United States

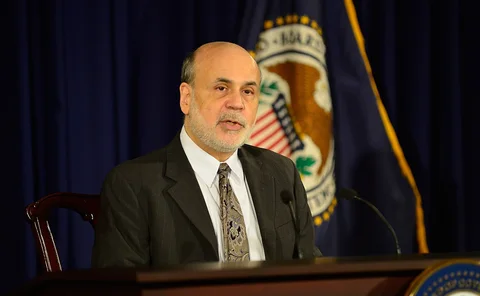

Departing Bernanke takes stock of Fed's unprecedented actions

Federal Reserve chairman discusses the ups and downs of the bank's asset purchases and attempt to guide market expectations; admits shortcomings but maintains policies are warranted

Moody's says big US banks no longer ‘too big to fail'

Agency cuts ratings of four systemically important US banks, including Goldman Sachs and JP Morgan, as Dodd-Frank believed to reduce prospects of future government bailouts

Yellen defends QE in congressional confirmation hearing

Prospective Fed chair says asset purchases have had ‘meaningful' impact on financial wellbeing of normal Americans; hints at further banking regulations ‘down the line'

Fall in OECD inflation highlights advanced economy monetary policy dilemmas

New OECD figures show lower annual inflation rates despite Japanese CPI turning positive; pressure mounts on ECB and Fed to counteract trend, but analysts unsure with what tools

US Senator vows to block Yellen nomination

Republican Rand Paul - son of long-time Fed critic Ron Paul - says he intends to fight confirmation of Janet Yellen as the next Fed chair unless monetary policy is subjected to Congressional scrutiny

FDIC inks MoU with China on bank resolution

The document, signed in Beijing yesterday, seeks to improve collaboration on resolution planning through the exchange of information and co-operation on risk monitoring

Fed’s Beige Book reveals ‘modest’ employment growth

Summary of the economic conditions across the 12 Federal Reserve districts finds both employment and economic activity were ‘modest’ in September, while price pressures were ‘limited’

New $100 bill the ‘most sophisticated piece of currency' to date, says Fisher

Most counterfeited US bill is embellished with new security features to 'deter bad guys' and protect consumers and businesses from losses

US resolution on debt ceiling ‘critical for global economy’, says BoJ’s Nakaso

Bank of Japan deputy governor Hiroshi Nakaso says the biggest threat to the US economy is the on-going dispute between politicians in resolving the debt ceiling; QQE in Japan remains on track

‘Unprecedented' US rate normalisation is global economy's biggest challenge, says IMF

Overshooting interest rates prompted by Fed taper may expose substantial financial weaknesses in both advanced and emerging countries, warns stability report; shadow banking of particular concern

Canadian bonds more normal than US and UK equivalents at ZLB

Canadian sovereign debt yields are more responsive to shocks than UK and US equivalents at zero lower bound; differences diminish at shorter maturities

Close elections kryptonite for foreign investors, Fed research finds

The timing of national elections causes FDI flows from US firms to affiliates in more than 40 countries to drop by an average of 12% compared to non-election years, according to Fed research paper

Lagarde says US has ‘special responsibilty' to unwind QE responsibly

IMF director says failure to raise US debt ceiling could seriously damage the global economy; warns emerging markets will have to adjust to new economic reality for remainder of the decade

Canadian yields shown to be less sensitive to data shocks than US or UK

Working paper from the Dutch central bank shows that at the zero lower bound, Canadian government bond yields are less sensitive to surprising domestic data than US or UK equivalents

FDIC chair discusses US effort to balance capital and leverage requirements

Martin Gruenberg says Basel III relies too heavily on capital ratios, potentially incentivising big banks to employ ‘imprudent' leverage strategies; discusses regulatory remedies

US fiscal stance is creating inflation, says Riksbank paper

Researchers show the existing unsustainable levels of US federal debt are generating inflationary pressures, but these are difficult to spot as they are being dwarfed by Fed policy and economic slack

IMF's Lagarde backs Fed over asset purchases

The IMF’s managing director believes the Fed should take a 'gradual' approach to reversing its asset purchases and rate cuts; stresses the importance of unemployment figures

A sad ending to Summers versus Yellen

The politicisation of the debate over who should be the next chair of the Federal Reserve may be a sign of the times, but it is a sad day for central banking, argues Thomas Cargill

Fed contemplates change to forward guidance

Minutes from the FOMC’s July meeting show members were divided over the outlook for the US economy, and on the prospect of tinkering with the Fed’s forward guidance

Boston Fed paper flags need for research into debt dynamics in recovery period

Research into the relationship between debt and consumption to the household level is ‘limited’ and does not ‘directly speak’ to the United States' recent weak performance, says discussion paper

A status report on Dodd-Frank and the Volcker rule

As the US and Europe move closer to co-operating on derivatives legislation, Vembar Ranganathan looks at the status of Dodd-Frank implementation aimed at curbing excesses in the derivatives market

Volcker rule is driving reluctance to hold risk, warn currency managers

US banks are holding less risk as they prepare for the requirements of the Volcker rule, leading to more short-term volatility and less liquidity in some currencies

NY Fed study says shadow banks are here to stay

Study says shadow banks will play a significant part in the future of the United States’ financial system; higher capital standards on banks will lead to increase in shadow activity