United States

IMF staff present mixed economic outlook following G-20 meeting

Report sounds note of cautious optimism as financial markets recover, but downside risks remain around the implementation of important policies in the US, Japan and Europe

NY Fed paper highlights money market fund ‘stampede’ risk

Staff report finds intermediation by money market funds can turn unexpected withdrawals into runs, meaning a small shock can bring down the whole banking system

FDIC director backs Haldane on leverage ratio

Jeremiah Norton follows Bank of England’s Andrew Haldane in criticising Basel III’s risk-weighted assets, and says a higher leverage ratio would be a simple, effective solution

San Francisco Fed dissects long-term unemployment

Long-term unemployment has ‘persisted remarkably’ since outset of recession; should disappear over time as economic activity increases

‘Crisis in the eurozone is not over’, says MAS chief

MAS's Ravi Menon offers a roadmap to central banks and governments to help ‘normalise’ the global financial system; hits out at loose monetary policies and says fiscal policy debate is misinformed

Rating agency warns of knock-on effect of Fed’s foreign bank rules

Fitch says tighter rules for foreign banks operating in the US are likely to make other countries raise standards as well, putting a squeeze on the growth of global banks

Calomiris unveils ‘Sword of Damocles’ CoCo to hold over CEOs

Columbia academic and ESRB committee member Charles Calomiris believes CoCos designed to force top bank executives to issue equity well before they are triggered would reduce systemic risk

Robert Pringle’s Viewpoint: Cameron’s high-risk European gamble

British Prime Minister David Cameron's high-stakes bid to renegotiate the UK’s role within the EU has rankled some officials in Europe. But both sides would lose from a UK withdrawal

Krugman adds lustre to $1 trillion coin plan

Proposal to mint a $1 trillion coin to avoid 'fiscal cliff' in US wins Krugman backing and Republican opposition

Fed could stop asset purchases ‘well before end of 2013’

FOMC members express concerns over costs of quantitative easing as the Fed’s balance sheet expands; most members see purchases ending within a year

US thrashes out partial solution to fiscal cliff

US government reaches agreement that postpones and reduces fiscal cliff; measures unlikely to have significant impact on Fed policy, some observers say

Book notes: Guardians of Finance

This is a book offering a useful contribution to the debate over the future of regulation. By James R Barth, Gerard Caprio Jr and Ross Levine

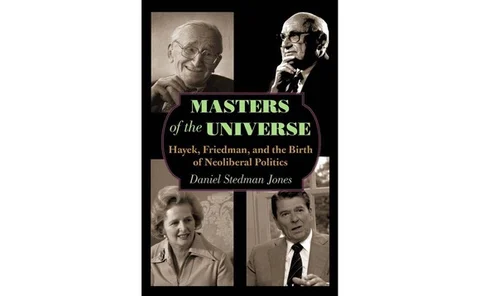

Book notes: Masters of the Universe: Hayek, Friedman, and the Birth of Neoliberal Politics

At first glance the cover of this book implies that the overweening attachment of Thatcher and Reagan to free market economics lay at the root of the 2007–08 crisis. But it is not as simple as that

Book notes: First Principles: Five Keys to Restoring America's Prosperity

The author's premise is that the best way to understand the problems confronting the American economy is to go back to the first principles of economic freedom upon which the country was founded

Racial equality boosted by deregulation in US, paper says

Banking sector policies that facilitated competition helped increase the black population’s relative wages in the US, but only in racially biased states

FSB presses forward with legal entity identifiers

Latest Financial Stability Board report shows further progress towards implementing the global legal entity identifier system with March 2013 deadline fast approaching

FDIC name new leadership

President Obama names acting-chairman Martin Gruenberg as the new FDIC head and ex-Kansas City Fed president Thomas Hoenig as his number two

Fed’s Tarullo outlines update to regulation of foreign banks

Rules for foreign banks operating in the US need to be strengthened, but should not be so harsh as to give domestic banks a competitive advantage, says Daniel Tarullo

IMF’s Lipton cools recovery talk

Greater euro area and US progress is needed to avoid another global downturn; more co-operation required on regulatory reform

Lagarde implores next US president to act fast on ‘fiscal cliff’

IMF managing director Christine Lagarde has challenged the next US president to urgently address Washington’s ‘policy uncertainty’ irrespective of who wins

Fed study shows US banks still wary of lending to European peers

US banks are continuing to tighten lending standards to their European counterparts with some winning additional business as a result of reduced competition from European banks, Fed study finds

Hurricane Sandy disrupts Federal Reserve operations

New York Federal Reserve suspended operations for a day as hurricane battered eastern US; temporary measures taken to support banking in face of disruptions to power, communications and staffing

Fed’s QE2 will have ‘modest impact’, says San Francisco paper

Research by the Federal Reserve Bank of San Francisco estimates the second round of Fed quantitative easing will have only a small effect on GDP growth and inflation

National production gaps don’t drive stock markets, says Swiss paper

Study by the Swiss National Bank finds global business cycle risks affect stock markets more than any nation-specific production gap