United States

Bair: FDIC-style bailout needed for very large banks

Chairwoman of the FDIC Sheila Bair outlines resolution regime for the biggest firms

IMF stockpiles funds for crisis resolution

Fund prepares for the worst with $500 billion in extra funds from a standing borrowing arrangement with selected members

Fed to lose monetary affairs chief

Monetary affairs director Brian Madigan plans to retire later this year, he is succeeded by deputy director William English

Greenspan defends position on free market

Former Fed Chairman deflects criticism over adherence to Ayn Rand's views on laissez-faire capitalism

Fed’s Duke warns community banks are under threat

Governor Elizabeth Duke highlights some of the dangers posed by troubled real estate markets on community banks

Richmond Fed appoints new head of supervision

Jennifer Burns succeeds Malcom Alfriend as senior vice-president at Richmond Fed

Boston Fed measures effect of equity extraction on consumption

Boston Fed research shows equity extraction as significant driving force for consumption during US housing boom

Goodfriend: interest on reserves best exit policy

Marvin Goodfriend offers Congress advice on how to exit from the Fed’s accommodative stance without disrupting markets

Philly Fed: banking sector returns to profit

Report for fourth quarter notes bank failures also dropped

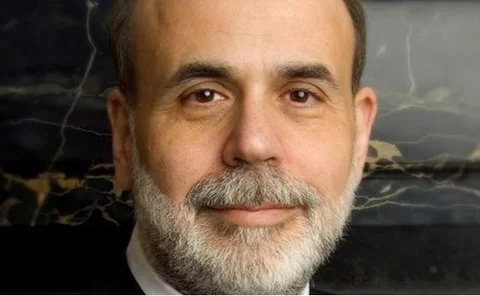

Bernanke: too-big-to-fail problem “unconscionable”

Fed chairman Ben Bernanke calls for a revision of regulation on firms, which are “too big to fail”

Exercise caution with Okun’s law: Bank of Canada paper

Research from the Canadian central bank shows recent evidence does not conform to the original specifications of relationship between output and unemployment

Major economies must heed Greece lesson: Carmen Reinhart

Co-author of This Time is Different warns sovereigns on debt sustainability

US, UK on the road to a downgrade: Moody’s

If the US and Britain cannot repair their balance sheets, the burden of servicing debt could cause them to lose AAA ratings, agency says

ECB’s Stark: global economy is heading for lost decade

Jürgen Stark says failure to learn from the crisis would result in anaemic global growth for the next ten years

Investment growth declines in Europe

Central Bank of Ireland research shows that while declines in investment growth is larger in US compared with the eurozone this year, it continues to lag behind the US overall

We won’t ban prop trading: British Lord

British business secretary Peter Mandelson says Volcker rule is “too difficult” even as Washington works to turn it into law

Community banks remain crucial for US economy

Chicago Federal Reserve summarises its conference on the impact of the financial crisis on community banks

Global rules for regulation or “catastrophe”: Trichet

ECB president Jean-Claude Trichet says international coordination is absolutely necessary in revamping regulation

Obama’s proposals – the only game in town

President Obama’s radical proposals recognise that the financial lobby can no longer hold society to hostage. They should be welcomed as a result, Robert Pringle, the chairman of Central Banking Publications, writes.

Schapiro seeks tighter reins on hedge-funds

US Securities and Exchange Commission’s Mary Schapiro eyes more stringent controls for hedge funds and credit rating agencies

Great Depression spread by Germany, not US

A new paper argues that the 1931 crisis was propagated by the collapse of Germany's banking system