United States

Fannie Mae posts lowest loss since conservatorship

Fannie Mae reports a $1.2 billion loss, the lowest quarterly loss since its conservatorship

Bair’s senior adviser leaves FDIC

Senior adviser to markets Joseph Jiampietro departs FDIC after less than 18 months

NY Fed: Funding liquidity explains investor hedging behaviour

New York Federal Reserve study finds funding liquidity risk plays important role in stock returns

Dallas Fed: Oil shocks driven by supply and demand factors

Dallas Federal Reserve study links variations in oil prices and US growth patterns over past four decades to endogenous shocks

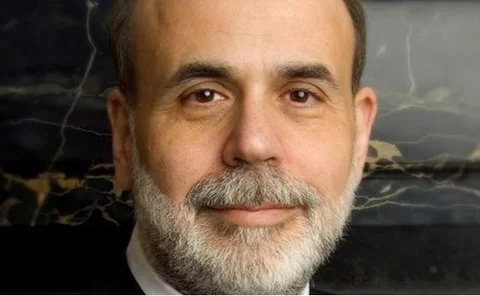

Bernanke on why states face fiscal shortfalls

Federal Reserve chairman Ben Bernanke pins shortfalls on recession, legislation and pensions

Greece’s fiscal situation far worse than US: Atlanta Fed

Atlanta Federal Reserve study says Greece’s fiscal debts more worrisome than the United States’s

Bear bailout vehicle turns first paper profit

Federal Reserve balance sheet data shows Bear Stearns’ assets held in Maiden Lane vehicle made a paper profit for first time since its inception

First FSAP for US flags commercial real estate woes

The US banking system at risk from commercial real estate woes, the IMF’s first Financial Sector Assessment Programme says

Fed’s Bullard calls for further QE

St Louis Federal Reserve president James Bullard says United States must commit to further stimulus if it wants to avoid a deflationary trap like Japan

Federal Reserve – Beige Book (July 2010)

Federal Reserve’s July Beige Book shows significant improvement in labour markets across five of the United States’ 12 districts

Boston Fed: poor subsidise card payment transfers of rich

Boston Federal Reserve paper shows low income households subsidise the cost of card payment transfers for high income households through higher relative prices

Fed’s response averted a depression: Blinder

A paper co-authored by former Federal Reserve governor Alan Blinder says the central bank’s extraordinary polices prevented the country from entering a second Great Depression

Fed better prepared than us for financial crisis: ECB paper

European Central Bank study shows stronger emphasis towards output allowed the Fed to react faster than Frankfurt to financial crisis

Fed survey shows growing appetite for risk in OTC markets

Inaugural Federal Reserve survey on financing of over-the-counter derivatives shows growing demand in risky assets

Fed’s Duke announces steps to improve data needs on SME lending

Federal Reserve governor Elizabeth Duke says data improvements will help Fed understand how lending requirements for small business

Bank of Canada: Chinese shocks have global bearing

Bank of Canada study shows China’s monetary policy is less effective at weathering shocks and country must be incorporated in global models

Atlanta Fed: Annual Report (2009)

Atlanta Federal Reserve Annual Report shows southeastern states hit hardest during financial crisis after boom in community banking

Four risks to growth: Atlanta Fed’s Lockhart

Atlanta Federal Reserve president Dennis Lockhart counts Gulf of Mexico oil spill and commercial real estate sector risks among imminent threats to growth

Cleveland Fed: Fed’s abandonment of FX controls justified

Cleveland Federal Reserve study says Fed was right to stop intervening in foreign exchange markets as it helped stabilise prices in long term

Greek debt crisis sparks widening of almost all global CDS spreads

Cost of protecting against a Greek default up 190% in three months to mid-June as CDS spreads widened for 93% of sovereign debt on back of sovereign debt crisis in Europe

Foreign holdings of US Treasuries rise as supply for agency securities runs dry

Fed data show official-sector holdings of US agency securities fell after 12 straight weeks of gains

St Louis Fed: FOMC largely ignored Phillips curve framework

A St Louis Federal Reserve study on Fed transcripts shows the FOMC was split on whether to use the Philips curve in monetary policy decisions

San Francisco Fed: jobs growth policies only temporarily effective

San Francisco Fed study shows recent government policies designed to stimulate employment failed to have any long-lasting effects

Central banks’ holdings of US agency debt rise on dollar demand

Fed data show official-sector holdings of US agency securities rose for a 12th straight week; auction for seven-year US Treasury bills displayed growing demand for dollar denominated assets