The turmoil test for emerging and advanced economies

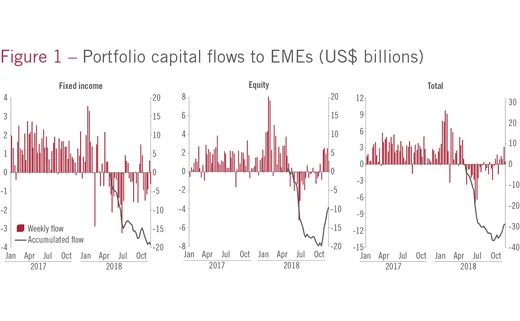

A period of strong non-resident portfolio capital inflows to emerging market economies (EMEs) in 2017 and early 2018 started to reverse in April 2018, with bond and equity fund withdrawals totalling around US$28 billion to date (see figure 1). This about-face was a response to a spike in risk aversion, reflected in a series of waves of uncertainty over the year around a combination of developments.

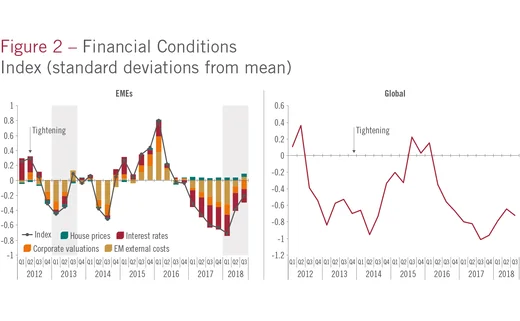

These developments included the upward trend of US interest rates, rising trade-related tensions, Chinese economic slowdown, the decline in key stock markets and heightened political and policy uncertainty in a number of EMEs, as well as a sharp decline in oil prices to levels not seen for around a year. As a result, financial conditions in these economies have demonstrated a significant tightening that, according to some estimates, is comparable to that experienced during the ‘taper tantrum’ of 2013 (see figure 2).

In the face of mounting pressure, the immediate policy response in EMEs has relied on two tools. First, monetary policy has generally become more restrictive, with reference rates increasing sharply in specific instances where conditions deteriorated more severely owing to persistent external vulnerabilities and perceived idiosyncratic risks. Second, the exchange rates of many EMEs adjusted in response to these shocks, with some currencies receiving support from foreign exchange intervention, either in the spot market or via derivatives.

Global tightening

Among the factors explaining the reversal of capital flows and consequent tightening in broader EME financial conditions, monetary policy normalisation in the US is particularly noteworthy. Naturally, higher interest rates in the US could be expected to represent a drag on capital flows towards EMEs. Notwithstanding some recent easing, market repricing of upside risks for the future trajectory of the federal funds rate in previous months led to outward pressures being stronger than anticipated.

In fact, more than 40% of the estimated outflows from EMEs in the first three quarters of 2018 that can be attributed to external factors was explained by increased market expectations about the US Federal Reserve Board’s policy.

It is worth highlighting global financial conditions remain accommodative in relation to historical standards, albeit tighter than a year ago. There are many factors at play behind such an outcome, and their interrelationships are complex. Two stand out in this respect.

First, the tightening bias at a global level that may derive from interest rate increases by the Federal Reserve is, at least partially, countered by the persistent degree of accommodation pursued by the central banks of other major advanced economies (AEs), in what has turned out to be a divergent monetary normalisation cycle in these countries.

Second, in the US, domestic financial conditions actually loosened even as the monetary policy rate started to increase in December 2015 and the Fed began unwinding its balance sheet in October 2017. Financial conditions in the US started to tighten only around the beginning of 2018.

Such an outcome runs counter to intuition. However, it is important to bear in mind that an economy’s financial conditions, broadly defined, are the result of the interplay of many variables, the impact of which may work in opposing directions. In the case of the US, the strengthening of the short-term growth outlook – in part resulting from the fiscal stimulus under way – may have raised expected corporate profits and thus supported asset prices through most of the run-up to the recent sharp market corrections. This effect was likely reinforced by the cross-border impact of large-scale asset purchases by central banks in Europe and Japan, thus stimulating demand for higher-yielding US securities. Furthermore, the tightening effects of monetary policy actions in the US may have been hindered by a gradual and, in general, predictable pace of increase in interest rates there.

In view of the difficulties inherent in trying to predict market movements – even more so in the context of unprecedented circumstances such as those prevailing – it is not at all clear how rapidly global financial conditions will tighten as the Fed and other central banks continue, or embark on, their respective policy normalisation cycles. To some observers, the recent adjustments in international financial markets – rising interest rates, declining stock indexes and depreciating currencies vis-à-vis the US dollar – are a welcome development, being consistent with a strong economic outlook, reduced risks of deflation in some AEs and, in general, a thus-far successful exit from the massive monetary accommodation of the decade following the outbreak of the crisis. However, the risk of a sharp tightening in financial conditions cannot be discounted.

At this current economic and political global juncture, several factors significantly increase the risk of a potentially disruptive scenario. First and foremost among these is the possibility of surprises in AEs’ monetary policy normalisation. This is particularly worrisome in the case of the US, where – notwithstanding downward adjustments in market expectations about the future path of interest rates following the recent market rout – inflation could surprise the upside as a result of ongoing fiscal stimulus measures in an economy operating at, or near, full capacity, in addition to price pressures that may derive from increased import tariffs.

Second, market sentiment might be adversely affected by increased political and policy uncertainty in a wide range of economies – both advanced and emerging. At the top of these concerns is the further escalation – or at least the persistence – of global trade tensions, especially between China and the US, the broader implications of which can well go beyond the current areas of dispute.

Third, confidence in the resilience and credibility of policy frameworks in EMEs may erode, as external shocks combine with existing vulnerabilities.

Structural challenges

In addition, structural challenges may further complicate matters. First, as previously noted, the context in which monetary policy normalisation in the US and other AEs is taking place is unprecedented, in turn making its potential ramifications difficult to foresee and assess. For one, interest rates have never been so low for so long, while the unwinding of the stimulus provided by unconventional monetary policy measures adopted at such a large scale remains untested. In light of these and other uncertainties, including those related to the characterisation and definition of ‘normality’ itself, it is evident that the potential for policy mistakes is sizeable. On one hand, adjusting policy too fast may, among other things, prompt disruptive responses in international financial markets, with adverse implications for the real economy at both domestic and international levels. On the other hand, moving too slowly may encourage the continued accumulation of debt as well as the build-up of risks and vulnerabilities in the financial sector.

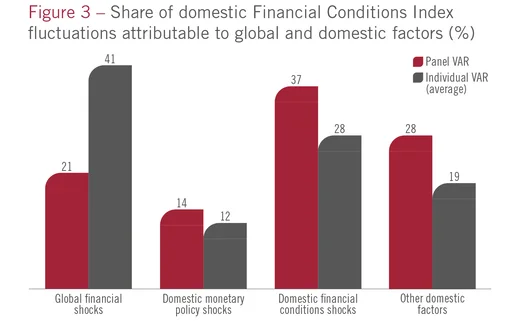

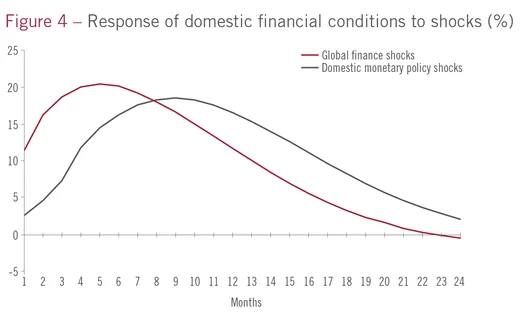

Second, on account of the greater financial integration across markets and economies brought about by globalisation, the control of domestic financial conditions by policy-makers may prove quite challenging (see figures 3 and 4). Some estimate that around 20–40% of the observed variation in domestic financial conditions can be explained by a single common factor, namely global financial conditions, an effect that tends to be greater – more than 60% in some instances – in EMEs. The situation is further complicated by the fact that local financial conditions tend to react faster and more strongly to external shocks than to adjustments in the domestic monetary policy stance. Furthermore, it is common for external financial conditions to be driven to a larger extent by factors other than macroeconomic conditions, such as abrupt swings in investor sentiment, financial contagion or regulatory changes, when tools to counter them may be more limited or less effective.

Third, the global financial structure has undergone profound post-crisis changes, which remain untested under widespread stress. One of them relates to evidence suggesting an increased segmentation of market liquidity, and the consequent risk that lower levels of liquidity enhance the potential for wide fluctuations in asset prices and financial stability. In this respect, the abundant liquidity resulting from overly expansionary monetary policies in AEs is anticipated to decline significantly in coming years.

Another change is the increased presence of foreign investors in local EME bond markets. It is true the level of risk is a function of the type of investor, with large institutional investors generally displaying a higher degree of stability. It is also the case that, in the final analysis, both foreign and domestic investors will have similar reactions to episodes of acute turmoil. However, it can also be argued that non-resident holders of domestic assets may be more sensitive to the impact of shocks, especially in cases with a significant share of investors operating through mutual funds and exchange-traded funds.

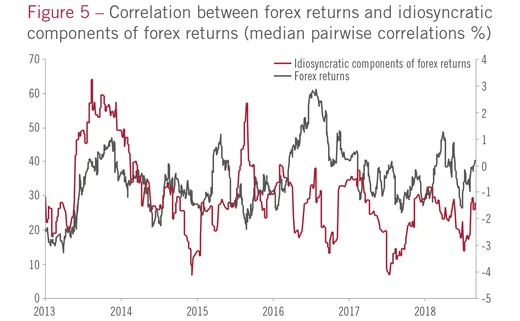

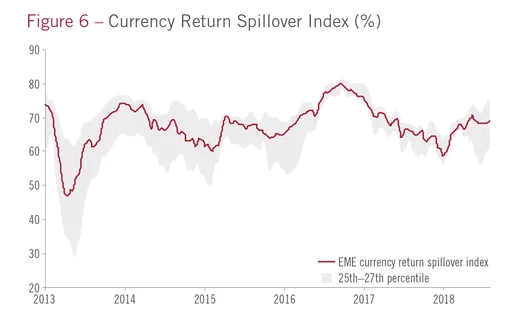

Clearly, EMEs should stand ready to face the materialisation of these and other risks. While isolation from changes in global financial conditions is unfeasible, the evidence clearly shows that domestic policies make a crucial difference. As in previous episodes of turmoil, global investors have differentiated EMEs on the basis of their economic fundamentals and other idiosyncratic factors. For instance, the deterioration of indicators of creditworthiness and currency depreciations has been sharper in countries facing more important economic and political challenges. Similarly, estimations of correlation of the idiosyncratic component of market exchange rates – or, more generally, of contagion among different EMEs – have increased recently, but they remain at low levels (see figures 5 and 6).

It would be naive and unfair, however, to assume EMEs will be able to overcome these challenges by themselves. Maintaining global financial stability is a complex task, and therefore its attainment and preservation is a shared responsibility that requires co-ordinated efforts from all parties. The role of AEs in this task is paramount to its fulfilment. Indeed, a careful communication of monetary policy decisions, a proper evaluation of spillover effects, strong support for the creation of an adequate global financial safety net and even co-ordinated policy action whenever needed, among other actions, should be the key ingredients of this co-operative approach.

AEs bear a clear responsibility for the current state of the world economy and should therefore assume an equally important role in overcoming the consequent challenges. But, beyond this, it is evident they also have much to gain from a solid performance of EMEs and stable global financial markets.

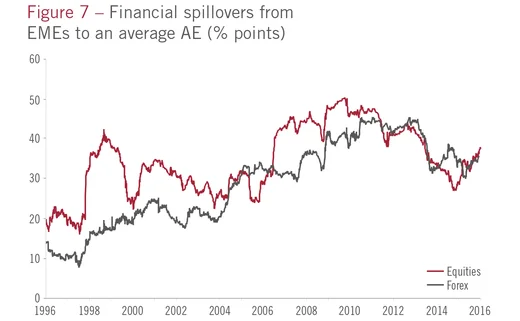

By virtue of their growing importance and integration into the global economy and financial system, the scope for spillovers from EME shocks into AEs has risen over the past decades to significant levels. According to International Monetary Fund (IMF) estimates, more than one-third of the variation in AEs’ stock market returns and in their exchange rates in recent years can be traced to spillovers from EMEs. Moreover, given the current extent of financial market integration and the unique features of international financial markets, financial volatility in EMEs may be widely transmitted even in the absence of crisis or near-crisis episodes (see figure 7).

In other words, policy-makers in AEs need to carefully consider not only the consequences of their policy decisions on EMEs, but also the risk of spillbacks from EMEs as a result of policy actions in AEs. The implications for international policy co-operation are self-evident.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com