The Belt and Road Initiative 2021 Survey – The impact of Covid‑19 on the BRI

The Covid‑19 pandemic had a stark effect on global GDP growth last year. In April 2021, the International Monetary Fund (IMF) said the global economy contracted by 3.3% in 2020 – the steepest downturn since the Great Depression of the 1930s. The plunge in economic output was the result of social distancing measures implemented to contain the novel coronavirus, which in turn caused supply chain disruptions and major project delays. Most governments worldwide have also been forced to take on substantially more debt to fund Covid‑19 emergency healthcare measures, as well as economic crisis-fighting policies aimed at limiting the immediate economic and social costs of lockdowns.

Some countries have emerged worse off than others, particularly low- and lower-middle-income countries. Since February 2020, the IMF has made $250 billion available to member countries, representing one-quarter of its total $1 trillion lending capacity, to assist in the battle against Covid‑19.

This has come at a time when the debt profile of some vulnerable nations has become precarious. As a result, all members of the Group of 20 extended a debt moratorium to nations they deemed the poorest borrowers in April 2020. This delayed around $16.5 billion in debt servicing to official bilateral creditors. China, as a member of the G20, signed the pledge.

The Belt and Road Initiative (BRI) Survey of Central Banks 2021 found that the Covid‑19 crisis has affected many BRI projects, with more than two-thirds of central banks saying it has had a negative impact on progress to some degree. The primary reason for disruption was related to social distancing and lockdown measures limiting work. But, when combined, a shift in government priority away from the BRI and local funding constraints had an even greater impact.

China is now one of the world’s largest creditors and has invested more than $500 billion in BRI-related projects, often lending to developing nations – particularly in Africa and Latin America. Any failure to repay BRI debts would push up the non-performing loan burden of China’s development banks and commercial banks at a difficult time.

As the first victim of the Covid‑19 pandemic, China also had to implement its own strict lockdown measures in early 2020 and experienced stresses to its manufacturing due to supply chain interruptions and deteriorating trade ties with the US and other key trade partners. This contributed to a year-on-year contraction in GDP of 6.8%% in the first quarter of 2020, according to China’s National Bureau of Statistics. But China’s relative success in social distancing and its vaccination of key workers has enabled it to resume much of its pre-crisis growth.

Despite its own economic challenges, central bank survey respondents indicated little evidence that Chinese institutions had restricted BRI financing. Moreover, the outlook in a post-lockdown world (once the debt issues are worked out) appears promising – with 80% of respondents believing that BRI projects will boost economic recovery and, of these, more than 70% saying they can contribute to a green recovery and more sustainable development.

Key findings

- Lockdowns and social distancing: two-thirds of BRI projects hit by Covid-19 restrictions

- Some governments are shifting priorities away from the BRI

- No central bank reported a reduction in funding from China

- Chinese development and state-owned banks still offer the most financial support

- Financial markets provide very limited funding

- Geopolitical tensions were cited as problematic by just 8%of respondents

- 87% expect BRI projects to contribute to post-Covid recovery

- 75% of these say the BRI can support a green recovery and sustainable development

- There is greater scope for environmental standards and green energy/transport co-operation

- The majority of respondents expect the BRI to boost GDP in the next five years

- 88% of survey respondents expect the BRI to contribute to home-jurisdiction development

- The BRI can help on infrastructure, job creation and catalysing other foreign direct investment

- There are low expectations of BRI alleviating poverty directly

- Most development is taking place in transport and logistics, power, and oil and gas

- Nearly 80% believe BRI projects are economically viable

- 23% said BRI debt is causing their external debt to rise to unsustainable levels

- BRI debt terms appear similar or more favourable to other financing terms and conditions

- Central banks would like to see BRI projects align more with national priorities.

Profile of respondents

Central Banking received responses from 25 central banks participating in the Belt and Road Initiative. Over half of respondents were European, with central banks from Asia and the Middle East making up 16% and 12%, respectively. In 2021, there was a decrease in response from central banks in the Americas and Africa, while the proportion of responses from Oceania stayed the same.

Percentages in some tables and graphs may not total 100 due to rounding. Data has been presented in the graphs to show the number of respondents as well as percentage totals.

Launched in 2013, the BRI is China’s flagship international project, aimed at reviving trade routes through large-scale infrastructure projects and, more recently, technology development. Over time, its scope and reach has proliferated beyond the original silk routes between China and Europe to include countries in South America, Africa and some areas of the Caribbean.

By the start of 2020, almost 3,000 BRI-linked projects (valued at around $3.9 trillion) were planned or under way, according to research from the Oxford Business Group. However, at the end of Q1 2020, following the arrival of the Covid‑19 pandemic and as borders were closed and lockdowns imposed, progress on many projects stalled. As part of the 2021 survey, Central Banking asked central banks how the pandemic had affected the progress of BRI projects in their jurisdictions. Just over half reported a moderate negative impact, and a further 18% said their projects had been significantly impacted due to Covid‑19, versus 30% of respondents who said the pandemic had no impact on projects (see figure 1).

The figures broadly align with China’s Ministry of Foreign Affairs, which said in June 2020 that 30%–40% of BRI projects had been affected by the outbreak, while a further 20% had been seriously affected.

According to numerous media outlets, during 2020, a number of BRI projects were paused to allow countries affected to focus on the spread of the pandemic. In recent months, a number of these projects have been restarted.

Responding to the survey, a central bank in Central Asia noted that its road infrastructure project was delayed and the deadline drawn further out, but the withdrawal of funds remained minimal. A central bank in Europe noted that, while Covid‑19 had not hindered the implementation of BRI projects in its jurisdiction, public debt had increased to meet pandemic-related expenditure needs. The rise in debt could “undermine the fiscal space of the country to meet the financing needs of future infrastructure projects”, the central bank said.

Social distancing and lockdown measures, and local funding restraints were among major causes of BRI projects stalling, according to survey data (see figure 2).

Of those that said the pandemic had had a negative impact in some form, social distancing was listed by 75% as the primary cause; a shift in government priority and local funding constraints were also highly placed, with 50% and 42% of institutions citing these issues, respectively. A relatively small percentage of central banks (17%) also noted reduced interest from local businesses.

Despite growing political tensions between China and the US, and some other economies – some US figures have criticised China for engaging in ‘debt-trap diplomacy’ for some BRI loans; Australia cancelled its BRI involvement and the European Union and India are co-operating on an alternative to the BRI – just 5.9% of central banks cited political tensions as the major cause of project delays.

Growth on the horizon

While the Covid‑19 pandemic may have stalled some BRI progress, 75% of central banks agreed the initiative will contribute to the post-Covid recovery within their jurisdictions (see figure 3). Thirteen per cent strongly agreed, while a further 13% neither agreed or disagreed.

When looking at the impact of the project on growth more generally, despite the current international political and economic environment, 69% of central bank respondents also agreed the BRI would make an important contribution to the global recovery and development (see figure 4). A further 25% strongly agreed.

“The disruption of supply chains and trade relations is one of the main negative consequences of Covid‑19. If realised, BRI-related projects could help alleviate the impact and accelerate post-pandemic trade flows among participant countries,” a central bank from Europe said. “In addition, financing new infrastructural projects under the umbrella of the BRI could be supportive to further facilitate economic recovery.”

Traditionally, BRI projects have focused on improving transport, energy and technology infrastructure. And some of these projects have continued to be approved during the pandemic. For example, the $3 billion Budapest–Belgrade high-speed rail scheme, financed by the Export-Import Bank of China, was agreed in May 2020. But there is an expectation that some capital-intensive infrastructure projects may be scaled back, although this could be replaced, in part, by a possible increase in digital and health infrastructure spending. Climate-related projects are also likely to come into focus.

A green future?

In the past, China has financed a major increase in highly polluting coal-fired power stations at home as well as in BRI countries, such as Pakistan, which can produce its own coal but must import cleaner alternatives – for example, natural gas. A failure to improve environmental standards and reduce emissions in key BRI countries could cause global warming of well above 2° Celsius limits, a September 2019 report by the Beijing-based Tsinghua Center for Finance and Development, consultancy firm Vivid Economics and non-profit the ClimateWorks Foundation warned.

At the second Belt and Road Forum in 2019, President Xi Jinping stressed the role of the environment as one of the key pillars underpinning the success of the BRI moving forward. President Xi’s focus on greater BRI sustainability – he subsequently committed China to reach carbon neutrality by 2060 – led to the formation of the nickname ‘BRI 2.0’.

One of the avenues for increasing the environmental sustainability of BRI 2.0 is via the BRI International Green Development Coalition. The People’s Bank of China is also supporting efforts by financial institutions to fully understand climate risk. Part of the central bank’s efforts include enforcing the BRI’s green investment principles, which look to bolster understanding of environmental, social and governance risks, disclose environmental information and leverage green financial instruments.

Chinese researchers said that, during the past 12 months, renewable power made up the majority of China’s energy investments for the first time. The share of wind, solar and hydropower comprised 57% (about $11 billion) of China’s total investment in energy infrastructure in 2020 – up from 38% in 2019, according to research from the International Institute of Green Finance at the Central University of Finance and Economics in Beijing. Efforts to tackle climate change have strengthened the need for developing countries to reduce their reliance on fossil fuels and focus on wind- and solar-powered projects. BRI members such as Pakistan, Bangladesh, Vietnam and Egypt have drawn up plans to ensure their pandemic recoveries are more environmentally friendly.

This trend was evident in the survey responses, with two-thirds of central banks that believe the BRI would support economic recovery also agreeing the initiative would contribute to a ‘green recovery’ (see figure 5).

Investing in green energy and transport (90%), and co-operation in introducing standards for BRI projects (80%) were most cited by central banks as ways the BRI could promote a green recovery (see figure 6). Policy dialogue (70%) and green technology (50%) were also noted as important drivers for a green future.

Two-fifths of respondents also recorded the importance of green finance, an area in which central banks are looking to standardise financial instruments. For example, the People’s Bank of China is currently seeking to finalise its single taxonomy for determining the green status of financial products and services.

The Hong Kong Monetary Authority (HKMA), meanwhile, has set up an interagency group to accelerate the growth of green and sustainable banking. Seven financial regulators and government bureaus – including the HKMA and the Securities and Futures Commission – will take part in the initiative. The group will also work with organisations regulated by the Chinese government in the Guangdong–Hong Kong–Macao Greater Bay Area.

In the past, Asian markets have lagged behind their European counterparts in terms of green bond issuance. However, over the past few years, a number of countries in the region have ramped up green bond issuance. According to HSBC, the supply of Asian US dollar-denominated green bonds rose from just $2 billion in 2015 to $217.5 billion in 2019. By comparison, total proceeds of green bonds issued in the EU reached $96.5 billion last year.

Growth slowdown

The BRI is also expected to act as a catalyst for future growth and economic development more broadly. Four-fifths of respondents expect the initiative to boost GDP in their jurisdictions in the next five years (see figure 7). However, a growing number believe the BRI will have a lesser impact on growth than in previous years.

A central bank from Europe noted that, given the size of the current projects and indications for the future, the contribution to the GDP increase would be “significantly lower than 1%”. A central bank in the Middle East added it would be “illogical” to expect a GDP boost in the next five years of more than 2.5%.

The pandemic will undoubtedly have an impact in the near term, as projects remain on pause and countries grapple with the immediate need to rebuild industry from the ground up. “The Covid‑19 pandemic has really affected almost all businesses and government revenue streams – a boost in terms of capital funding will revive the economy,” a central bank from Oceania said.

Nevertheless, 50% of central bank respondents expect growth of 1% or less, and nearly one-fifth said they expected the BRI to boost GDP by up to 5% over the next few years. A small proportion of central banks (13%) indicated BRI-related increase to its GDP over the next five years could be 10% or greater – both respondents came from the Oceania/Asia region.

A central bank respondent from the Middle East noted it was “not an easy task” to estimate the expected contribution of the BRI to GDP. However, the central bank said “generally speaking, [jurisdictions could] expect a positive impact due to the fact that BRI projects would ease trade movement, create infrastructure and reduce transportation cost, as well as save time.”

Three-quarters of central banks agreed the BRI would contribute to the economic development of their jurisdictions. An additional 13% strongly agreed, while an equal number of respondents neither agreed nor disagreed. The central banks that strongly agreed were from the Oceania/Asia region, while those that remained indifferent were domiciled in Europe (see figure 8).

Improving infrastructure (100%) and creating jobs (86%) were listed as major ways in which the BRI could contribute to economic development, according to respondents (see figure 9). Data from China’s government shows that, from 2003–2018, more than 244,000 jobs were created for locals.

“High-quality infrastructure is envisaged as one of the main drivers to improve the country’s economic competitiveness, foster economic growth, and facilitate trade flows along the corridor; the BRI-related projects complement the strategic directions of development in the country,” a central bank from Europe said.

Fifty per cent of central bank respondents also said building industrial and technological capacities, and promoting private investment (43%) were also major ways in which the BRI would contribute to economic development. Reducing regional disparity and poverty was listed by just 20% of central banks.

A study conducted by the World Bank in 2019 concluded that the BRI could speed up economic development and reduce poverty “for dozens” of developing countries – but it came with the caveat of ensuring increased transparency, improved debt sustainability and mitigating climate and corruption risk. If implemented fully, the World Bank said the BRI could lift 32 million people out of moderate poverty – that is, living on less than $3.20 per day.

Respondents appeared well aware of the potential risks associated with their respective jurisdictions’ involvement in BRI investments. One respondent from the Americas said the BRI has the scope to contribute to recovery and growth – but only if funding was provided at “a reasonable cost”.

A central bank from Europe noted that “intensifying” investment in large-scale infrastructural projects could support a post-pandemic recovery. “We have to keep cautious optimism in this regard – taking into account funding capacity hindered by the current circumstances,” it said.

Debt concerns

Since the BRI’s establishment eight years ago, one of the biggest concerns has been debt sustainability – an issue the pandemic has put under the spotlight again.

However, the survey results reveal that those questioning the viability of projects in terms of cost appear to be the minority (see figure 10). More than 65% of central banks agreed that most of all BRI projects under way in their jurisdiction are economically stable and financially viable.

Nevertheless, there are some concerns that BRI debt is causing external debt to reach unstainable levels. More than 20% of respondents agreed BRI commitments were putting a strain on their nations’ balance sheets (see figure 11).

President Xi and other Chinese officials have repeatedly stated that they do not want debtor nations to be in difficulty. China and 27 other countries have jointly adopted the Guiding principles on financing the development of the Belt and Road, which highlights the need to ensure debt sustainability in project financing.

Many respondents said their debt was not unsustainable, perhaps reflecting efforts under way to ensure debt remains at sustainable levels. To assist nations in avoiding excessive debt, new institutions have also been created. The China‑IMF Capacity Development Center is being funded by China, as is the International Development Cooperation Agency.

Only a small proportion of central banks commented on the financial terms and conditions of BRI-related debt – probably due to ongoing discussions with Chinese authorities. In June 2020, China suspended debt repayments for 77 low-income countries as part of the G20’s debt relief programme. Almost 60% of respondents said BRI debt had similar conditions to normal market terms and conditions, while the remaining one-third said they were more favourable.

A respondent in the Americas said that, while BRI projects in its country were yet to get under way, previous Chinese-funded projects had provided “favourable financial terms relative to market rates” (see figure 12).

Funding supply

The scope of projects to receive funding support varied across jurisdictions. However, the results revealed the oil and gas, and transport and logistics sectors are the most supported. Water and sanitation, as well as the broadly defined power sector, were also ranked among the most important areas of investment (see figure 13).

A large number of energy-related projects are taking place in the Middle East owing to the region’s abundant energy reserves. However, the results show broader power projects have also risen in importance, highlighting a potential shift to more renewable energy projects. According to a 2019 report from the Natural Resource Defense Council, the projected installed capacity of renewable energy for 38 countries in the BRI could reach 644 gigawatts from 2020–2030, and total investment in wind and solar power could reach $644 billion.

While there is room for China to grow its direct investment in the energy sector through BRI renewable projects, there are already glimpses of the massive potential to scale up investment in this sector.

The Cauchari Solar Plant, currently under construction in Argentina, is expected to reduce carbon emissions by around 325,000 tonnes. The $390 million project is being funded primarily by the Export-Import Bank of China. China also has involvement in renewable projects in the United Arab Emirates and Kenya, among others.

On the investment size of the largest ongoing projects – classed as either under way or in the preparation/planning phase – 43% of respondents said investment was less than $250 million. This figure was slightly less than last year (50%) (see figure 14).

However, almost two-fifths of central banks said the investment size of the largest BRI project in their jurisdiction was between $1 billion and $5 billion – a significant increase from 2020, when only 10% of respondents reported projects above $1 billion. The majority of these respondents heralded from South-east Asia, but countries in the Middle East and Africa also reported large investments.

According to data from Refinitiv, Sri Lanka has emerged as the country with the highest number of BRI projects announced as of July 2019, with seven developments at a combined value of nearly $700 million. While Pakistan has attracted plenty of attention for its involvement in BRI projects, Russia has received the largest investment from China – $298 billion worth of projects are currently under way.

A large proportion of BRI financing comes from China. Responses from participating countries corroborate this dynamic: Chinese development banks and state-owned banks were the most important funding sources of BRI projects, followed by private Chinese corporations and China-backed multilateral institutions (see figure 15). The China Development Bank (CDB) and the Export-Import Bank of China were once again singled out by central banks as providing core funding for projects. Both lenders operate directly under the State Council of the People’s Republic of China, and are responsible for raising funds for and implementing economic policies of the government at home and abroad.

Chinese parties involved in BRI projects may have considered whether they have clauses in their contracts that could free them from liability when circumstances out of their control occur, such as during the pandemic. Since February 2020, the China Council for the Promotion of International Trade has issued thousands of force majeure certificates to Chinese companies, according to law firm Norton Rose Fulbright.

There is the possibility to make BRI projects in the pipeline more open to other financing options – such as through the inclusion of multilateral institutions, foreign banks, private equity and green bonds. It is also likely the private sector will be encouraged to take on a greater role as Chinese state banks reduce funding. Currently, financial markets and international commercial banks are seen as the least important sources of funding – only one respondent from Europe ranked financial markets in their top five sources – specifically the market in Macao.

Project implementation

One of the greatest concerns around BRI projects historically has been a delay in project completion; this concern is likely to be exacerbated further by the pandemic. However, the majority of central bank respondents (77%) said they neither agreed nor disagreed that most BRI projects had been implemented without much delay. But 15% disagreed and 8% agreed with the statement. This suggests project delay is not a major concern for most respondents at this time (see figure 16).

One central bank in Europe noted BRI projects launched recently were being implemented without “significant delays”. “However, the initiation of the one of the biggest infrastructural projects that was intended to enhance transit capacity has been temporarily postponed due to financial viability issues,” the central bank said.

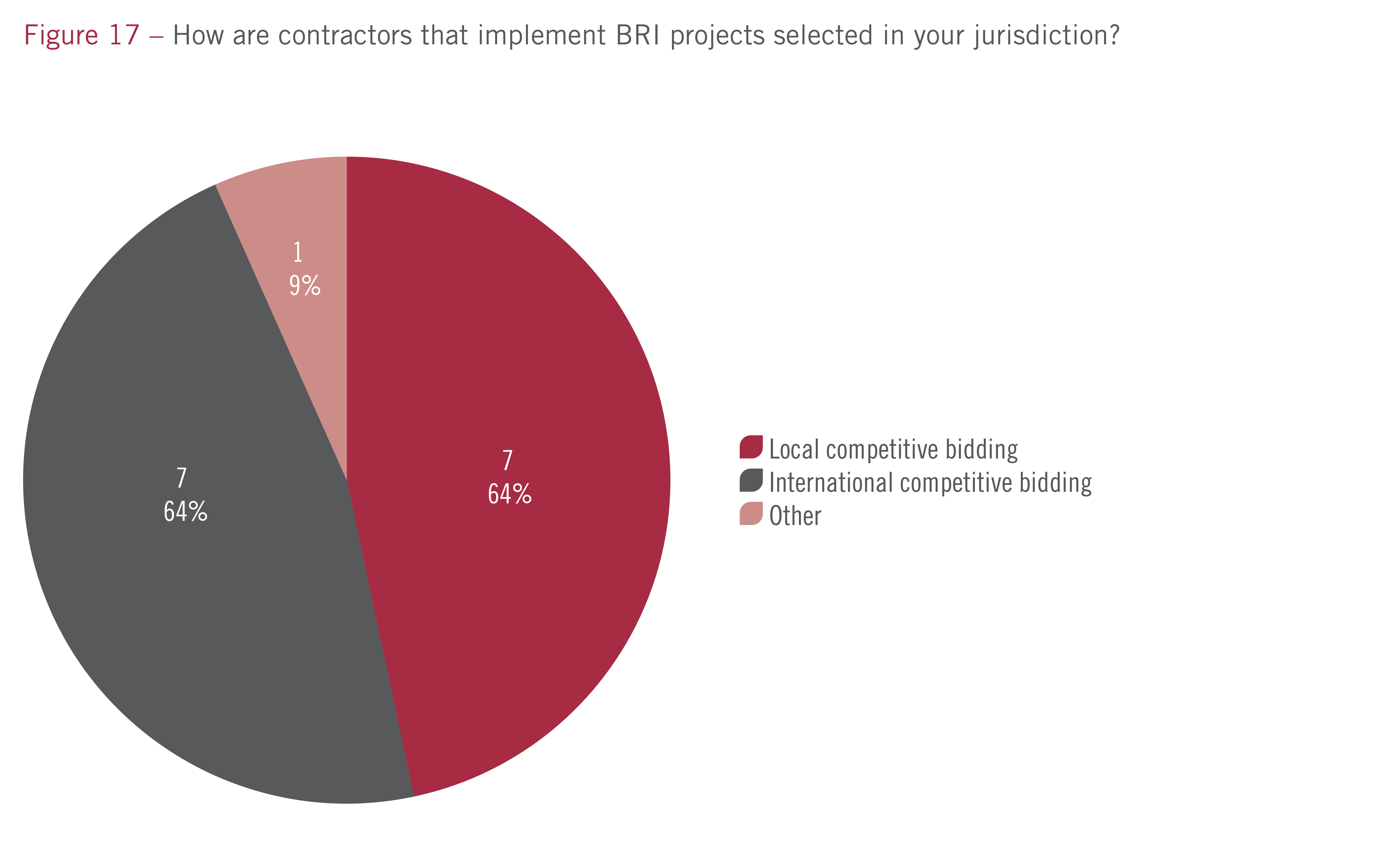

Another issue that had attracted close attention in the past was how BRI project contracts are awarded. There were concerns that the selection of contractors is often not sufficiently transparent, and that more BRI project procurements were undertaken by Chinese companies.

However, according to the survey results, almost 65% of central banks indicate that BRI project contractors in their jurisdictions were selected through local competitive bidding and international processes. Only three respondents indicate the use of local bidding solely, and 9% used sole-source procurement – a direct contracting procedure.

But, a central bank for the Americas said “greater emphasis should be placed on the mix of workers (local versus Chinese) and how the selection process is done”. “There may be need for more competitiveness in the procurement process of contractors to ensure greater value for money is obtained,” it said.

Currently, relatively little systematic data exists on the practices being followed by the different entities that finance BRI-related contracts, nor how firms are selected to execute projects. A 2018 working paper from Macroeconomics, Trade and Investment Global Practice of the World Bank indicated that Chinese companies account for the majority of BRI procurement.

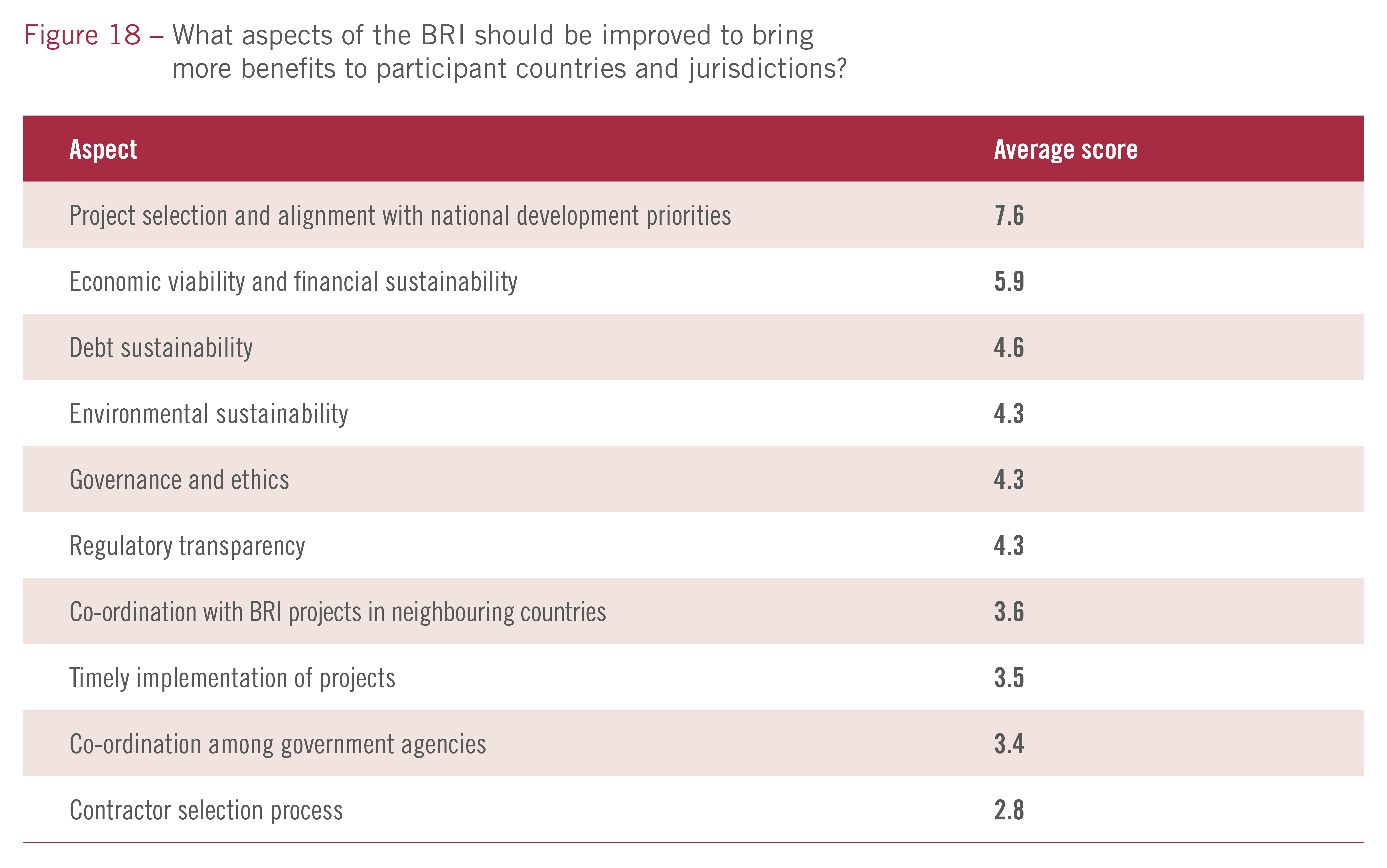

However, according to the survey, contractor selection process was identified as the least priority for improvement by respondents (see figure 18).

Room for improvement

When respondents were asked which aspects of the BRI should be improved to bring greater benefits to participating jurisdictions, project selection and alignment with national development priorities received a score of 7.6. The economic sustainability of projects, which received a score of 5.9, was also a frontrunner in terms of areas of improvement. Environmental sustainability and regulatory transparency also received high scores of 4.3. The contract selection process was given an average score of 2.8 (out of a possible 10).

The results highlight the need for BRI projects to be better co-ordinated and in line with national and international strategies – a need that is only going to become greater in the wake of the pandemic.

The 2020 Belt and Road Initiative (BRI) Survey

In 2018, the IFF, in collaboration with Central Banking, inaugurated the BRI survey. Last year, with responses received from 30 global central banks, the findings concluded the BRI would support globalisation. However, there were concerns projects under way were not in line with current climate goals. The 2021 survey reveals the focus of the BRI is likely to change and authorities will need to think carefully about the sustainability of their debt financing.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com