Monetary Policy

Russia chops another half point off benchmark rate

Central Bank of Russia cuts key rate to lowest since July 2008

Bank surprise boosts sterling

Bank of England’s decision to hold quantitative easing programme at £125 billion sends pound up against euro and dollar

Banks’ capitalisation matters for monetary policy

Bank of Finland looks at the role of the banking sector in the monetary-policy transmission mechanism in an emerging economy with a rapidly developing financial system

UK government wards Bank off leaning against wind

Alistair Darling’s long-awaited proposals beef up bank regulation but say the Bank of England should avoid leaning against the wind with rate moves

Nigeria liberalises FX regime, looks to spur liquidity

The Central Bank of Nigeria’s new governor displays intent to move rapidly to fix the financial sector

German finance minister warns ECB on liquidity overhang

Peer Steinbrück joins Angela Merkel in warning of potential inflationary impact of central bank’s extraordinary measures

Ex-IMF’s Johnson queries NY Fed’s bubble-bursting claims

Former International Monetary Fund research head challenges New York Fed’s Dudley claim that central bank can burst bubbles

Riksbank moves into negative rate territory

Sweden’s central bank, the world’s oldest, will on Wednesday become the first since the crisis began to penalise banks for holding deposits

A fifth of prices change each month in Belgium

National Bank of Belgium examines how frequently prices change in Belgium

NY Fed’s Dudley: central banks must look to lean against the wind

New York Federal Reserve president backs calls for central banks to counter bubbles

BoJ’s Shirakawa: monetary policy not enough against bubbles

Bank of Japan governor says more policy tools required to preserve stability

East Asia-Pacific central banks softened US shocks

Hong Kong Monetary Authority research finds East Asia-Pacific monetary authorities dampened shock from United States money market

RBI's Subbarao: India must go for growth

The governor of the Reserve Bank of India says restoring growth to pre-crisis levels and de-mystifying the office of the governor are among his main objectives for his first term at the helm

RBI's Subbarao on reviving growth, decoupling and global imbalances

The governor of the Reserve Bank of India discusses his objectives for his first term and how the decoupling argument needs to be revised

In return to normality, fiscal order must come first

Governments must put their books in order before central bankers raise rates, say economists

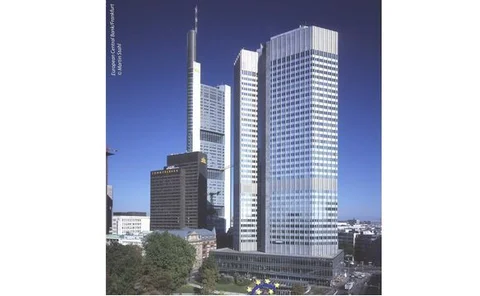

Central concerns

José Manuel González-Páramo, a member of the ECB’s executive board, talks to Risk about the role of the central bank and the need for greater oversight and transparency in the derivatives market

BIS's Cecchetti moots longer time horizon for monetary policy

Central banks may need to stretch their time horizons for inflation targeting to successfully combat financial instability, says Bank for International Settlements’ Stephen Cecchetti

BIS's Cecchetti on inflation, imbalances and instability

The head of the Bank for International Settlements' monetary and economic department, on how central-bank policy should change in light of the crisis

Weaker CBs must work harder in face of shock

Central banks with less credibility must work harder to combat a cost shock

Bank’s second monetary-policy roundtable

Bank of England summarises its monetary-policy roundtable

Fed's Yellen: rates may stay low for years

Janet Yellen, the president of the San Francisco Federal Reserve and a respected senior US policymaker, has given a bleak assessment of the US economy’s prospects

Mexico's Ortiz - crisis shows how far we've come

Ability to cope with turmoil is a sign of success of monetary-policy reform, says Bank of Mexico governor

Eurozone inflation negative for the first time

Euro-area inflation has headed below zero

Ortiz on governance, risk and Mexico's progress

The Bank of Mexico governor and BIS chairman discusses central bank governance, monitoring systemic risk and why Mexico has managed to avoid a financial meltdown despite being hard hit by the crisis