Federal Reserve System

Fed’s Lacker warns of elevated inflation expectations

Richmond Federal Reserve president Jeffrey Lacker says using monetary policy to address unemployment risks permanently elevating inflation expectations

The euro funding gap and its consequences

The crisis has highlighted that the euro is far from a true reserve currency. That has worrying implications, argue Annina Kaltenbrunner, Duncan Lindo, Juan Pablo Painceira and Alexis Stenfors

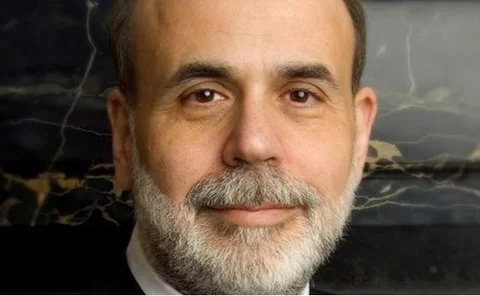

Bernanke: QE2 a misleading moniker

Federal Reserve chairman Ben Bernanke says $600 billion Treasury purchase scheme not officially quantitative easing

HKMA, PBoC react to QE2

Hong Kong Monetary Authority and People’s Bank of China counter Fed’s quantitative easing programme with regulatory and monetary policy measures

Plosser: focus on real, not nominal, rates

Philadelphia Federal Reserve president Charles Plosser suggests targeting interest rates to lean against strong asset-price growth

Fed issues guidelines on Volcker rule enforcement

Federal Reserve guidelines cover aspect of rule that extends compliance period to firms regulated by the central bank

What’s wrong with QE2?

Geoffrey Wood explains why he signed a letter arguing against the Federal Open Market Committee’s latest round of asset purchases

St Louis Fed: Chinese house prices have minimal effect on savings rate

St Louis Federal Reserve study says rising housing prices in China do not explain the high savings rate of households

Academics attack QE2

Twenty-three academics call on Federal Open Market Committee to “reconsider and discontinue” QE2; signatory argues problems are as much on supply side as demand side

Fed’s Hoenig: US housing policy badly flawed

Kansas City Federal Reserve president Thomas Hoenig says government intervention in housing markets was counterproductive

Fed’s Tarullo defends US record on Basel II

Federal Reserve governor Daniel Tarullo dismisses criticism over US implementation of minimum capital requirements under Basel II; says Basel III will only be effective if applied rigorously by all countries

Fed’s Warsh advocates pro-growth fiscal policy in US

Federal Reserve governor Kevin Warsh says pro-growth fiscal policy will spur long-term investment

Too soon to judge QE2: Korea's Kim

Bank of Korea governor Kim Choong-soo says Federal Reserve's second round of monetary easing cannot be prejudged; outlines challenges for domestic economy

New York Fed announces QE2 purchase plan

New York Federal Reserve sets schedule for $105 billion-worth of purchases of Treasuries over the next month

QE2 criticisms “baffling”: King

Attacks on the Federal Open Market Committee’s latest round of asset purchases meet with scorn from Bank of England governor

Focus on trade rather than stimulus: business leaders to G20

International Chamber of Commerce honorary chair Victor Fung calls on G20 to focus on boosting international trade rather than monetary stimulus to raise growth; currency tensions expected to feature heavily at Seoul Summit

Boston Fed names new first vice president

Boston Federal Reserve appoints Federal Reserve Information Technology vice president Kenneth Montgomery as first vice president

Fed's Fisher lambasts QE2

Dallas Fed president Richard Fisher claims QE2 will not create jobs, just spur speculation; comments highlight threats to Bernanke consensus when Fisher and others become FOMC voters in 2011

Michael Bordo: Fed failed as lender of last resort

Federal Reserve did not fulfil its role as lender of last resort

Eugene White: Fed supervision increased probability of crises

Fed’s increased role in banking supervision during the early part of the last century altered behaviour of banks and regulators

India’s PM backs QE2

Backing from Manmohan Singh follows attacks from other emerging markets

Ron Paul set to renew bid to audit Fed

United States representative Ron Paul vows to audit Federal Reserve if he wins power of House subcommittee on monetary policy

Zhou, Meirelles attack QE2

Central Bank of Brazil president Henrique Meirelles and People's Bank of China governor Zhou Xiaochuan bash Federal Reserve’s latest stimulus programme

Kansas Fed on moral hazard in lending

Kansas City Federal Reserve study shows moral hazard poses greater threat to lending than adverse selection