Federal Reserve System

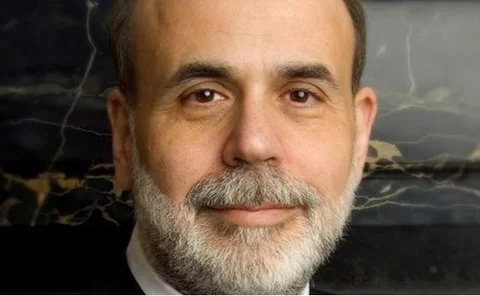

The dangers of Bernanke’s calls for change

Fed chairman Ben Bernanke’s calls for more research into areas of economics underexplored by central bankers is commendable, but translating this into policy has its risks, writes Claire Jones

Fed’s Yellen: macroprudential policy must balance rules and discretion

Federal Reserve vice chair Janet Yellen says macroprudential supervisors should be guided by fixed rules, but have discretionary capacity to surprise firms

Diamond, Mortensen, Pissarides win Nobel Prize

Peter Diamond, Dale Mortensen and Christopher Pissarides share Nobel Prize in economic sciences for work on labour market search frictions

Shirakawa flags limits of monetary policy

Bank of Japan governor says loose monetary policy is a necessary condition for recovery, but its efficacy is limited and may have unintended consequences

St Louis Fed: forward rates provide investors little advantage

St Louis Federal Reserve study says informational value of longer term forward rates provides no additional economic benefits

Philly Fed: school failure insurance reduces dropout rates

Philadelphia Federal Reserve study says introduction of insurance against college failure risk could increase retention rate

NY Fed’s Sack on FOMC’s policy shift

New York Federal Reserve executive vice president Brian Sack said further measures represent meaningful shift in balance sheet path

Paper problems delay release of new $100 note

Federal Reserve says sporadic creasing of paper on new banknote will setback release of new $100 bill

Senate confirms two out of three Fed directors

Last-minute deal seats Yellen and Raskin, Diamond turned down

Basel II grievances stir transatlantic tensions on new accord

BNP Paribas chairman Michel Pébereau slams United States’ failure to implement Basel II across the board; says Basel III will unfairly impair Europe

Bernanke stresses importance of financial education

Federal Reserve chairman Ben Bernanke says financial literacy is important part of school curriculum

SF Fed: SWFs trump central banks on foreign investment returns

San Francisco Federal Reserve study shows central banks are more risk averse than sovereign wealth funds, producing lower average returns on investments in foreign assets

Fed’s Lacker: constructive ambiguity is unworkable

Richmond Federal Reserve president Jeffrey Lacker says fudging tactics over bailouts will be short-lived

Bernanke charts new course for Fed economics

Federal Reserve chairman Ben Bernanke suggests research must veer away from assumptions based on classical paradigm; stresses models must better capture irregular behaviour

Fed’s Plosser calls for rules for crisis-fighting measures

Philadelphia Federal Reserve president Charles Plosser says Fed risks undermining its credibility if it does not provide clear policy rules for the exceptional policy measures seen during the crisis

BoJ doing all it can to bolster growth, says Shirakawa

Bank of Japan governor Masaaki Shirakawa points to central bank’s multiple efforts to boost activity

Fed's Alvarez favours balanced incentive compensation design

Federal Reserve general counsel Scott Alvarez says overly restrictive compensation packages may create risk to organisations

New York Fed research finds flaws in inflation expectations polls

New York Federal Reserve research uncovers faults in measuring inflation expectations; says questions on rate of inflation rather than price level provide better guide to future uncertainty

Rate decisions this week

Majority of central banks stand pat as uncertainties persist over growth, price pressures; Iceland cuts while Turkey, Uruguay tighten policy

US to launch financial stability council next week

Financial Stability Oversight Council to hold first meeting on 1 October

Money market rate best policy target: BIS research

Bank for International Settlements research finds lower macroeconomic volatility where central banks use money market rather than repo rate as policy target

Rajan, Krugman renew spat

Ex-IMF chief economist Raghuram Rajan and Nobel laureate Paul Krugman revive clash over central banks' role in the crisis

Monetary policy best placed to boost short-term growth: King

Bank of England governor Mervyn King tells trade unionists that monetary policy is best suited to revive flagging broad money figures; says fiscal emphasis should be on debt reduction

SF Fed: fiscal stimulus had short term benefits

San Francisco Federal Reserve study finds fiscal stimulus has had mixed effect on employment in the United States