Research

Colombian paper flags danger from abnormal credit growth

Credit expansion does not always imply excessive risk-taking, but abnormal credit growth causes greater risk-taking and contributed to Colombia’s financial crisis in the late 1990s, paper finds

Bundesbank research says sovereign default can be the best option

Discussion paper finds it may be optimal to choose a costly default over legal repayment, but only when a country is facing disaster

French paper warns of banks precipitating crises through hoarding

Research develops new ‘domino effect’ model, examining how banks may bring about crises by attempting to protect themselves

New DSGE model finds anticipated 'low for long' policy can cause a boom

Finnish paper, inspired by US policy of the early 2000s, finds combination of too-low-for-too-long interest rate policy and optimism leads to an increase in overall leverage

Interest rate forecasts ‘constrain’ central banks

Norwegian paper finds that Norges Bank and Reserve Bank of New Zealand are ‘reluctant to deviate’ from interest rate paths they have previously published

IMF researcher proposes new method for top-down stress testing

New, simple methodology for structural market-based top-down macro stress tests aims to overcome onerous data requirements

Sri Lankan central bank reveals inflation spike in 2012

Sri Lankan annual report says economic growth, while still strong, fell in 2012 while inflation rose sharply; central bank increased reserves by 15%

Polish paper scrutinises interest rate holds

Research finds that central banks keep interest rates unchanged on majority of occasions; proposes model that distinguishes between rate-holds in period of tightening, easing and neutrality

New model prescribes strongly counter-cyclical medicine for financial shocks

Working paper from the Bank of Canada suggests counter-cyclical bank capital rules can help steady the ship in the wake of financial shocks, in tandem with monetary policy measures

ECB paper examines shifts in fiscal regimes

Study finds responsibility for stabilising debt levels has swung between monetary and fiscal authorities in UK, Germany and Italy; most clearly defined in UK

Accumulating reserves to guard against inflation is 'misplaced'

Researchers at Bofit institute find that using reserves as a ‘bulwark against goods price inflation' is a mistake; say best protection against costly reserves accumulation is flexible exchange rate

Payment pricing preventing electronic migration in Ireland

Article in central bank’s quarterly bulletin finds Ireland could save €1 billion by switching from cheques to a more efficient payment instrument

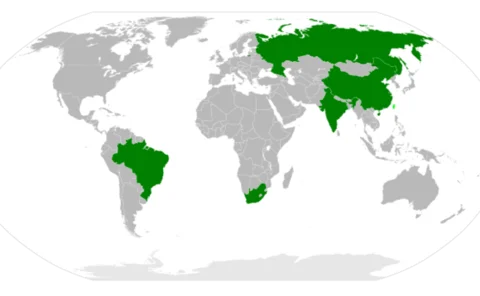

Chilean paper finds room to reduce risk by diversifying investment in Brics

Statistical analysis finds little co-integration of stock market vectors in Latin America and the Bric countries; says this gives investors a good opportunity to diversify, which would reduce risk

IMF paper uses monetary model to explain term premium

Study says central bank supply of liquidity influences asset prices; argues that this relationship can explain greater proportion of term premium than non-monetary models

Contribution of Irish financial sector to GDP ‘overstated’

Paper questions the statistical methodology behind claim that Irish financial sector contributes €15 billion to country’s output

Chilean paper finds central bank’s forecasts influence private sector expectations

Working paper finds evidence the private sector updates inflation expectations based on the Central Bank of Chile’s forecasts; suggests more central banks should publish forecasts to aid policy

Czech research examines macroprudential policy in small economies

Policy note stresses the importance of considering cyclical systemic risk when setting macro-prudential policy in a small EU economy

IMF working paper examines monetary policy ‘leaning against the wind'

Monetary authorities that want to stimulate the economy while maintaining financial stability should cut deeper, but then raise rates again faster

BIS paper urges statistics expansion

Research tells policy-makers to take advantage of the ‘sense of urgency’ that follows financial crises to expand the data they collect, including more comprehensive information on banks

Bundesbank research finds strong role for China in global inflation dynamics

Discussion paper weighs cross-border effects of supply and demand shocks in China; results suggest Chinese shocks explain an average of 5% of total inflation across countries

Portugal must strengthen institutions to attract foreign direct investment - working paper

Bank of Portugal researchers call for a focus on corruption and strengthening the independence of the financial system to increase attractiveness for FDI

IMF paper recommends China adopt ‘better-targeted’ macro-prudential policies

Study encourages China to tailor macro-prudential tools to regional and economics differences in country’s banks; suggests coupling policies with greater commercialisation

Norwegian paper finds implicit intra-day interest rate in UK money market

Research says that – in the absence of contractually binding repayment time – there is an implicit cost of delaying payments in the UK’s overnight money market

Bundesbank researchers test if higher inflation could ease public debt burden

Paper finds 'minor effect' on public debt from a raised inflation target, and would only be felt over a long time-frame