United States

Fed May 2010 Bulletin: 120 US commercial banks failed in 2009

Federal Reserve report into balance sheet developments at US commercial banks shows continued stress in banking sector

Foreign holdings of US Treasuries fall for second straight week

Data show holdings of US Treasuries by foreign central banks with accounts at the Federal Reserve declined for a second successive week; use of swap lines lower than expected

SF Fed: pre-crisis regulation of financial markets

A San Francisco Federal Reserve study looks at the role of government during the financial crisis and calls for a greater state role in regulation

FOMC minutes reveals divergent views on timing of asset sales

Federal Reserve minutes outlines discussions over an asset sale programme at the FOMC meetings in April

Philly Fed: trade declines in US recession normal

Philadelphia Federal Reserve study shows that inventories stock created a buffer following declines in post-crisis trade

China sought safety in US Treasuries as eurozone markets unsettled investors

Treasury data out on Monday show China and Japan heavily increased their holdings in US Treasuries in March

Philly Fed blames subprime crisis on bankruptcy reform

Philadelphia Federal Reserve study shows reform to homeowner bankruptcy rules caused default rates to rise during subprime mortgage crisis

Europe to place CDS markets under spotlight: Barnier

European commissioner Michel Barnier says legislation in works requiring credit default swaps to be registered and made fully transparent; follows criticism of investors from European leaders

The Volcker Rule: wrong answer or the right question?

The Volcker Rule recognises that the structure of the banking system needs to change. For that it should be supported, says Michael Taylor

Richmond Fed on sovereign debt dilution

A Richmond Federal Reserve study shows having a sovereign debt default program in place reduces sovereign market risk

Fed’s Hoenig approves Hutchison amendment

Kansas City Fed president Thomas Hoenig says the Hutchison amendment will strengthen the oversight of small banks

RBA: inflation expectations converging globally

Reserve Bank of Australia paper finds inflation targeting policies helped the convergence of inflation forecasts to US levels

Deficits set to stay sky-high despite growth revival, warns Fund

IMF says deficits worldwide will fall by less than expected in 2010, in spite of improved growth prospects; developed economies worst offenders

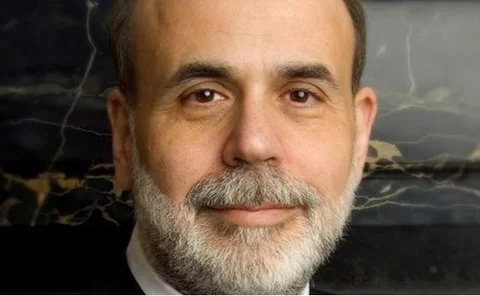

Bernanke: happiness is relative

Federal Reserve Chairman Bernanke sets out his view on the economics of happiness and the Easterlin paradox

Bernanke on the success of stress testing program

Federal Reserve chairman Ben Bernanke says stress testing helped return credibility to banking sector

Fed’s Hoenig calls for counter-cyclical leverage ratio, slams Basel requirements

Hoenig calls for change in regulatory approach to bank lending by ditching Basel II approach in favour of ceiling on leverage

Fed’s Rosengren: full US recovery years away

Boston Federal Reserve president Eric Rosengren identifies several challenges towards economic recovery in the United States

Atlanta Fed: subprime bubble linked to numeracy

Atlanta Federal Reserve study shows people with limited numerical skills are more likely to default on their mortgage

Dallas Fed - Annual Report 2009

Dallas Fed report for 2009 looks at causes of financial crisis and outlines shape of new policy

Rate round-up: Brazil hikes, most hold, Russia cuts

Brazil raises policy rate to 9.5%, Russia cuts to 8.25%; United States, Poland and New Zealand hold

US Senate finds rating agencies influenced by banks

Inquiry says conflict of interest between agencies and their customers did influence ratings of mortgage-backed securities

Abandon your ‘furious’ lobbying: Obama to banks

Obama warns banks’ lobbyists off descending on the Hill; laments Republican attacks

New York: US recovery setback by unemployment figures

New York Fed president William Dudley describes sluggish recovery growth related to high unemployment

Bank of Canada highlights requirements for global recovery

Study shows a rebalance in global current account necessary for sustainable growth