese-led funding along the BRI for infrastructure and other development projects – utilising skills China has secured during its own 40-year economic transformation – the BRI has also fostered a spirit of co-operation in a number of countries.

Examples of this can be observed in Central Asia. For example, Kazakhstan celebrated 2018 as ‘the year of Uzbekistan’, while Uzbekistan has named 2019 ‘the year of Kazakhstan’. The arrangement is characterised as symbolising the role of Kazakhstan as the entry point for the ‘western branch’ of the Silk Road Economic Belt and Uzbekistan as the entry point for its ‘southern branch’. It highlights how the BRI is helping nations to forge stronger relations with each other. The BRI may also have helped in the process of improving the legal status of the Caspian Sea in terms of the areas of control claimed by Russia, Iran, Turkmenistan, Kazakhstan and Azerbaijan.

Another less-discussed area are efforts by the Chinese authorities to set up international commercial courts in Shenzhen and Xi’an to address commercial disputes related to BRI projects. These are likely to be based on courts similar to those in the Dubai International Financial Centre and demonstrate another ‘soft’ development taking place in addition to ‘hard’ infrastructure investments.

The BRI may also be about to gain traction among the Group of Seven, with Italy becoming the first major developed economy to endorse the BRI. Twenty-nine deals amounting to €2.5 billion were signed in Rome in March 2019. The UK, Germany, Italy and France are already members of the Asian Infrastructure Investment Bank, which has invested in projects in BRI countries.

Italy’s position, however, appears at odds with that of some of the other European Union member states, and the US has publicly voiced its objections. The US administration under President Donald Trump has become noticeably more critical of the BRI than the previous Obama administrations. “We view the BRI as a ‘made in China, for China’ initiative”, is the refrain of some US officials, in an apparent reference to the benefits being stacked in China’s favour. An often-cited example is that of Sri Lanka, which, after struggling to make payments on its debt to Chinese firms, ceded control of its major port of Hambantota to China for 99 years. A report published in March 2018 by the Center for Global Development also claimed the BRI has created “the potential for significantly increased debt sustainability problems” in “at least eight countries” – Djibouti, Kyrgyzstan, Laos, the Maldives, Mongolia, Montenegro, Pakistan and Tajikistan.

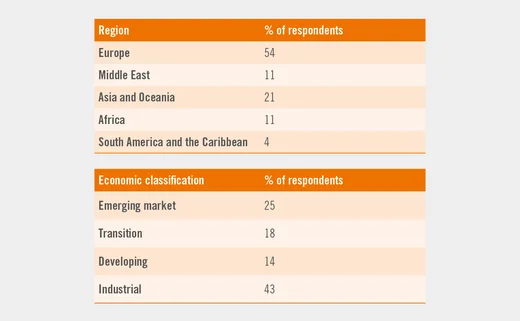

Profile of respondents

Central Banking received responses from 28 central banks participating in the Belt and Road Initiative. Over half of respondents were European, and Asian respondents made up 15% of the replies. Central banks from the Middle East and Oceania also featured and, for the first time, responses were received from African countries. More than two-fifths of responses to the 2019 survey were received from developed countries, with one-quarter of respondents from emerging market economies.

Risks for China

Part of the problem is that many of the countries included in the BRI are already ranked by the Organisation for Economic Co-operation and Development as being some of the world’s most risky economies. But this does not mean they do not need to develop.

Then there is the issue of a newly elected government taking a polar view on a major infrastructure initiative that was wholeheartedly supported by its predecessor.

This was witnessed in the Maldives after Ibrahim Mohamed Solih succeeded Abdulla Yameen as president. Another obvious example emerged in August 2018, when the newly re-elected prime minister of Malaysia, Mohamad Mahathir, planned to cancel three BRI projects in Malaysia, having earlier suspended them. However, despite the cancellation of these projects because of concerns about runaway costs, Malaysia still supports the BRI. “China’s BRI will promote regional exchanges and co-operation, which will benefit all countries in the region,” Mahathir said.

Chinese officials are well aware that better attention is needed to address concerns about project viability, debt sustainability, transparency and the geographic diversity of contractors. However, the results of the BRI survey of central banks provide evidence that many nations still have a positive perception of the benefits of the BRI – indeed they unanimously regard it as an essential initiative to support globalisation and bolster economic growth.

Key findings

- All central banks viewed the BRI as an important measure to promote globalisation.

- All countries expected the BRI to boost China’s GDP, with 16% believing the boost would be between 2 and 10 percentage points over the next five years.

- More than half of respondents expected a GDP boost of between 1 and 2 percentage points over the next five years.

- No BRI projects have been influenced by political pressure linked to the US-China trade war.

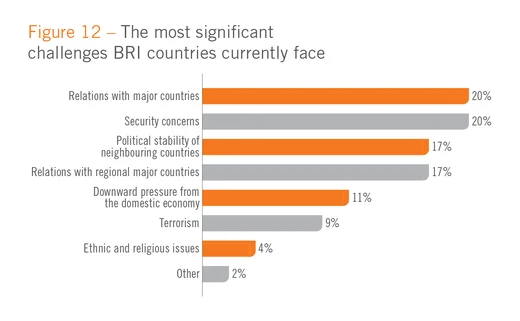

- Relations with major nations are viewed as the greatest challenge to the BRI.

- No BRI projects have faced increased financial pressures.

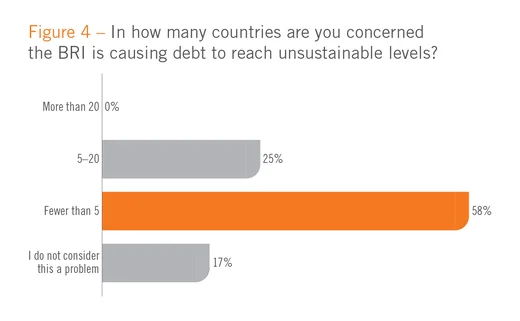

- There is limited concern about debt sustainability, with 75% of respondents saying any problems linked to the BRI are limited to fewer than five countries.

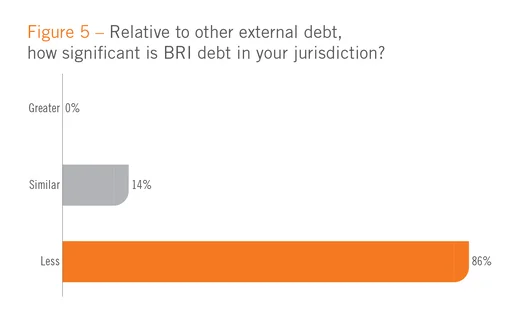

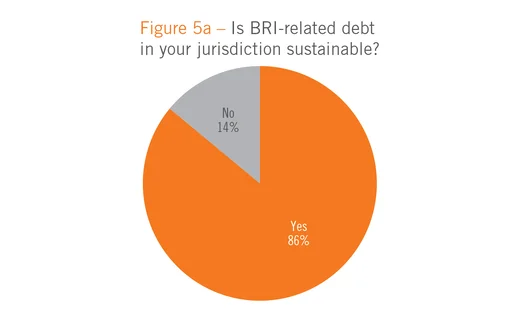

- A total of 86% of respondents reported BRI-related debt to be smaller in scale than other external debt, and a similar percentage believed home-country BRI debt was sustainable.

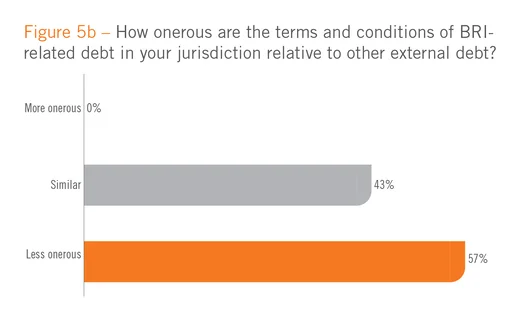

- More than half of respondents said BRI-related debt carried less onerous terms and conditions than other external debt.

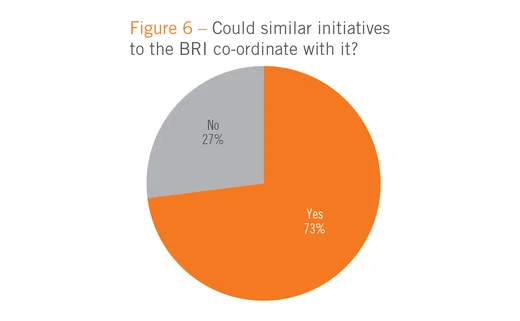

- Nearly three-quarters of respondents believed other development initiatives will complement BRI initiatives.

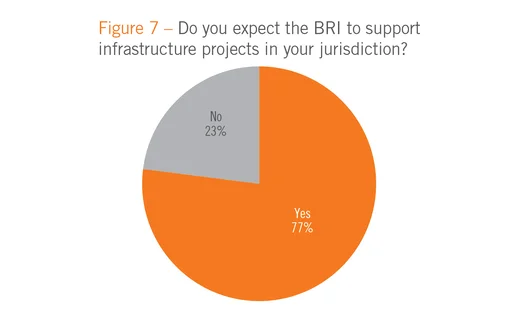

- Near four-fifths of central banks expected the BRI to support infrastructure projects in their home jurisdiction.

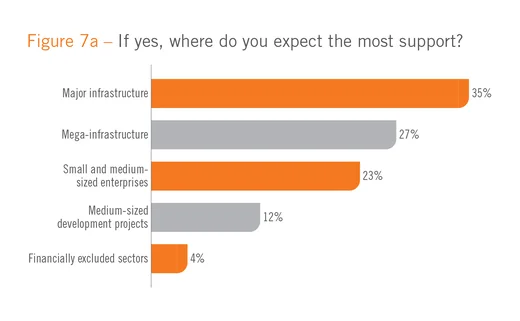

- Most of the BRI support would focus on major infrastructure, followed by mega-infrastructure and small and medium-sized enterprise (SME) financing.

- There was a perception of limited support for financial inclusion initiatives.

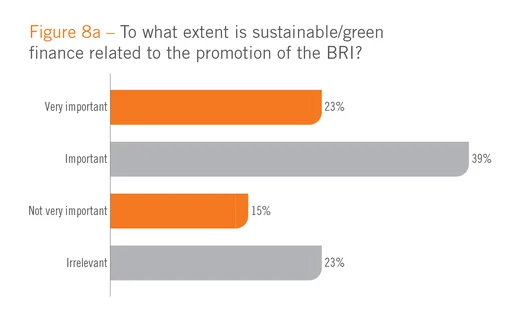

- Central banks generally found green finance to be related to the promotion of the BRI.

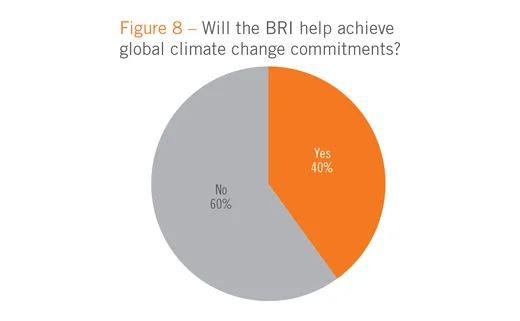

- Only 40% believed the BRI would help achieve global climate change commitments.

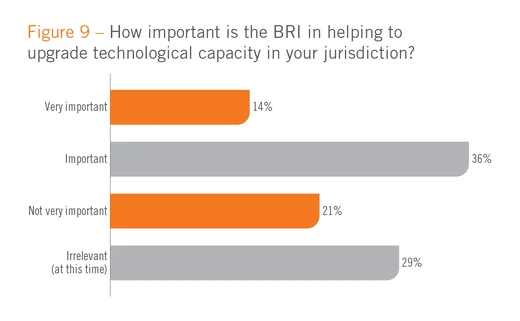

- Central banks were divided on whether or not the BRI would support the upgrading of home-country technological capacity.

- Regulatory transparency, support by development banks and co-ordination were the main areas where the BRI could be improved.

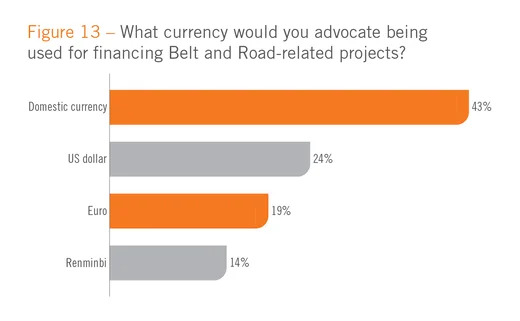

- A total of 43% of central banks would favour domestic funding for BRI projects.

- The US dollar edged out the euro and renminbi as the favoured foreign funding currency.

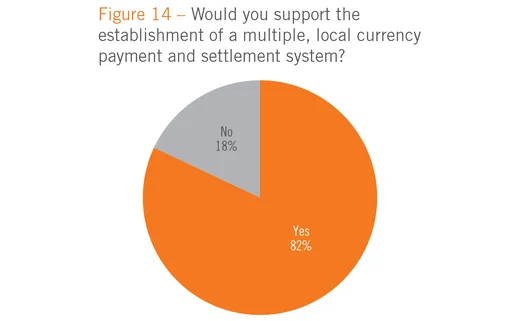

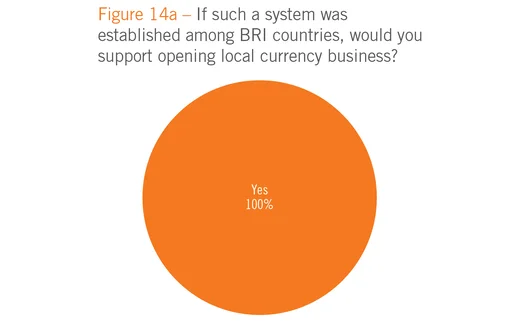

- Central banks would support BRI local currency payment and settlement systems.

- Just over half of central banks would favour opening the local currency business for trade-related purposes.

Survey responses

Underpinning globalisation

The BRI is viewed by many policy-makers as an important effort to reinforce globalisation. This was certainly the view of central banks responding to this year’s survey. These respondents from around the world were resoundingly of the view the BRI is “an important measure” for “promoting globalisation”. Not one respondent challenged this view (see figure 1).

“The very objectives of the BRI – in effect to link Asia, Europe and Africa to foster economic and cultural ties – promote globalisation,” said one African central bank. “In the current international economic situation, the BRI offers countries (including in Africa) the needed financing to develop their infrastructure and grow their economies.”

A European central bank added it sees the BRI as an important driver for development and growth, “considering that it tries to foster trade, economic and financial integration over a vast area, comprising a large number of countries”.

Indicating the geographic reach of the BRI – the Chinese government’s Yi dai, yi lu portal says 124 countries and 29 international organisations are now included in the BRI – a Caribbean central bank believed the BRI “can assist in expanding trade volumes and reduce costs through the utilisation of improved trade channels”.

One of the obvious challenges with the BRI is, given its breadth and scope, different parties have somewhat different interpretations of how it should be implemented. A European central bank, for example, said the BRI “needs to comply with WTO rules”, and “should not actively seek to build up closed or exclusive networks of trade and production”.

Closer to China, however, a Southeast Asian central bank said the BRI is “not as much mentioned as before”, indicating the expansion into many new countries and organisations may be somewhat diluting. Nonetheless, this central bank said the BRI “is still important to the development and growth in this region”.

Not feeling the pressure

None of the central bank respondents said their jurisdictions had encountered any increased international political pressure related to BRI projects due “to heightened China-US trade frictions” and “a tightening of US monetary policy” (see figure 2). This view was summed up by one central European central bank, which stated: “We have not observed any overt external political or geo-strategical move to the contrary.”

It was a similar situation when it came to revealing issues related to implementing BRI projects in home jurisdictions – for example, onerous financial pressures and other challenges. None of the respondents to the survey said they had faced such difficulties (see figure 3). However, in their comments, it appears a number of respondents represented countries where major BRI projects are not in full swing.

“There is presently no implementation initiative related to the BRI,” said one central European central bank. Another policy-maker mentioned its country had only recently signed a memorandum of understanding with China on the BRI. Another central bank pointed out that it only played a “facilitation role in financing and investment in infrastructure”.

Central bank respondents did not appear too concerned about debt sustainability in other countries either. Seventeen per cent of respondents reported there was no problem, with 58% saying any problems were limited to “fewer than five countries” – meaning three-quarters of respondents believed debt issues were restricted to less than five countries. Of the 25% of respondents that believed debt sustainability was a more prevalent issue, all of them said the problem was limited to between five and 20 countries (see figure 4).

Countries specifically highlighted as having issues included Sri Lanka – which, after struggling to make payments on its debt, relinquished control of Hambantota, its major port, to China for 99 years – and Djibouti, where China has established its first overseas military base.

One European central bank said: “This may be a problem for countries with weaker macroeconomic fundamentals and/or relatively high levels of external debt.”

None of the responding central banks felt they had especially large debt exposures related to the BRI. Just 14% put their external debt related to the BRI as similar in scale to other foreign debt, with the rest reporting it was smaller in scale (see figure 5). A total of 86% of central banks viewed their jurisdiction’s BRI debt as “sustainable”, although 14% viewed it as unsustainable (see figure 5a). This could reflect that, while BRI debt may not be larger than other forms of debt, it may have been taken on more recently and so puts a country closer to a potential ‘tipping point’.

While 43% of central bank respondents said BRI-related debt had similar terms and conditions to other external debt, the majority (57%) of respondents viewed BRI debt as having less onerous terms and conditions (see figure 5b). This may explain why some relatively highly debt-laden countries are keen to seek out BRI funding from China.

“Sources of external financing for us have been both bilateral (including from China) and multilateral in nature, and have also included financing from international capital markets,” said one developing economy central bank. “As we prepare to exit our current programme with the IMF and to [move beyond aid, the government] is seeking sources of long-term finance to help it address its infrastructure and development needs. In this regard, we are hoping to get some further support from China.”

Co-operative initiatives?

Other countries and regions such as the EU, India, Russia and Japan have proposed and implemented initiatives and/or development plans with similarities to China’s BRI. When asked for their views on whether or not these initiatives and development plans could co-ordinate with the BRI, nearly three-quarters of respondents said they could, while just over one-quarter did not see co-operation as possible (see figure 6).

One European central bank stressed co-operation on initiatives and development plans “would tend to depend on specific initiatives at hand”. But an Asian central bank said: “The BRI reaches many regions of the world – it is inevitable that those other initiatives will have to co-ordinate with the BRI.”

Building an infrastructure

While the BRI is designed to promote many forms of cross-cultural exchange and connection, it has also made rapid progress in supporting infrastructure projects worldwide. Close to 77% of central banks surveyed said they expected the BRI to support infrastructure development in their region (see figure 7).

Of this funding, central banks expect the most support (35%) for major infrastructure (such as roads, factories and agricultural water conservation); followed by (27%) mega-infrastructure (for example, power stations and high-speed railway networks); then (23%) SME enterprises; then (12%) medium-sized development projects (schools, hospitals, housing, minor transport links, and so on); trailed by (4%) financially excluded sectors (see figure 7a).

Green financing

China has learned to its cost that rapid industrialisation can have severely negative consequences for the environment. As it moves to recalibrate its economy towards high-tech industry, services and consumption, it has also placed an increasing focus on green finance, where the finances raised are explicitly used to fund environmentally responsible projects and businesses.

More than $30 billion of Chinese green bonds have been issued, and Chinese banks have started to issue BRI-focused green bonds. For example, the Industrial and Commercial Bank of China issued $2.15 billion of BRI green climate bonds in Luxembourg in late 2017, with the proceeds to fund renewable energy, low-carbon transportation and sustainable water management, among other areas.

This effort is having some effect, with 40% of central bank respondents saying the BRI would help to achieve global climate change commitments (see figure 8). “This is not an explicit goal of the BRI, but it may be a positive externally,” said one Caribbean central bank. But the majority (60%) currently believes this is not the case. “It is not expected the BRI will help to achieve global climate change, due to the required infrastructure and investment projects, which result in more climate changes,” said one Middle Eastern central bank.

China’s funding of coal-fired power plants in countries such as Pakistan that would have struggled to secure funding from multilateral lenders for such heavily polluting plants highlights the conundrum for China and developing countries. Pakistan has large coal resources but not gas. If it secured funding for gas-fired power stations, it would need to import the gas, placing a strain on its national finances. Coal, on the other hand, does not need to be imported. But coal-fired stations are generally viewed as less environmentally friendly than gas-fired stations.

Central bank respondents believe a sustainable and green focus is important in the promotion of the BRI, with 23% saying it is “very important” and another 39% saying it is “important”. Meanwhile, 38% of central banks said it was either “not very important” or “irrelevant” (see figure 8a).

Central banks were split on their views about the importance of the BRI in terms of helping to upgrade technological capacity in their jurisdiction. A total of 14% said they considered the matter “very important”, and 36% “important”, but not essential; while 21% said they viewed it as “not very important”, and 29% as “irrelevant” at this time (see figure 9).

GDP boost

All respondents to the survey expect the BRI to lead to an increase in China’s GDP over the next five years, with 70% expecting the BRI to boost growth by more than 1 percentage point. Most central banks expected an increase of between 1 and 2 percentage points. But 8% expected GDP to rise by 2–5 percentage points; while another 8% said they expected an even greater boost of 5–10 percentage points (see figure 10).

Asked which aspects of the BRI should be improved, central banks gave “regulatory transparency” and “financial and project management support by development banks” as primary concerns. The biggest secondary issue was related to “co-ordination with the national development strategy or the regional strategy projects of BRI countries”. “Ethics” and “project selection” were much lower down their priority lists, perhaps in contrast to last year’s survey, in which a combined option of ethics and transparency scored very highly (see figure 11).

Identifying the most significant challenges BRI countries currently face, there was limited concern about terrorism, ethnic and religious issues, and downward pressures from domestic economies. The greatest challenges came in the form of relations with other countries, with 20% citing “relations with major countries” and 17% citing “relations with regional major countries”; 20% cited “security concerns (wars and military conflict)” (see figure 12).

Financing currency

When it came to the most appropriate funding currency, more than two-fifths (43%) of central banks – regardless of geographic location – said they would advocate the use of their domestic currency for financing BRI projects (see figure 13).

“Using domestic currency will mitigate possible currency mismatches that contractor firms might experience in their balance sheets,” said one G20 central bank.

“Domestic currency loans will eliminate foreign exchange risk and reduce the risk of default,” added an African central bank.

Other central banks, including one European central bank, pointed out that foreign currency financing may make sense if there is “some sort of natural hedge, in the form of trade revenues”. Another major African central bank said: “There could be a need to have payment in an international currency, given that the projects will in some instances be undertaken by international companies.”

When it came to funding in foreign currencies, the US dollar was the most preferred, with 24% of the overall votes, followed by the euro with 19% and the renminbi with 14%.

Given recent global political events, it is somewhat surprising to see the US dollar grow in popularity among BRI countries. In 2018, the euro was the preferred foreign currency, receiving 29% of the votes; the dollar and renminbi both received 19% of the votes. One explanation for this is a large number of BRI countries are emerging markets that rely heavily on US dollar funding.

The majority of central bank respondents also said they would support the establishment of a multiple, local currency payment and settlement system should BRI countries choose to establish such a system. Only 18% of central banks said they would object to such an initiative. Moreover, if a multiple currency system was established, all respondents reported that their institutions would be amenable to opening a local currency business (see figures 14 and 14a).

“We treat payment infrastructure as crucial for the successful implementations of projects under the BRI,” said a large central bank. “We do pay attention to business in local currencies;

at the same time, we admit market demand in payments in multiple currencies.”

“The use of multiple currencies for payments will help to facilitate trade, and in that regard the central bank will be supportive,” added one African central bank. “Central bank support, however, will be to the extent that banks are able to settle any long/short positions in a currency among themselves (or with their branches in other jurisdictions) without having to resort to the central bank.”

To avoid the spillover of financial risk brought about by the ‘opening-up’ of local currency business, more than half of respondents to this year’s survey ranked being “open to trade-related local currency business” as their top response, and another 27% as their second-placed option. Other strategies – as shown in figure 15 – comprised a partially open capital account, including direct and securities investments, while controlling the total volume (27% of first-place votes, 9% of second-place votes and 63% of third places) and open the local currency business and provide national treatment and control the total volume (18% of firsts, 63% of seconds and 18% of thirds).

The 2018 Belt and Road Initiative (BRI) Survey

In 2018, the IFF, in collaboration with Central Banking, inaugurated the BRI survey. With responses received from 25 central banks from around the world, the findings concluded the BRI would bolster growth. However, more effective co-ordination was needed among member countries for the initiative to fully achieve its potential. The 2019 survey reveals the cogs of co-ordination are starting to turn, with expectations the BRI may flourish in an environment where traditional globalisation initiatives are beginning to crumble.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com