Research

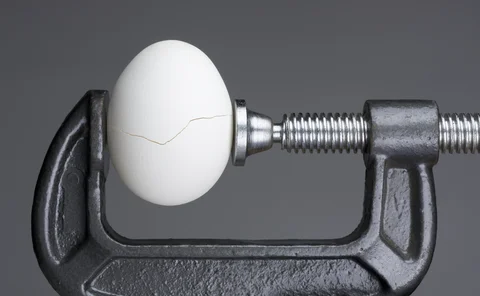

ECB study finds banks window-dressing before stress tests

Lower-ranked lenders shifted risky assets ahead of 2021 and 2023 exercises

Politics influences US citizens’ inflation expectations – study

Party affiliations help explain divergence in different surveys’ results, say Cleveland Fed economists

Stablecoin growth may decrease loan supply in US – Fed study

Bank lending could be reduced by $325 billion over next three years, author claims

Weak productivity reduced output in Australia by up to 3% – study

RBA paper says decline has “profound implications” for citizens’ welfare

Investor sentiment now back at pre-tariff level – BIS study

However, authors warn that accommodative conditions could reverse at any time and trigger disruption

Investment funds procyclical to bond markets – ECB blog

Vehicles sell sovereign debt in times of stress while other investors step in to buy it

Foreign open-end funds threaten financial stability – BoJ study

Researchers say external crises could lead to large outflows from vehicles investing in Japan

Central banks’ climate comms influence markets – CEPR column

Researchers draw conclusions after examining more than 35,000 speeches on environmental issues

Tariffs only partly explain April’s volatility – BIS paper

Movements in dollar and Treasury term spread driven by other factors, authors say

Fed policy may disproportionally affect largest banks – study

More leveraged US lenders experience sharper stock declines following rate hikes, Fed paper finds

RBNZ survey respondents expect bank to cut policy rate

Business leaders and forecasters also expect weaker inflation in New Zealand over medium term

News coverage affects inflation expectations – NBER paper

Authors say bad news has bigger impact on perceptions of inflation

ECB paper finds strong policy can stop expectations de-anchoring

Communicating counterfactual scenarios can help to inform monetary policy decisions

Monetary policy alone will not solve Korea’s problems – paper

Study calls for structural changes to tackle ageing population, high debt and low growth

Fed independence concerns raising risk premia – research

Authors of BBVA study say long-term yields briefly spiked amid rumours that Trump would fire Powell

Ageing societies limit monetary policy space – BoK study

“Super aged” populations cut growth and inflation, and weaken banking sector, authors say

More independent central banks take on greater risk – ECB paper

Low rates, tighter fiscal policy and good growth accompanied by higher risk-taking on balance sheets

BIS paper debuts new metric to gauge monetary policy stance

Index captures how size of central bank balance sheet affects borrowing conditions

Markets bet on cuts when Trump threatens Powell – research

Economists link attacks on Fed independence with expectations of policy easing

‘Start late, then sprint’ may cost when tackling inflation – CEPR

Research says approach ultimately succeeded post-Covid, but hurt central banks’ credibility

Tailored central bank messaging boosts trust – BoJ study

Citizens are more confident about inflation forecasts when delivered by someone similar to them

Central banks’ CBDC sentiment can prove contagious – BIS study

Authors say Fed and ECB’s positions on digital assets affect how the currencies are perceived elsewhere

China’s policies reduce risk of ‘Japanification’ – study

Bank of Spain research compares country’s economic challenges with its Pacific neighbour’s in 1990s

Oil shocks create ‘persistent’ labour downturns – IMF paper

Gains for oil-exporting countries are “comparatively modest”, say researchers