Federal Reserve System

Dudley warns Trump tax plan leaves US finances ‘unsustainable’

New York Fed chief says policymakers may have to tighten rates harder to offset stimulus

Fed economists tackle question of optimal balance sheet size

Cutting balance sheet would significantly reduce interest rate risk, economists find, as Fed acknowledges lower profits due to interest payments

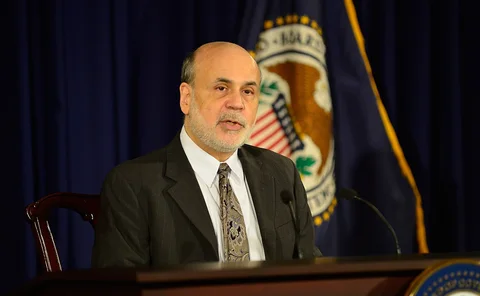

Bernanke says Fed likely to review policy framework

Former Fed chair says analysis on change to inflation targeting is likely; panel of experts presents wide range of views on what any change should be

Fed could use rates to counter instability – Mester

2015 exercise showed major problems in use of macro-prudential tools, says Cleveland Fed chief

Fed proposes expanding risk regime to foreign subsidiaries

New consultation suggests widening the scope of the August 2017 proposals to foreign-owned operations

Richmond Fed paper explores Fed’s monetary policy history

The author identifies a lack of consensus on the nature of the monetary regime as a policy weakness

People: Bank of England official to become FCA chair

Charles Randell to take over as FCA chair in April; BoE appoints its first job sharers at executive director level; Vietnam names deputy governor; Mark Mullinix to leave Fed; and more

New US tax plan promising for growth – Fed minutes

FOMC members revise the growth outlook upwards for next 12 months, as tax cuts promise to provide “some boost” to consumer spending

Fed paper studies inequality in three dimensions

Authors find examining three dimensions simultaneously gives new insights

2017: The year in review

Over the past year, the global economy regained some strength, and some central banks began to return their policy to normal; but it was not all smooth sailing

Some banks’ living wills have ‘shortcomings’ – US agencies

The latest assessment finds previous “deficiencies” have been corrected, but four banks show less serious “shortcomings”

Fed paper sets out model of financial panics

Mark Gertler, Nobuhiro Kiyotaki and Andrea Prestipino examine banking panics in a DSGE model

Macro-pru tools helped offset taper tantrum – paper

Macro-prudential measures helped reduce the impact on cross-border lending growth, say authors

Fed backtracks on CCAR cleared swaps exposure

Regulator had also postponed plan to feed cleared client exposure into G-Sib rankings

People: Fed appoints new payments security strategy chief

Boston Fed vice-president to lead payments security; director of prudential regulation of UK banks to stand down; Kuwaiti governor to chair Council of the Islamic International Board in 2018; and more

Fed hikes as Yellen hails strong job growth

Janet Yellen gives her last press conference as Federal Reserve chair

Fed finalises new market benchmarks

Three transaction-based alternatives to US dollar Libor will launch in 2018

Fed proposes sharing more information about stress tests

Proposal includes insights about how the regulator estimates hypothetical losses

Richmond Fed appoints McKinsey executive its next president

Tom Barkin will serve as a full FOMC member as of 2018

Small open economies benefit from QE spillovers – IMF paper

Fed’s QE had a similar net positive effect in Canada to that in the US

Goodfriend nominated to Fed board

Central bank veteran to fill one of the four vacant spots on the board of governors

Strong growth and lower unemployment allows Fed to normalise policy, Yellen says

Outgoing chairwoman adds policy is not preset and will depend on economic data

Slower health care price rises limiting US inflation, San Francisco Fed paper says

Medicare prices rise by 1.1% annually since 2012, compared with 3.5% in mid-2000s

Powell to explain policy outlook before US Senate

Nominee set to defend loose policy stance and independence of central bank as new chair