Central Banking Journal

Book notes: Money in the Great Recession, by Tim Congdon

A stimulating collection of papers on the monetarist theory that had central bankers in late 2008 focused on boosting the quantity of broad money “the Great Recession would not have happened”

Patrick Njoroge on reshaping banking and finance to work for the masses

The Central Bank of Kenya governor speaks to Christopher Jeffery and Rachael King about exchange rate intervention, food prices, banking reform and financial inclusion

Google’s Hal Varian on how technology is changing economics

Google’s chief economist talks to Christopher Jeffery about how big data and machine learning are facilitating changes in economic thinking; discusses the impact technical breakthroughs may have for central banks

Productivity puzzles and the neutral rate of interest

Monetary policy frameworks should be subjected to internal and external reviews to ensure they remain fit for purpose

Book notes: The Right Balance for Banks, by William Cline

An interesting analysis of optimal capital requirements for G-Sibs, examining whether Basel III requirements will be enough to stem another financial crisis

Book notes: Hole in the Wall, by James Shepherd-Barron

Cash machines have changed the way cash is managed, but is there a future for such machines in a world looking to go cashless?

Big data in central banks focus report 2017

The second Central Banking Journal focus report on big data expands on the original study from 2016, assessing how challenges have evolved in the past year.

The rapid evolution of data

As big data enters the mainstream, it is critical to understand how it can transform our thinking, but also to be realistic about its shortcomings and biases

Making the most of big data

Per Nymand-Andersen, adviser to senior management at the European Central Bank, discusses how central banks can benefit from embracing big data and what this could mean for the industry in the near future.

Big data in central banks: 2017 survey

As an active area for new projects, big data is becoming a fixture in policymaking, with an increasing number of central banks carving out a budget for data handling, writes Emma Glass.

Collaboration is key to central banks making the most of data

As data becomes increasingly significant for central banks, working with the right people and employing the right approaches is central to meeting objectives, says Maciej Piechocki of BearingPoint.

Tapping into big data’s potential

Central Banking convened a panel of experts to discuss how central banks can harness big data for their needs, hopefully without falling foul of some of the many pitfalls that await.

Sponsored forum: Tapping into big data's potential

Central Banking convened a panel of experts to discuss how central banks can harness big data for their needs, hopefully without falling foul of some of the many pitfalls that await.

A new era for the BIS

As Basel III inches towards closure and a new BIS general manager prepares to move into his post, Jaime Caruana talks to Daniel Hinge about his eight years at the helm

Teaching machines to do monetary policy

Machine learning may not yet be at the stage where central bankers are being replaced with robots, but the field is bringing powerful tools to bear on big economic questions

The optimal size for central bank balance sheets

As the Fed seeks to reduce the assets on its balance sheets, Charles Goodhart examines the role between monetary and fiscal policy, central bank and debt office, and the optimal size of a central bank’s balance sheet

Interview: Edward Prescott

The Nobel Prize-winner speaks to Daniel Hinge about time inconsistency and real business cycle theory, and explains why there is no ‘productivity puzzle’

Kenya’s digital transformation

The use of innovative digital financial services has transformed financial inclusion in Kenya, writes the chairman of the Central Bank of Kenya

Japan’s ineffective efforts at monetary easing

A study of the natural rate of interest indicates the Bank of Japan’s QQE may not have been as accommodative as claimed, Sayuri Shirai argues. The failings appear to be related to effectiveness, rather than scale

Book notes: Econometrics as a Con Art, by Imad Moosa

Every central bank should have a copy of this interesting study, which holds common econometric practice under the microscope, writes Graham Bannock

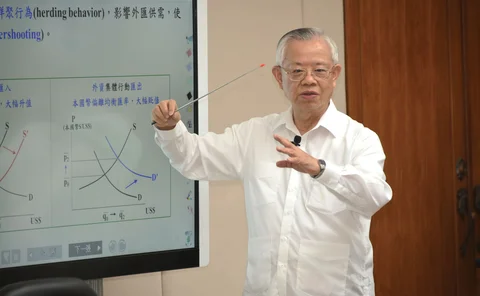

Perng Fai-nan on how Taiwan has eluded crisis for 20 years

Taiwan’s governor explains how pragmatic interventions have engendered two decades of financial stability, despite the island’s status as a small, open economy

John Williams on the neutral rate of interest and mandate change

The president of the Federal Reserve Bank of San Francisco speaks about the plunge in the natural rate of interest, and why it means central banks should work together to review their price stability targets

Financial regulation, the PBoC and Zhou’s legacy

Zhou Xiaochuan failed to secure a new ‘super-regulator’ under the PBoC, but has ensured the central bank has a strong voice on China’s new apex stability committee at a time of increased regulatory scrutiny

Book notes: Advice & Dissent: My Life in Public Service, by YV Reddy

An engaging look into the private life and career of a former governor of the Reserve Bank of India, and arguably one of the best central bankers of the twentieth century, YV Reddy