Central Banking

Plosser: Fed should cut asset purchases now

Philadelphia Fed president says there has been ‘substantial improvement’ in US economy and labour market; sees scope to taper asset purchases now and end programme altogether in 2013

Interest rate forecasts ‘constrain’ central banks

Norwegian paper finds that Norges Bank and Reserve Bank of New Zealand are ‘reluctant to deviate’ from interest rate paths they have previously published

IMF researcher proposes new method for top-down stress testing

New, simple methodology for structural market-based top-down macro stress tests aims to overcome onerous data requirements

Italian governor calls for greater understanding of Islamic finance

Ignazio Visco says ethical finance focuses on 'the link between financial transactions and underlying assets'

ECB’s Cœuré outlines efforts to cushion impact of regulation on SME lending

Executive board member says the European Central Bank can only tackle funding constraints – other stakeholders must address credit risk and lack of capital

IMF annual report says asset bubbles among risks of ‘MP-plus'

IMF warns of risk associated with loose monetary policy in the world's biggest economies, but says stance should remain 'very accommodative until recovery is well established'

Irish central bank puts 'embarrassing' error on new Joyce coin

Erroneous quote from James Joyce novel could make the collectors' coin even more valuable

Disjointed regulation could spell end of global banking era

Report says global banks must move faster with reform if their global operations are to weather the 'balkanisation' of financial markets caused by mismatching regulation between jurisdictions

Central banks weigh use of OTC clearing houses

Survey finds nearly 40% of central banks are considering clearing their OTC derivatives

Haldane issues call to arms in fight against regulatory complexity

Bank of England executive director warns incremental approach to regulation papers over cracks and leads to a burdensome, ineffectual patchwork of rules

Zimbabwean governor attempts to stem panic as StanChart faces closure

Gideon Gono tells depositors not to withdraw their savings following a government announcement that Standard Chartered will be shut down for non-compliance with indigenisation laws

EU and OECD say weak supervision shares blame for Slovenia's impending bank crisis

European Commission follows OECD in highlighting Slovenia's 'excessive imbalances'; both bodies call for improved supervision from the central bank

Lagarde highlights emergence of ‘three-speed’ global economy

IMF managing director says differences between regions are ‘starker than ever’ as emerging markets leave many advanced economies behind

Zambian governor targets Muslim banking expansion

Michael Gondwe says the economically valuable Muslim community is shunning the use of commercial banks due to lack of appropriate products; proposes banking expansion

Palestine Monetary Authority finds greater parity between West Bank and Gaza territories

Palestinian central bank develops business-cycle indicator to assess economic performance in real time; finds gap in performance between two territories is shrinking

Norges Bank governor outlines Norwegian model for stability

Øystein Olsen tells Harvard audience of Norway's fiscal rule and inflation-targeting - but warns the system has yet to be seriously tested

Sri Lankan central bank reveals inflation spike in 2012

Sri Lankan annual report says economic growth, while still strong, fell in 2012 while inflation rose sharply; central bank increased reserves by 15%

FDIC vice-chair says Basel III capital requirements provide illusion of safety

Thomas Hoenig says capital ratios allow banks to leverage up while outwardly appearing safe; warns systemically important banks have much worse leverage ratios than smaller institutions

IMF says independent central banks have ‘muzzled’ the inflation threat

World Economic Outlook says central banks have little reason to fear inflation resulting from loose policy – so long as their independence is upheld

FOMC members saw QE continuing ‘through midyear’ at March meeting

Participants at the FOMC’s last meeting broadly agreed to continue QE at existing pace ‘through midyear’ but failed to reach a consensus on when to slow asset purchases

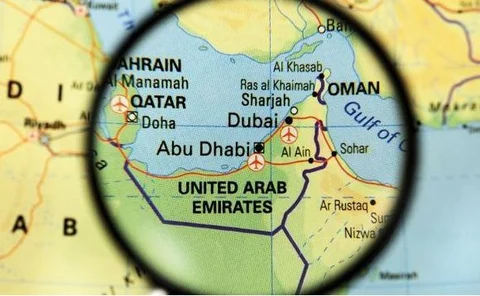

Emirates central bank to introduce direct debit system

Central Bank of UAE to bring in direct debit system to allow payment in instalments without the need for post-dated cheques

Norwegian authorities chase benchmark rate reform

Financial Supervisory Authority of Norway proposes new framework for Norwegian Interbank Offered Rate-setting process; central bank looks to push envelope further

Bernanke says Fed stress tests were a ‘critical turning point’ in crisis

Fed chair says stress tests offer macro-prudential dimension to supervision; US banks have more tier 1 common equity under a severe stress scenario than they did in reality in 2008

Polish paper scrutinises interest rate holds

Research finds that central banks keep interest rates unchanged on majority of occasions; proposes model that distinguishes between rate-holds in period of tightening, easing and neutrality