Macroeconomics

Forecaster surveys improve eurozone inflation modelling – ECB paper

Households’ and firms’ expectations do not provide useful data on inflation

Delta variant had smaller impact on US consumer spending

Cleveland Fed finds weaker or no link between hospitalisation and spending in 2021

ECB paper examines ‘euroised’ economies

European countries’ informal adoption of euro places limits on central banks, says working paper

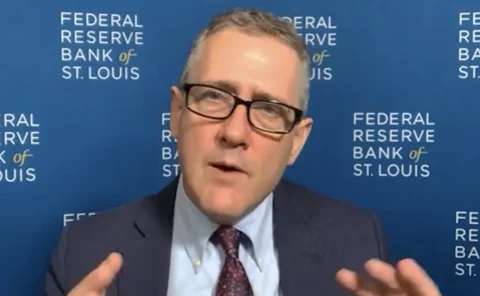

Fed’s Bullard believes a ‘five-year window’ for AIT is ‘realistic’

St Louis Fed president says “big tent language” was a reason overshoot details were not specified; “precise numerical implementations” can “get you into trouble”

Permanent or transitory? Officials wrestle with inflation uncertainty

Bailey warns of possible damage to credibility, but Carstens urges caution amid high uncertainty

James Bullard on Fed policy, action and governance

St Louis president calls for tapering amid “exceptional” job market and risk of “more persistent” inflation, quantifies ‘big tent language’ for pioneering AIT move, and details Congress’s role in Fed ethics oversight

IMF: growth prospects dim as pandemic lingers

Fund revises down growth forecasts, warning of inflation, disruption and divergence

Empirical economists win Nobel Prize

Card, Angrist and Imbens share prize for work on labour markets and causality

BIS paper outlines model of managed floats

Framework captures financial frictions while being simpler than other models, authors say

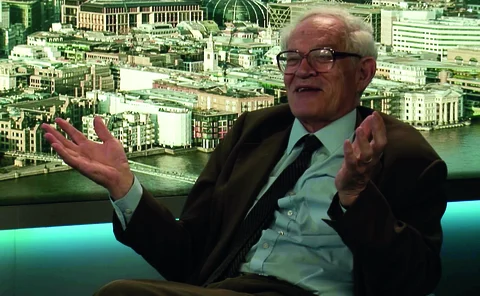

Goodhart, Gopinath and Lippi disagree on inflation

Central banks lack tools to deal with inflation, Goodhart warns, but IMF chief economist disagrees

Inequality sharpens monetary policy’s effects – ECB paper

Author analyses “inequality channel” using model with three types of heterogeneous agent

BDF paper analyses banks’ capital buffers

Researchers suggest new approach to setting banks’ structural and cyclical reserve levels

Bolivian ex-governor warns pension law poses bank risk

Current governor has stayed silent on risks posed by measure, former governor Morales says

Powell says taper test has been met ‘with regard to inflation’

Fed chair tells Jackson Hole conference that slowing QE this year “could be appropriate”

Chilean governor opposes new pension withdrawals

Congress considering authorising fourth drawdown as stimulus measure

Jackson Hole conference switches to online-only model

Kansas City Fed cancels Wyoming get-together, citing Delta variant

Fed may taper asset purchases this year, say FOMC minutes

Federal Reserve staff warn US financial system has “notable” vulnerabilities

Link between US labour costs and inflation has weakened – ECB paper

US can sustain robust labour markets without risking inflation outbreak, researchers say

Macro-pru can help avoid ‘reversal interest rate’ – Bundesbank paper

Use of capital ratios can aid eurozone monetary policy, researchers say

Macro-pru mortgage limits were successful – RBA research

Central bank rates performance of policies implemented to cool risks in the housing market

Paper analyses eurozone consumers’ inflation expectations

Short-term views, trust and Covid-19 shaped medium-term expectations – Bank of Finland paper

BdF paper analyses inflation tolerance ranges

Ranges “should not be zones of inaction” and may have unfavourable trade-offs, researchers say

Vast majority of central banks provide communications training

Social media, writing skills and public speaking emerged as key areas

Bank of Italy paper uses agent-based model of housing market

Limits on borrowing are effective but not currently needed for Italian housing sector