Forecasting

Monetary policy tops US CFOs’ concerns

Survey finds high rates curtailing spending in 40% of firms

BoT unexpectedly raises policy rate by 25bp

Central bank cut inflation and growth forecasts for 2023, but raises next year’s projections

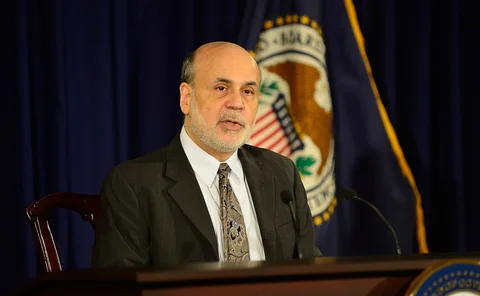

BoE publishes terms of reference for Bernanke review

Former Fed chair to provide insights into how to forecast in “significant uncertainty”

FOMC members’ narratives add value to projections, finds paper

Both staff and FOMC members 'projections aid forecasting, refuting Romer and Romer

Latin America roundup: Brazil makes second 50bp rate cut

Paraguay eases rates down, while Costa Rica holds as negative inflation continues

Bank of England pauses for first time since December 2021

MPC votes 5–4 to halt cycle amid slowing inflation and a sluggish economy

Canadian official says mortgage rates not big cause of inflation

Kozicki says taking home loans out would make only small dent in core reading

Jackson Hole in the wake of policy rules

Symposium heralds a shift to relying on incoming data and judgement, rather than rules or even formal models, to hit inflation targets, writes Barry Eichengreen

Jordan revamps forecast model with richer interactions

Jam2.0 adds a fiscal block and captures more complexities of central bank policy

Lagarde envisions new model for world of ‘shifts and breaks’

ECB chief predicts bigger supply shocks and relative price swings in future

RBNZ holds policy rate but revises up projection

Central bank expects rate to stay higher for longer and raises estimate of neutral rate

Focus is needed on improving central bank forecasts

Charles Goodhart believes tougher action over forecasting errors is preferable to policy-maker performance-related pay

BoE paper analyses banks’ forecasting accuracy

Banks with better governance, including more senior women, make better predictions, authors find

BoE raises rate 25bp as ‘mixed’ data clouds outlook

“I don’t think it is time to declare it is all over,” Bailey says

AI can forecast inflation more accurately than professionals – St Louis Fed

Large language models may be powerful tools but have some drawbacks, researchers say

Bernanke to lead BoE review of inflation forecasting

Former Federal Reserve chair will work with Bank of England officials

Monetary Policy Benchmarks 2023 report – navigating uncertainty

Benchmark data highlights ongoing evolution in policy frameworks as central banks move beyond the pandemic – and into the high-inflation period

Guillermo Avellán on BCE independence, capacity-building and dollarisation

Central Bank of Ecuador general manager speaks about the need to bolster the central bank’s legal autonomy, dollarisation challenges, payments developments and monetising local gold production

Machine learning pushes frontier of forecasting

AI techniques are starting to transform central banks’ statistical modelling. They could soon revolutionise structural models as well

Researchers use natural language processing to estimate inflation

Applying NLP techniques to earnings calls provides useful economic indicators, paper says

ECB’s monetary policy is taking effect rapidly, says Lane

But chief economist warns tighter financing conditions could cause eurozone contraction

Advanced economies most likely to survey trust and understanding

Data shows differences in how central banks judge the effectiveness of monetary policy

Latin America: Brazil holds rates despite president’s attack

Chilean board also holds policy, while Costa Rica cuts after inflation goes below target

Switzerland and Norway raise rates

Norges Bank expects further increases while SNB does not rule them out