Financial crisis

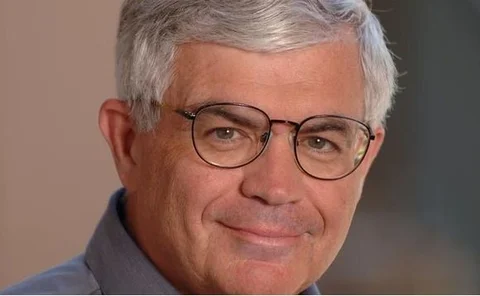

Obama’s proposals – the only game in town

President Obama’s radical proposals recognise that the financial lobby can no longer hold society to hostage. They should be welcomed as a result, Robert Pringle, the chairman of Central Banking Publications, writes.

Big fiscal spending hurts post-crisis recovery: IMF

International Monetary Fund looks at whether there is a trade-off between committing large fiscal resources and a quick recovery

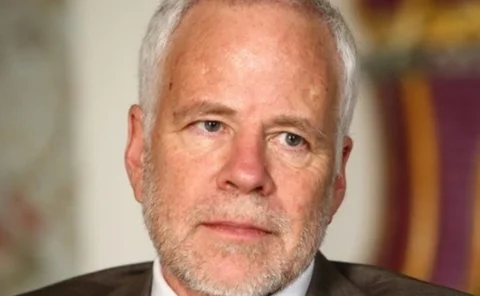

Israel’s Hizkiyahu on financial regulation architecture

Bank of Israel’s Rony Hizkiyahu says move from sectorial to functional regulation key

RBA chalks up half century

Australia's central bank turns fifty

Iceland -- Financial Stability Report 2009

Central bank's report shows a lack of international support for rescuing systemically important institutions

How cash flow shocks spread: ECB paper

ECB paper finds local shocks can spread quickly through banks and non-financial firms, even without defaults

Fed appeals to withhold bailout names

Federal Reserve goes to a US appeals court to overturn ruling forcing it to reveal the institutions rescued to the tune of $2 trillion at the height of the financial crisis

Systemic risk ebbing away: ECB's Papademos

ECB vice-president says financial system support measures have worked

Asset fire sales spread shock to emerging markets

A paper from the Centre for Economic Policy Research shows that financial shocks spread from developed to emerging economies through portfolio reallocations in the crisis

A century of financial crises in New Zealand

Recent analysis from the Reserve Bank of New Zealand suggests that improvements in policy will reduce the risk of a currency crisis going forward

Taylor-rule author blasts Bernanke’s argument

Economist John Taylor says Bernanke was wrong to argue that low interest rates were not a factor in the housing bubble that led to the financial crisis

Bernanke: low rates didn’t spur housing bubble

Federal Reserve’s Ben Bernanke says direct linkages between low federal funds rate and rise in house prices weak; fix regulation not monetary policy

BoE’s Miles calls for smaller banking sector

Bank of England’s David Miles says the enormous size of the banking sector is no longer justified

Crisis down to global imbalances: Obstfeld, Rogoff

Maurice Obstfeld and Kenneth Rogoff say global imbalances key source of crisis

Biggest exit barriers political: Buiter

Willem Buiter says main obstacles to exiting unconventional policies

Fed does not respond to oil price shocks: CEPR paper

CEPR paper argues against the standard view that Fed’s policy responses to oil-price-led inflation caused economic instability

CentralBanking.com panel: it’s too soon to exit

Charles Goodhart, Paul Mortimer-Lee, Lucrezia Reichlin and Gabriel Stein concur that dangers are greater from exiting too early than too late but warn that asset prices risk becoming over inflated

BIS on how to make stress tests better

Research examines the reasons for poor performance of stress tests pre-crisis and notes implications for their design and conduct in the future

Unconventional monetary policy reviewed

Claudio Borio and Piti Disyatat set out a framework of definitions to help categorise and clarify the functions of various monetary policy tools, and assess central banks’ actions since the crisis

Influences on crisis fighting in emerging markets

International Monetary Fund examines why some emerging-market economies took special-liquidity-easing measures during the crisis

Debt managers responded to crisis with flexibility

National Bank of Denmark’s Jens Thomsen says debt management offices better accommodate investors’ needs as a result to the crisis

Interview with Donghyun Park

Donghyun Park, a senior economist at the Asian Development Bank, discusses reserve management post-crisis and fostering demand in Asia

Fiscal stimulus crucial for recovery

Centre for Economic Policy Research (CEPR) compares the Great Depression with the global credit crisis

The relationship between money, credit and policy

A new paper finds evidence that the relationship between money and credit changed after the second world war