Financial crisis

Greenspan deflects blame during heated testimony

Former Federal Reserve chairman Alan Greenspan defends record but accepts some criticism

Greenspan defends position on free market

Former Fed Chairman deflects criticism over adherence to Ayn Rand's views on laissez-faire capitalism

IMF: credit markets key to economic recovery

IMF study shows that a healthy financial sector is essential to a speedy recovery in the economy

RBNZ: inflation targeting no guarantee of stability

Reserve Bank of New Zealand Monthly Bulletin shows more than targeting inflation alone is needed to ensure macroeconomic stability

NY Fed’s Sack warns of excessive reforms

New York Fed’s Brian Sack discusses lessons from the crisis but cautions reforms may be superfluous

RBA’s Stevens pledges new regulation

Governor Stevens compares the troubles in financial markets to a patient in cardiac arrest, but claims new regulation will be the cure

Trichet: credit agencies essential

In reply to a question from MEP Nikolaos Chountis, Jean-Claude Trichet highlights the importance of rating agencies

Finnish central bank offers pessimistic outlook for growth

Bank of Finland report forecasts anaemic growth in 2010 following continued declines in exports sector

IMF: Bolivia foreign reserves adequate

Research charts developments since 2005

Yellen: Fed won’t inflate debt away

San Francisco Fed’s Janet Yellen tells LA town hall inflation will not run rampant so long as Fed retains independence

Italy’s Draghi favours “enforcement” over European Fund

Bank of Italy governor Mario Draghi says a new pact should be drawn up to enforce fiscal discipline, rather than building a continental version of the IMF

Lockhart: Fed inflation anchor under threat

Atlanta Fed’s Dennis Lockhart warns that inflation expectations may be dislodged as a result of accommodative Fed stance

Svensson: Riksbank needs to be more forceful

Riksbank deputy Lars Svensson explains Sweden’s response to crisis and draws on lessons for future

Merkel and central bankers clash over Greek fix

Bundesbank shows reluctance to back Merkel; ECB president Trichet pushes for European rescue fund to aid beleaguered eurozone members

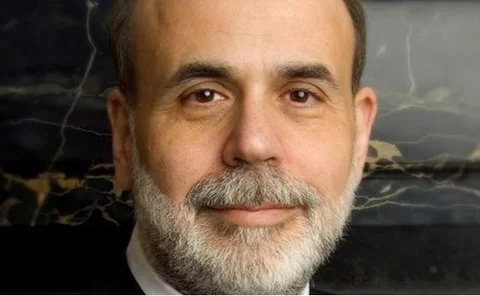

Bernanke: too-big-to-fail problem “unconscionable”

Fed chairman Ben Bernanke calls for a revision of regulation on firms, which are “too big to fail”

Fullani: reassures parliament on steady recovery

Bank of Albania governor Ardian Fullani reassures lawmakers of continued growth following IMF performance review

Top-level Swiss committee to fix "too big to fail"

Liquidity and "too big to fail" will dominate agenda for Steering Committee bridging central bank and regulator’s boards, says FINMA’s Zuberbühler

SNB, Finma set up stability steering group

Central bank and regulator intensify their collaboration on financial stability

ECB’s Stark: global economy is heading for lost decade

Jürgen Stark says failure to learn from the crisis would result in anaemic global growth for the next ten years

Stimulus is not the bulk of debt: Fund’s Lipsky

International Money Fund first deputy John Lipsky says underlying increases in spending and lower taxes from financial sector underpin the debt burden, rather than stimulus

Fed’s Fisher: break up the big banks

Dallas Federal Reserve’s president gets tough on those deemed too big to fail

MPC’s Miles leaps to the defence of QE

Rate-setting committee’s external member David Miles says the Bank’s asset purchase programme has shored up the private sector despite focus on gilt purchases

Brazil jacks reserve ratio up by 200 bps

Central Bank of Brazil lifts reserve requirement ratio back to pre-crisis level, move is expected to withdraw more than 70% of liquidity provided during crisis

Towards a new framework for monetary policy

Jacques de Larosière argues that monetary policy played a major role in the run-up to the financial crisis and that a new operational framework is needed