ERM

Armenia’s Galstyan calls for a new framework to tackle uncertainty and nonlinearities

Central Bank of Armenia governor says central banks can start to regain credibility by admitting their mistakes. This could include employing a risk-management approach to monetary policy aimed at avoiding nonlinear ‘dark corners’ and placing much less…

People: July to September 2022

A round-up of central bankers in the news and on the move during the past three months

PBoC announces policies to help pandemic-stricken economy

Package of 23 measures echoes actions taken in 2020

Hong Kong recovery expected to slow – IMF

Fund warns of risks including exposures to Chinese real estate and further supply disruption

Half of fintech benchmarks respondents use AI/ML tools

Richer nations more likely to use artificial intelligence

Minority of central banks define project risk appetite

Institutional risk and delegated risk appetites defined more often

Minority of central banks use GRC platforms

RSA Archer and SAP named as providers

ISO 31000, COSO-ERM are influential risk management approaches

IOWRG, Basel and NIST also used by central banks

Over half of central banks modified collateral policies during the pandemic

Most reduced haircuts on banks’ collateral

The longest book ever written?

The Single Rulebook on EU financial regulation is a serious contender for the prize of the longest book ever written. But will it deliver a safer and better financial system?

Podcast: central banks’ data models going granular

Vizor Software’s chief technology officer, Ryan Flood, provides an update on changes to central banks’ regulatory data models

An assessment of the ECB’s strategy review

A number of aspects of the new framework raise challenges for implementation and credibility, while the inclusion of climate change may politicise the institution, writes euro architect Otmar Issing

Fed launches standing repo facilities

Facilities to be open to foreign central banks and domestic primary dealers; FOMC keeps policy on hold

The ‘golden age’ of central banking has passed

Central banks face multi-faceted challenges and weakened autonomy amid highly polarised inflation expectations

The ECB’s monetary policy strategy review

The ECB’s founding monetary policy architect, Otmar Issing, offers some initial perspectives on the ECB’s strategy review

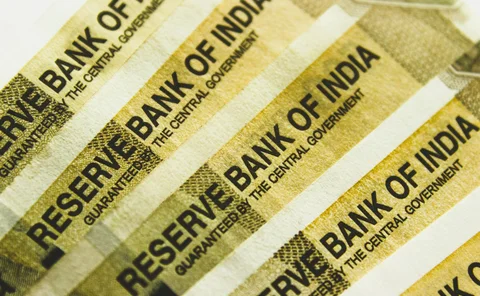

The RBI’s next big question: how to normalise monetary policy?

India’s central bank needs to plan an exit from its efforts to manage the ‘impossible trinity’

A rebuttal of Philip Turner’s criticism of the BIS ‘house view’

Robert Pringle critiques the key findings raised in Philip Turner’s occasional paper, ‘The new monetary policy revolution: advice and dissent’

Lifetime achievement: Charles Goodhart

The LSE and BoE veteran economist has his own ‘law’, and played a key role in the establishment of monetary policy in the UK, Hong Kong’s peg and the ‘New Zealand model’, which influenced a generation of central bankers

Why Bulgaria needs to deepen its currency board

The BNB’s currency board rules should be extended to transaction deposits at commercial banks, which could in turn issue digital currencies, even in the event of euro adoption

Stability versus solvency

There is still far too much regulatory forbearance on troubled bank debt. More on-site inspections and genuine writedowns are needed to fix the banking system

Book notes: The power of money, by Robert Pringle

Economists would benefit from reading this “remarkable” book, which contains “brilliantly written snapshots” about money’s historical and social roles

The challenges facing Christine Lagarde

The new ECB president will need to focus on a successful review of the ECB’s monetary and communications policy, while encouraging fiscal stimulus and structural reform

Creating trust in money in a data economy

The NDB’s compliance chief, Srinivas Yanamandra, speaks about the need for new approaches to regulating digital currencies, distributed ledgers and deep-learning algorithms

Purists lament as most cheer Lagarde as next ECB chief

Lagarde expected to adopt similar philosophy to Draghi at ECB, making the central bank the ‘only game in town’ – at least for a while