Monetary Policy

Recession-hit Turkey cuts rates

Central bank surprises markets with a half-point reduction

Key questions for Marcus

Gill Marcus, governor-designate of the South African Reserve Bank, will have her work cut out in maintaining the central bank’s hard-won credibility

Bagehot 's tenets needs to be revised

New York Federal Reserve investigates whether Bagehot’s 19th lender-of-last-resort doctrine still applies

Prices increases of manufactured goods low

Reserve Bank of Australia looks at price movement

China’s reserves exceed $2 trillion

China’s foreign-exchange reserves reach a new record high

Monetary policy for small economies

Bank of Albania publishes volume on monetary-policy strategies for small economies

Japan extends special measures to 2010

Bank of Japan says credit easing and dollar liquidity provision will last until at least the end of this year

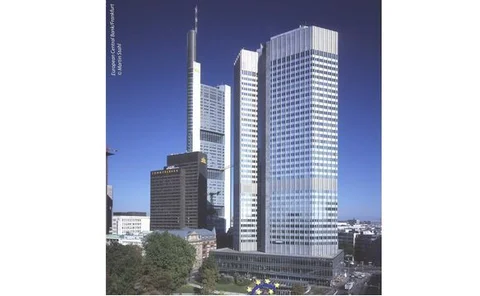

European Central Bank – July Monthly Bulletin

ECB calls on euro-area governments to prepare fiscal exit strategies

No need for further euroisation in Cape Verde

International Monetary Fund finds that Cape Verde’s peg to the euro suits its economy just fine

BoE’s Bean confident Treasury would agree to more QE funds

Deputy governor Charlie Bean says Bank of England would “expect” chancellor to allow more funds for quantitative easing

UK inflation sinks below target

British price gauge falls below Bank of England’s target for first time in almost two years

MPC’s Posen queries symmetry of inflation targets

Newest member of Bank of England’s Monetary Policy Committee cites dangers in undershooting target and questions “mechanistic” monetarist view on quantitative easing

Economists petition lawmakers for Fed independence

Former Federal Reserve governor Frederic Mishkin among the signatories of online petition to keep monetary policy independent

Chile to lend at record-low interest rates until 2010

Chilean banks to be able to borrow at 0.5% until end of year

Russia chops another half point off benchmark rate

Central Bank of Russia cuts key rate to lowest since July 2008

Bank surprise boosts sterling

Bank of England’s decision to hold quantitative easing programme at £125 billion sends pound up against euro and dollar

Banks’ capitalisation matters for monetary policy

Bank of Finland looks at the role of the banking sector in the monetary-policy transmission mechanism in an emerging economy with a rapidly developing financial system

UK government wards Bank off leaning against wind

Alistair Darling’s long-awaited proposals beef up bank regulation but say the Bank of England should avoid leaning against the wind with rate moves

Nigeria liberalises FX regime, looks to spur liquidity

The Central Bank of Nigeria’s new governor displays intent to move rapidly to fix the financial sector

German finance minister warns ECB on liquidity overhang

Peer Steinbrück joins Angela Merkel in warning of potential inflationary impact of central bank’s extraordinary measures

Ex-IMF’s Johnson queries NY Fed’s bubble-bursting claims

Former International Monetary Fund research head challenges New York Fed’s Dudley claim that central bank can burst bubbles

Riksbank moves into negative rate territory

Sweden’s central bank, the world’s oldest, will on Wednesday become the first since the crisis began to penalise banks for holding deposits

A fifth of prices change each month in Belgium

National Bank of Belgium examines how frequently prices change in Belgium

NY Fed’s Dudley: central banks must look to lean against the wind

New York Federal Reserve president backs calls for central banks to counter bubbles