Federal Reserve System

Monetary policy best placed to boost short-term growth: King

Bank of England governor Mervyn King tells trade unionists that monetary policy is best suited to revive flagging broad money figures; says fiscal emphasis should be on debt reduction

SF Fed: fiscal stimulus had short term benefits

San Francisco Federal Reserve study finds fiscal stimulus has had mixed effect on employment in the United States

NY Fed: charter schools preferred over public

New York Federal Reserve study finds charter schools in Michigan compete for student enrollment with private schools

Fed proposes high frequency method to calculate equity returns

Federal Reserve study finds new method of measuring equity returns using high frequency data reduces forecasting bias

Beige Book points to gloomy outlook for US economy

Reports from twelve regional Federal Reserve districts add further weight to fears of double dip; say weakness in housing market tempering recovery

Boston Fed: Massachusetts suburb receives housing boost from Boston

A Boston Federal Reserve study shows inner city growth impacts positively on housing recovery in suburban areas

Interview: Raghuram Rajan

University of Chicago Booth School of Business' Raghuram Rajan on Fed policy and officials, the structural flaws in the US economy, and the future of economics in central banks

Federal Reserve: discount rate minutes July-August 2010

Two of 12 regional Feds wanted higher primary credit rate

Cleveland Fed: Foreclosure lowers home prices by 1.6%

Cleveland Federal Reserve paper finds effects of foreclosure on house prices larger than previously thought

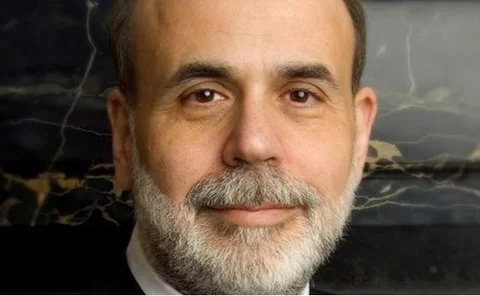

Bernanke: Fed won’t rule out leaning against wind

Regulation should be “first line of defence” against bubbles, but FOMC is monitoring financial imbalances

Fed cannot bear full burden of job creation: Fisher, Plosser

Regional Federal Reserve presidents Richard Fisher and Charles Plosser say loosening monetary stance further will not cure unemployment ills; monetary policy no panacea for macroeconomic problems

Rajan, Krugman clash over Fed policy

Ex-IMF chief economist Raghuram Rajan and Nobel laureate Paul Krugman lock horns over Federal Reserve’s loose monetary stance

FOMC officials cite disinflation in explaining policy shift

Federal Open Market Committee minutes reveal officials see anaemic growth tempering price pressures

Governors from five continents meet in Jackson Hole

Roster of attendees shows 41 central bank heads travelled to the wilds of Wyoming for Jackson Hole meet; number of Fed officials in attendance falls by a third

BoJ expands fixed-rate fund supply on growth, yen fears

Bank of Japan unveils six-month term to existing fixed-rate funds operation; facility to expand by $238 billion on fears of weak US growth, yen strength

Focus on banks’ incentives must continue post-crisis: Bank’s Bean

Bank of England deputy governor Charles Bean says crisis focus on bank incentives must remain; financial market problems require macroprudential instruments

Kansas’s Hoenig calls for Fed to oversee mobile payments

Central bank is the only authority that will take holistic view of mobile payments security, Kansas Federal Reserve president Thomas Hoenig says

Unemployment caused by structural mismatch: Minneapolis Fed’s Kocherlakota

Minneapolis Federal Reserve president Narayana Kocherlakota analyses the breakdown between job openings and unemployment in the United States

Bernanke dismisses higher inflation targets, unconvinced on conditional commitment

Federal Reserve chairman Ben Bernanke rejects higher inflation targets; says conditional rate commitment too risky, despite success in Canada

Too much expected of central banks: CentralBanking.com poll

CentralBanking.com poll shows more than 66% of readers think monetary authorities cannot be expected to boost growth and protect price stability

Fed looks to take Bloomberg battle to Supreme Court

Federal Reserve asks appeals court for stay on ruling that will force it to reveal emergency lending details; central bank considering appeal to country’s highest court as last resort

Decomposing the education wage gap

Atlanta Federal Reserve paper adds to plethora of research on link between education and wages

Atlanta Fed on dual labour markets

Income inequality may be exacerbated by firing costs, Atlanta Federal Reserve research argues

Impact of pledge to keep rates on hold unclear: Bank of Canada

Canadian central bank research says conditional commitment to keep rates low has had mixed effect; study shows pledge lowered interest rates on government bonds, but findings not statistically strong