Systemic importance

FSB reports ‘solid’ progress on financial regulatory reforms

FSB chairman Mark Carney gives update to G-20 finance ministers and central bank governors; new reports cover D-Sibs and the sensitivities of harnessing the power of shadow banking

Fed names academics on 2012 model validation council

US Federal Reserve names academic economists that will provide independent advice regarding models used in annual stress test of major banks and financial institutions

CPSS and Iosco set out central bank responsibilities for FMIs

CPSS and Iosco issue new standards for financial market infrastructures; include core responsibilities for central banks and other supervisory bodies

Commission paper sheds light on dangers of shadow banking

The potential for shadow banking to damage the wider banking system and disrupt the macro-prudential aims of the ECB has been highlighted in the latest green paper from the European Commission

Data: a core challenge for financial regulatory reform

Improving financial stability through the use of interconnected and predictive supervisory tools requires a rethink on data. By Constantin Gurdgiev and Keith Saxton

Robert Pringle’s Viewpoint: Central bank macro-prudential powers are no panacea

Central banks will take on substantial new macro-prudential supervisory powers in the years ahead. But this is a dangerous experiment, and a step in the wrong direction

Ingves targets domestic Sifis with tougher capital rules

Basel Committee chairman Stefan Ingves says all institutions whose disorderly distress or failure could trigger a systemic crisis should be subject to additional capital requirements

FSB discusses plans for the year

Financial Stability Board covers 2012 work plan in latest meeting; considers extending Sifi framework to domestic banks and globally significant insurance companies

Final rules to tackle systemically important institutions announced

G-20 agrees on policy measures to address risks posed by systemically important financial institutions; 29 institutions identified as of global systemic importance

Sifi rules will make financial system safer: BIS’s Cecchetti

Bank for International Settlements head of the monetary and economic department Stephen Cecchetti says new Sifi rules will provide positive externalities to entire financial system

Identifying Sifis: Central Bank of Colombia paper

Central Bank of Colombia releases a working paper outlining a method to establish the systemic importance of financial institutions; offers an alternative method to the BIS

BIS’s Cecchetti highlights merits of G-sibs surcharge

Bank for International Settlements economic adviser Stephen Cecchetti says reducing probability of G-sibs failing is cornerstone of regulatory response to too-big-to-fail

G-sibs surcharge will have positive macroeconomic impact, says joint Basel, FSB working group

Macroeconomic Assessment Group says growth benefits from capital surcharge on global systemically important banks outweigh costs from higher bank funding costs

Bank of Canada paper measures systemic importance of banks

Bank of Canada study builds framework to identify systemically important financial institutions

Forbearance incentive is greater among Sifis: IMF paper

Fund study says regulators have strong incentive to forebear systemically important financial institutions

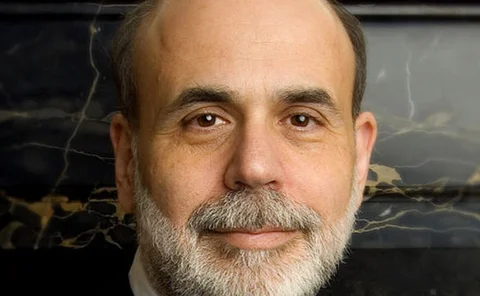

Fed aims for summer Sifi regulations

Bernanke says Fed expects to issue proposed rules on Sifi oversight this summer; also 'on schedule' to implement Basel III

Basel targets 28 banks with GSIB surcharge

Basel Committee says 28 banks will be required to hold additional loss-absorbency capital under proposed methodology for identifying global systemically important banks

BIS’s Caruana urges completion of regulatory reform agenda

Bank for International Settlements general manager Jaime Caruana highlights a number of challenges facing national authorities in implementing critical reforms

Going-concern triggers on CoCos unrealistic, says White

Contingent capital instruments designed to provide a capital boost before the point of non-viability are laudable but unrealistic, says former RMMG chair Mark White

Basel Committee will not impose CoCo requirement for Sifis

Basel Committee proposes a staggered common equity capital surcharge for systemically important banks, but steers clear of contingent capital

Fed’s Hoenig says Sifis are at odds with values of capitalism

Kansas City Federal Reserve president Thomas Hoenig says systemically important financial institutions inconsistent with capitalism

Ex-IMF adviser calls for 'hard rules' on cross-border resolutions

Former IMF adviser Rosa Lastra says international regulatory framework should apply 'hard' rules on cross-border resolutions; says FSA was scapegoat in crisis

BIS’s Hannoun spots conundrum in 'no bailout' line

Bank for International Settlements deputy general manager Hervé Hannoun says aversion to taxpayer-funded bailouts not fully priced in sovereign spreads

Basel Committee’s Walter: consensus reached on method to identify Sifis

Basel Committee has now agreed on criteria for banks posing systemic threat; FSB agrees on accelerated timetable for G-20 recommendations