Banks

Consultancy and advisory provider of the year (currency management): De La Rue

The UK-based company is helping central banks monitor the lifespan of banknotes in a bid to improve stock management and cost-effectiveness of currency operations

Payments and market infrastructure provider of the year: Perago

The software company is helping central banks around the world implement reliable and highly adaptable RTGS and retail payments systems

Fed paper models risk-taking channel of monetary policy

Model in which monetary expansion increases risk-taking appears to fit with the data

Technology consultant of the year: Vizor Software

The Dublin-based company continued to grow its client base in 2017, proving its mettle in emerging markets, with the addition of Brunei’s central bank and the Zambian pensions and insurance regulator

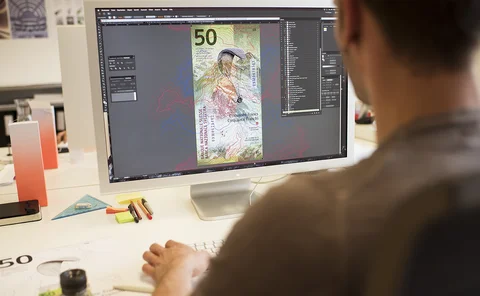

Banknote and currency services provider of the year: Landqart

The leading hybrid substrate provider offers the durability and increased security of polymer combined with the security features and customer familiarity of paper

Innovation in reserve management: HSBC

The global bank stepped in during Egypt’s economic crisis, arranging a private funding package that proved instrumental in turning around the country’s fortunes

Consultancy and advisory provider of the year (data and regulatory management): BearingPoint

BearingPoint’s expertise in data and reporting has informed a number of high-level bodies over the past year, including the Basel Committee and the IMF, following groundbreaking work in Austria

Asian central banks crack down on cryptocurrency

Central banks in China, Korea, Malaysia and Singapore all taking action as cryptocurrency prices slump

EU ombudsman asks Draghi to relinquish G30 seat

Prolonging the president’s membership threatens independence and public’s trust in the ECB, O’Reilly declares

BoE economists challenge conventional wisdom on yield curve

Steeper curve may not be as good for bank profitability as widely believed

Short-selling bans increased instability – ESRB paper

Banks’ volatility, leverage and default probability increased by bans on short-selling – researchers

Central banks lack ‘firepower’ to combat financial crises, says report

Without interest rate cuts available, the next financial crisis could be much “longer and deeper”, Global Risk Report says

RBI’s Acharya tells banks to deal with interest rate risk

Indian banks are vulnerable to changes in yields and have relied on regulatory forbearance for too long, deputy says

German savings banks may buy debt to gain political favour, ECB paper says

Research warns this behaviour increases interdependence between banks and governments

BoE’s Tenreyro sees hopeful signs for UK productivity

Many factors dragging on productivity may soon start to fade, MPC member says, though the UK seems to be missing out on a global investment boom

Core-periphery model of bank networks called into question

Researchers find multiple cores in the interbank market, posing different systemic risks

BoE’s Woods warns of ‘point of tension’ in Brexit negotiations

PRA chief fears EU supervisors may adopt a local mindset when dealing with cross-border firms

Economists need to better understand macrofinancial links – BIS paper

Stijn Claessens and Ayhan Kose call for “new generation of models” among other research to solve ongoing puzzles

Banking ‘deserts’ do not explain financial exclusion – NY Fed economists

Data shows absence of nearby banks fails to explain “unbanked” share of the population

Home truths on Europe’s NPLs

Europe needs to overcome fears of a hypothetical crisis, and impose more intrusive supervision and greater provisioning on its banks

Gontareva accused of complicity in money laundering

Ex-governor denies she improperly helped former president Yanukovych

HKMA launches consultation on open API framework

Open API enables personalised services for bank users but requires access to customer data

IMF’s Obstfeld: effects of accommodative policy remain unclear

The IMF chief economist weighs up the productivity puzzle and whether monetary policy helped or hindered growth following the financial crisis

PBoC tightens bond trading rules, relaxes renminbi controls

China’s financial regulators continue their efforts to deleverage the economy and promote renminbi internationalisation