Central Banking

Fitch ups Iceland default rating outlook to stable

Rating agency Fitch affirms Iceland rating; revises outlooks to stable from negative

Egypt asks IMF for loan

IMF announces Egypt has requested a loan of $10 billion-12 billion

Eurozone sovereign bailouts likely to stop at Portugal, say investors

The Eurozone crisis has already forced three members of the currency union to take EU/IMF bailouts but Spain, the next potential target of investors, is unlikely to follow

Trichet on the building blocks for financial reconstruction

European Central Bank president Jean-Claude Trichet describes three ways in which finance must be rebuilt

Italy presents a legal perspective on cross-border insolvency

Bank of Italy draws on conference proceedings to produce booklet on legal issues surrounding cross-border insolvency

South Africa inflation set to exceed target range

Monetary Policy Committee statement reveals South African Reserve Bank’s fears over inflation

Lipsky to leave IMF in August

First deputy managing director John Lipsky says he will not seek a second term; will stay on as special adviser until the autumn

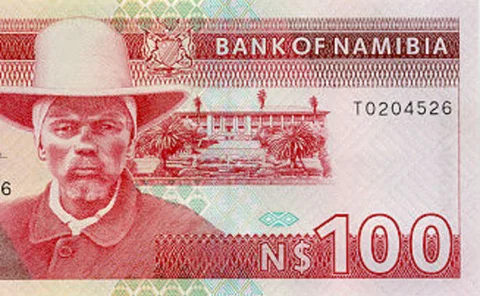

Namibia introduces interbank lending rates

Bank of Nambia launches the country’s first-ever official short-term interbank lending rates; gives full endorsement and encourages further developments

Fed critic Ron Paul to run for Republican presidential candidacy

Ron Paul announces he wants to be Republican candidate for presidential elections; fierce Fed critic wants central bank abolished

Bernanke: Fed striving to ensure level playing field

Federal Reserve chair Ben Bernanke outlines road map ahead for Basel Committee and the Financial Stability Board

Bernanke to make motion picture debut in “Too big to fail” film

New film chronicles the months leading up to Lehman Brothers’ collapse in 2008; centres on treasury secretary Henry Paulson

We can never get rid of financial instability: FDIC’s Bair

FDIC chair, Sheila Bair says it is impossible to regulate to remove all financial instability; Dodd-Frank reforms “can make the core of our financial system more resilient to shocks”

ECB Monthly Bulletin - May 2011

European Central Bank report highlights the need for structural reform

ECB’s Tumpel-Gugerell: self-regulation hasn’t worked for Sepa

European Central Bank executive board member Gertrude Tumpel-Gugerell acknowledges banks’ progress “has not achieved the required results”

Philly Fed’s Plosser offers perspective on economic outlook

President of Philadelphia Federal Reserve notes “somewhat troubling” movements of inflation expectations

Finland supports Portuguese bailout; calls for international banking tax

National Coalition Party and Social Democratic Party agree to support bailout; want to see EU-wide banking tax “to collect funds from banks in advance in view of a possible future financial crisis”

IMF makes strong call for strengthened policy response in Europe

International Monetary Fund wants stronger financial integration to bolster Europe’s recovery; comes as officials gather in Greece to see progress

Thai governor becomes latest to attack IMF capital controls framework

Bank of Thailand governor Prasarn Trairatvorakul’s criticisms of IMF framework on capital controls come after similar comments from Brazilian, Indian officials

Lambert will not take up seat on Bank’s FPC

Former Monetary Policy Committee member Sir Richard Lambert says he no longer wishes to become one of four external members of macroprudential body

Basel Committee unveils final proposals on pay

Basel Committee on Banking Supervision reveals risk-adjusted remuneration report; urges large firms to move away from remunerating employees based purely on their profits

Frank’s FOMC attack offers further evidence of the politicisation of Fed policy

Attempts to rescind regional Fed presidents’ voting rights as members of the Federal Open Market Committee manifest an unfortunate trend in US monetary policy, Thomas F. Cargill believes.

IMF re-examines link between exchange and inflation rates

IMF examines link between nominal exchange rate and inflation

Watch out for policy spillovers: Subbarao

Reserve Bank of India governor warns that process of globalisation can cause unexpected policy spillover damage

New model for assessing underlying inflationary pressure: Canada

Discussion paper calls for exclusion of components with “exceptionally large price changes” when assessing underlying inflationary pressures