Big data in central banks: 2017 survey

As an active area for new projects, big data is becoming a fixture in policymaking, with an increasing number of central banks carving out a budget for data handling

This article reports the findings of a new survey conducted by Central Banking in association with BearingPoint during August and September 2017. Central Banking first surveyed how central banks governed, managed and processed big data in 2016, and this new survey sets out to expand on the original results. This work has only been possible with the support and co-operation of the central bankers who agreed to take part. They did so on the condition that neither their names nor those of their central banks would be mentioned in this report.

Key findings

- Big data is an active area for new projects in central banks. As a result of these, central banks are making significant changes in three areas: reforming departments, implementing new technology and upgrading systems.

- Development of credit registers is a key focus for many central banks’ big data projects, closely followed by administrative sources and consolidation of internal systems.

- Big data has become a fixture in the policymaking process for central banks. Over half of survey respondents said it was an input into processes, with just over one-third saying it was a core component.

- Data collection is the greatest challenge central bankers face as the use and application of big data becomes more prevalent.

- A significant data governance gap exists in central banks. Over half of respondents said they did not have clear data governance – although work is under way to address this.

- Expertise in big data is typically shared across departments. Very few central banks have a designated big data department.

- Central banks are increasingly carving out a budget for data handling. The number of central banks with such a budget is twice that of the 2016 survey.

- An overwhelming majority of central banks have strategies in place for dealing with collecting and managing data.

- Self-developed data platforms are the most popular method for regulatory data collection, followed by Excel and document-based handling and commercial solutions from the market.

- Ensuring data quality is the greatest challenge to central bankers in the process of data collection.

- Social media is an emerging source of data for central banks: just under one‑fifth of respondents collect data for policy purposes from social media.

- Central banks see benefits from collaborating on big data projects, chiefly in terms of efficiency and cost reduction.

- Considerable investments are being made in new technology to support developments in big data.

- Data mining and trend forecasting are the most popular methods for data analytics.

- Shared internal platforms are integral to working on big data, with three-quarters of respondents using them.

- Central bankers typically avoid external data storage such as the cloud. Many central bankers view external data storage as risky, particularly in terms of the security and confidentiality of data.

Detailed responses

Profile of respondents

Central Banking received responses from 50 central banks, with 27 of those that took part in the 2016 survey taking part again this year. The average staff size was 1,338 and 40 respondents had fewer than 2,000 employees. The average staff size of a central bank is 2,698.1

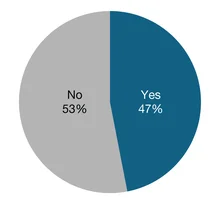

Has your central bank undertaken any new projects involving big data in the past 12 months?

Big data is an active area for new projects in central banks. These new projects have three aims: reforming central bank departments, implementing new technology systems and upgrading systems to better process big data. Just over two‑thirds of respondents said they have undertaken new projects involving big data in the past 12 months. This group of 34 was dominated by central banks from Europe. Just under half this group were from industrial economies, and the remainder were evenly spread between transition,2 developing and emerging-market economies.

Respondents explained how big data-related projects were impacting their institutions, which can be grouped around three themes. First, central banks are changing the structure of their institutions to accommodate this new area of research. Of the 34 central banks that answered positively, five referred to institutional changes, such as the creation of a data unit, in their comments. A large central bank described the structural change that has taken place: “We have created an internal team across different departments with different skills to work on specific projects involving big data and central bank issues.” An Asian central banker said big data projects had been outsourced: “Our bank outsourced a research project to enhance the quality of economic forecasting using big data information.” Internal discussion plays a key part in institutional change. This is recognised by one European central bank as a means to facilitate new structural changes and encourage communication on the topic. This bank launched a “big data forum”, which is “intended to be a forum for internal discussion”.

Second, central banks are implementing new technologies that draw on big data, something four central banks referred to in their comments. A European respondent referred to their own database and “common registry entities (in collaboration with national statistical services)”. An Asian respondent listed four new projects that are under way: “data catalogue (internal and external), private cloud, exchange market surveillance and data collection from financial institutions”.

Third, central banks are upgrading the systems they have in place to process big data. Two central banks made reference to this, with one central banker from Europe providing this extended comment: “The bank is running methodological and technological upgrades of the statistical business process under its mandate. A new innovative project that is intended to collect, validate, process and disseminate big amounts of data from different sources is under way.”

Sixteen respondents said they had not undertaken new projects involving big data. Emerging-market economies made up half of this group, with only two drawn from industrial economies. The respondents who commented suggested that small steps were being made in this area, but nothing substantial. A respondent from the Americas said: “There are individual efforts by some experts, but not in a project context.” A European central banker pointedly said: “We do not intend to use big data.”

If yes, in which area(s) were the projects focused?

Development of credit registers is the most important focus for many central banks in big data projects. This was closely followed by administrative sources3 and the consolidation of internal systems. Credit registers were almost always selected with another option – only one respondent checked this option alone. A European respondent who selected credit registers, web scraping and administrative sources detailed their institution’s plans: “We started to plan a new credit register database suitable for AnaCredit purposes. We collected administrative data from the National Pension Insurance Institution for research purposes, and price data from retail trade companies’ websites.” A smaller central bank with fewer than 100 employees said: “Credit registers service will be operative from the last quarter of 2017. The present small quantities of data will increase over the next few years.”

Administrative sources also proved popular among respondents. Sixteen central banks chose this option, with over half of these from developing and emerging-market economies. A common pairing was with credit registers or consolidation of internal systems. Eleven central banks chose administrative sources with credit registers, while seven chose it with consolidation of internal systems.

A respondent from the Americas who selected administrative sources and the consolidation of internal systems has centralised economic and financial databases to provide reliable, up-to-date and accurate data including Bloomberg and ASYCUDA, and its financial institution report management system comprising a data collection module, a supervisory data centre and data visualisation reporting tool.

Consolidation of internal systems was selected by 32% of respondents. Three central banks – two of which were European and from industrial economies – chose this option in isolation, while the remaining 13 chose it in tandem with at least one other answer. Six central banks chose four or more options. These central banks gave greater priority to big data work at their institution, with one central bank in Asia pointing out that it was now part of their strategic plan: “The bank has enhanced its data analytics capability, especially the use of micro data. This initiative is part of the bank’s three-year strategic plan.”

A respondent in an industrial economy noted their priorities: “The considered administrative sources include information from several databases, namely securities statistics integrated systems; simplified corporate information (central bank balance-sheet databases), database accounts and other sources, which refers to payments data, which are obtained from the payment systems department.”

The “other” category garnered various examples. An institution with more than 2,000 staff said it was using Google search data, while another – also in Europe – commented that its project was focused on “the broad range of financial and statistical data, as well as macroeconomic institutions”. A central bank in a transition economy is looking to alternative sources for its data, primarily in commercial banks.

Consumer debt, social media, mobile phone data and house prices proved to be less popular with respondents. A central banker from the Americas said: “So far we have used social media (Twitter) data to assess public and market perceptions on central bank policies. We are working on RSS feeds and sources (mainly newspapers) to complement this analysis.” All respondents who chose social media in this field also chose web scraping as an option.

Which best represents your central bank’s view of big data?

Big data has become a fixture in central bank policymaking. Over half of survey respondents said it was an input into these processes, with just over one-third saying it was a core component. The number of central banks that described big data as a core input into policymaking is double that from the 2016 survey. Eighteen central banks – one-third of all respondents – reported big data as a core input in comparison to eight in Central Banking’s 2016 survey.

Of the 18 who view big data as a core input, developing economies made up one-third, with almost half from European central banks and just over one-fifth (22%) from the Middle East. Respondents who commented stressed the application in the area of financial stability and supervision. A European central banker explained the role big data played in supervision: “The organisation sees data as a key enabler in meeting supervisory requirements and driving insight generation. It recognises there are gaps in the infrastructure and processes that drive the optimal use of data in the organisation.”

A respondent from Asia was expanding its use: “The bank has always used data in its policymaking and supervisory processes. We are continuing to expand our data capabilities, including applications in new areas of process automation and machine learning that would have impact not just on internal operations but also on the finance sector.”

In addition, 11 central banks said big data was an auxiliary input into policymaking and supervisory processes. The group was evenly split between industrial and emerging-market economies. A European respondent said: “We have acknowledged the importance of these new data sources, which might help central banks grasp a more accurate picture of economic reality in almost real time.” An industrial-economy central bank said: “The use of micro-data brings flexibility to data management in a way that we can readily adjust and satisfy ad hoc requests, in some cases tailor-made to our customers’ needs.”

For a minority of respondents, big data remains an interesting area of research. However, comments made by these respondents typically noted how they expected big data to enter the policymaking processes. A central banker from the Americas said: “It is currently an area of keen interest. We expect this view to be upgraded to ‘an auxiliary input to policymaking and supervisory processes’ within the next 24 to 36 months.” A central banker from an emerging‑market country acknowledged that their view of big data had changed: “Before there was not much interest. As a first stage there is a clear interest to view big data as a research topic, answering new questions and producing new business-cycle indicators. Ultimately, our goal is to explore its potential as an auxiliary monetary policy tool.”

In which area of big data have you encountered the greatest challenges to increasing the use of datasets in your central bank?

Data collection is seen as the greatest challenge central bankers face as the use of big data grows. Sixteen central banks – 37% of respondents – see this as most significant. This group was dominated by industrial economies from Europe, with the Americas, Africa and the Middle East also featuring. Two common themes emerged from respondents’ comments; those regarding outsourcing data collection and those with concerns about inefficient systems. A respondent from the Americas typified the former sentiment: “We have been experiencing difficulties in collecting data from private resources (credit card companies).” In Europe, a central banker said: “We have found the greatest challenges in gathering data – not only using web-scraping techniques but also trying to buy the data directly from the private companies that own that kind of data.” Equally, an Americas-based counterpart’s comment spoke to the second theme: “The technological issue is always the most challenging one because of its resources and cost consumption.”

Almost two-thirds of respondents found data processing challenging, ranking it either first or second in terms of significance – 28 respondents selected this option. From their comments, it is clear the issue with data processing for many central bankers is having the technical capabilities available to process the data. A central bank in the Americas said: “There isn’t an infrastructure of technology that allows experts the use of datasets available, in terms of big data.”

Data management was the most popular third choice, although it should be noted that 26% of respondents said it was the most significant challenge they face. Almost half of this group of 12 who placed it third were from African and Asian institutions. One of the biggest concerns raised regarding big data is managing the volume and variety of the datasets. An Asian respondent noted this issue: “Most of our current efforts are focused on consolidating internal systems to provide data consumers with a single view of data. This approach will go a long way to addressing the data management issues that arise from the volume and variety of big data.”

Fifty-seven per cent of respondents selected data analysis in third or fourth place. Twenty-four respondents – more than half of whom were from Europe – gave this response.

Does your central bank have clear data governance, with defined roles and responsibilities?

A significant data governance gap exists in central banks. Over half of the survey respondents (57%) said they did not have clear data governance, although many noted work is under way to address this. Industrial economies featured prominently in this group, and comments from these respondents stressed work is also in progress. A respondent from the Americas referred to altering policy: “We are working on designing the necessary policies to implement institutional data governance, as well as on the proposal to create an organisational structure that supports this process.” For one central bank from Asia, change had already taken place, with the establishment of a new division in May 2017: “We are planning to involve external consultants in order to organise the data management system in the central bank, develop standards, regulations, policy and definitions of key roles.”

Just under half of respondents said their central bank has clear data governance in place. This group comprised ten European central banks, four from the Americas, three from Asia, three from the Middle East and one from Africa. Developing and emerging-market economies were in the majority, with two-thirds of the results. One common theme in respondents’ comments was the departmental assignment of data management. A European central banker said: “The statistics department is responsible for the data collection [for] both statistical and supervisory purposes, but the increasing need for micro data requires us to rethink our current processes and create a strategy in data management.”

A respondent from an industrial economy described their approach to data governance, which is the responsibility of the statistics department in co-ordination with IT: “Both departments should aim to promote the organisation of information architectures, the definitions of concepts, and the creation of metadata and catalogues, dictionaries and repositories of information. Each department of the bank has a data steward responsible for the content and management of the data it produces. There is also a master data steward, who co-ordinates the activity and oversees general guidelines.”

Does your central bank have a specific function working on big data?

Expertise in big data is typically found across departments in a central bank – less than one-third of institutions have dedicated big data functions. Of the 34 who did not have a specific function, two-thirds were from Europe. A common theme in comments from central bankers was the dispersal of big data specialists throughout the institution. A central banker from the Americas captured this sentiment: “This function is scattered in different areas. This is a project to build multiple area task groups to deal with these issues in a unified and more efficient way.” Similarly, a European respondent said: “So far we only have an internal team of experts from different fields trying to solve some policy-relevant issues using big data with the continuous help and support of the IT department.”

A European central banker said their institution did not have a specific function working on big data; however, a new unit has been carved out within the statistics department: “[The unit was created] to ensure the integration and sharing of data across the organisation, with operational responsibilities within the scope of the integrated model of information management. This unit will also be responsible for bridging IT and statistical producing units regarding any big data research or developments, and is also involved in improving the corporate data warehouse and refining the data catalogue.”

Just under one-third of respondents reported having a specific function working on big data at their institution. Of these 15 central bankers, two-thirds were from developing and emerging-market economies. A respondent at a small European central bank said: “In general, the monetary statistics division is responsible for data production at the bank. However, this division does not have specific function [formally] working on big data.” In contrast, a large European central bank with more than 1,500 staff said: “The data operations function was set up to manage all data initiatives across the organisation. Its remit is not limited to big data but focuses on all data challenges.”

Data analytics units proved to be common in Asia. Two respondents referred to them in their comments: “We established a data governance and analytics unit in 2015, which subsequently was expanded in March 2017 to a data analytics group (DAG). This serves a wide range of data-centric functions such as collecting data analytics techniques, including using big data technologies.”

If yes, in which of the following departments is it located?

Where central banks have a big data function, the statistics department is typically its base, though it may share some responsibility. Six central banks selected the statistics department along with another department, and six central banks said their big data work was shared across departments. A respondent from the Americas described their collaboration with the IT department: “The big data set is compiled from the banking system’s institutions, then it’s processed from the IT department for the statistics department’s use.”

Six central banks located their big data function in the IT department. Only one chose this option in isolation, with the remainder selecting a combination of options. These were, in the main, small institutions. A central banker who typified this said: “It was initially proposed to have this team more closely aligned with the business but they report to the chief information officer.” Several respondents stressed the links between the IT department and their data analytics teams. A respondent from a central bank in Asia said: “The data analytics unit reports directly to the assistant governor responsible for group-wide IT.” Another respondent commented on the collaboration between the two: “DAG is a separate department, but works very closely with the IT department in implementing the necessary systems and architecture to support data collection and analysis.”

Does your central bank have a single allocated budget for handling data – including big data?

Central banks are allocating budget to data, although this is still the preserve of a minority. Those with a single allocated budget for the handling of data is double that reported in the 2016 survey. Fourteen central banks – 28% of respondents – have a budget assigned for big data. Developing and emerging-markets countries figured prominently in this group, making up two‑thirds. In some instances, this budget is supplied for specific big data projects. A European central banker said it was part of the bank’s protocol to allocate budget to projects: “All data projects that require organisational resources need approval from the organisational investment committee.” Of the 50 respondents, only two central bankers revealed their budget amount.

Thirty-six respondents do not have a single allocated budget. This group included all Middle East respondents and two-thirds of the European central bankers who took part in the survey. As many of these central banks do not have a specific big data function, budget is taken from departmental resources. A medium-sized institution said the statistics department was given a specific percentage of the budget.

Does your central bank have a strategy for collecting and managing collected data?

An overwhelming majority of central banks have strategies in place for dealing with collecting data and managing the collected data. Thirty-four central banks said yes to both options, with only one central bank having a strategy for collecting data. Two-thirds of respondents who answered yes to both were European. In comments, two themes prevailed: strategies in place for IT departments and outsourcing data collection and management. A central bank in the Americas referred to the first theme: “The central bank has an infrastructure of technology that supports database management in a planned and organised manner.” A European respondent epitomised the latter theme: “Data processing and collection is outsourced via regular procurement.” A central banker from Europe said data was collected via an online reporting portal: “Collected data is managed differently, depending on whether it is required from an analysis perspective or to satisfy mandatory reporting requirements.”

Thirteen central banks do not have a strategy for dealing with collecting and managing data. Transition and developing-economy central banks featured strongly in this group, which were typically smaller institutions. A respondent from Europe said: “The central bank has established the practice of collecting all input data through the ‘single entry point’ – through the department of financial statistics and review.”

Of the 50 survey respondents, only one had a strategy for collecting data, but not for managing it. In their comment, they said this was something the central bank is working towards changing: “To receive the information that the bank required from financial institutions, we have the organisation, processes and infrastructure necessary for data collection and its processing. Internal consolidation processes also include data processes that allow the integration of information. However, since we have just begun to implement big data solutions, we have not yet decided how to take data to the server cluster.”

What methods does your central bank employ for regulatory data collection?

Central banks typically use a suite of techniques to manage regulatory data collection. Self-developed data platforms are the most popular method, with almost all respondents from Europe employing this approach. While common, it tends not to be the only method used: 29 respondents chose it in combination with at least one other. The most popular combination was all three methods. One central banker said: “The vast bulk of data collected from a regulatory collection perspective is done through a self-developed collection platform.” A respondent from a large central bank in an industrial economy rejected commercial solutions: “We do not rely on external commercial solutions for confidentiality issues. However, we use both proprietary visual analytics software and open-source solutions to handle this kind of data.”

Commercial solutions were indeed a delicate issue for some central banks due to confidentiality concerns. One central banker from the Americas said: “We use commercial tools for extracting, transforming and loading (ETL). Data stage is the most used tool; however, we have some internally developed applications that use Pentaho for validations and online ETL processes.”

The second most popular choice was Excel and document-based handling, though this too was often employed in combination with another option. Only three central banks chose this option alone, two of which were from the Middle East.

Which represents the greatest challenge to data collection?

The quality of the data collected is the greatest challenge in the process of data collection. Twenty-eight respondents (57%) selected this option. Developing and emerging-market economies were in the majority here, with 10 respondents from an industrial economy and only two from transition countries. Respondents from two large central banks expanded on the issues they were grappling with.

A respondent from a large institution with more than 2,000 staff said: “The biggest challenge is dealing with unstructured data and semantics.”

For a central banker whose institution employs more than 3,000 staff the issue was cleaning data: “The development of risk models implies the need to implement data cleaning processes that allow the results of the algorithms to be more reliable. For this reason, data cleaning is one of our top priorities, continuing the need to process high volumes of information with better response times. Therefore, we are working to install a layer of statistical servers that will interact with the server cluster to reduce processing time and calculate complex metrics.”

Resourcing is also an issue for central bankers, as a respondent from Asia explained: “In collecting data from financial institutions, ensuring data quality – beyond simple validation checks such as correct summation – is paramount. However, the process of querying anomalies and assessing financial institutions’ responses is labour-intensive, especially as assessing financial institutions’ responses requires domain knowledge and experience.”

The second most significant challenge was processing large volumes of data, said 22% of respondents. Eleven respondents were from industrial and emerging‑market economies. Just over half were European, with an even representation globally. A central banker from Europe said: “The greatest challenge is in processing large volumes of unstructured data to filter out the noise and obtain the right signal. This affects the timely analysis of the collected data. Data quality is also an important issue when we deal with policy because we might have a false sense of precision and take the wrong action due to sampling composition bias and other statistical challenges connected with big data.”

The third most significant challenge was the timely analysis of collected data. Thirty-nine per cent of respondents – five central bankers from the Americas and nine from Europe – chose this option. The remaining five were from Africa, Asia and the Middle East. A central bank from Asia pointed out that priorities varied by department: “Statistics-relevant departments see timely analysis of collected data as the greatest challenge, and processing large volumes of data as the least challenging. However, the information management department ranks data quality as the most significant, and timely analysis of collected data as the least.”

Does your central bank collect data from social media to gauge sentiment on key issues related to central bank policy?

Social media is emerging as a source of data on sentiment for central banks, though this is a minority pursuit. Less than one-fifth of respondents collect data from social media to gauge sentiment on key issues related to policy. Respondents from central banks in developing and emerging-market economies in particular used this source. A respondent from Asia said: “The bank uses social listening services that collect data from social media (such as Facebook and Twitter) to gauge sentiment on key issues related to central bank policy.” One emerging‑market central banker said their central bank was in the process of developing a Twitter-based sentiment tool.

Thirty-nine central banks do not use social media to gauge public sentiment. More than three-quarters of respondents (81%) gave this answer, with all respondents from the Middle East and the Americas choosing this option. Several comments referenced future projects, however. For example, a central bank in Europe said: “There are some examples of this within the organisation but it does not have widespread traction at this point.” Another central banker – also from Europe – said: “Some projects with that focus are already in the pipeline.” In some cases, central banks made reference to using news articles rather than social media to gauge sentiment. This European respondent did so in their comment: “Recently we have initiated a project for construction of a policy uncertainty index, based on news articles.”

There are trends towards collaborative approaches in the market – what is your central bank’s view on data collaboration?

Central bankers see benefits from collaboration with others and those in the industry. Most see efficiency and cost reduction as the main areas in which the benefit will be felt. This was the most popular option with more than three‑quarters of respondents. European central banks dominated here, making up two-thirds of the total responses. One-third (13) of the 39 central banks were from industrial economies, and 21 were from developing and emerging-market economies.

For one-third of respondents, the most popular combination was all three benefits. A common theme was the implementation of new schemes and committees that encourage collaboration. A European central bank referred to the Irving Fisher Committee, where members work on “pilot projects”.

Similarly, a respondent in the Americas expressed the benefits a similar committee would provide for them: “Definitely, the collaboration – mainly of clean data and with the necessary quality – allows a greater efficiency of the processes, but to have a scheme that allows us to provide information to society in an accessible format has many benefits for society. Although, to reach this level, it is necessary to make an adequate analysis and an infrastructure design that allows collaboration with society without affecting the bank’s operations.”

Following closely behind this, 64% of respondents said that data collaboration is beneficial for innovation. All of the respondents from the Americas chose this option, whereas only half of the respondents from Europe prioritised innovation. Data collaboration being beneficial for transparency was also selected by 64% of respondents.

Has your central bank invested in any new technology in the past 12 months that supports developments in big data?

Considerable investment is being made in new technology to support developments in big data, with just under half of respondents investing in the past year. Twenty‑three central banks noted a change in technology in the past 12 months – a group in which large central banks from industrial economies featured prominently. A budget allocation allowed many central banks to invest in this area, with some developing their own data warehouses. A central banker from the Americas explained: “We have recently purchased a big data solution that is in the process of installation and configuration.” A respondent from a large institution commented: “More powerful servers and databases have been purchased for big data.”

A respondent from an industrial economy said: “The central bank developed a proof of concept for the AnaCredit project to explore the use of new infrastructures and software solutions, namely Hadoop, for the storage and analysis of big data. This technology may also be used in the corporate data warehouse technology stack.”

A respondent from Europe had been given the green light: “Budget approval and implementation process are under way.” Another European central bank was ahead of the curve: “We already invested in some new technology two years ago. We should improve our big data platforms in the near future, according to the demand of new indicators from the business units.” More investment is being made in this area, as exhibited by a central banker from Europe: “A new framework on reporting has been developed, covering all reporting institutions.”

Twenty-six respondents indicated their central bank had not made an investment in new technology in the past 12 months. More than two-thirds of respondents were from Europe. Common themes in the responses to this question referred to investments made before the reference period and the possibility of future investment in this area.

Which of the following new methods does your central bank use to analyse big data?

Central banks employ a range of tools to analyse big data. Data mining and trend forecasting are the most popular methods for data analytics, with visual analytics and machine learning also enjoying support. Typically, central banks employ a range of methods, with just nine respondents choosing a single option. A respondent from the Americas described the multiple methods they use: “We actually use visual tools and pattern recognition in our analysis. We are also exploring machine-learning techniques for forecasting purposes.” In the main, the larger the central bank, the more methods employed. This was the case for two very large central banks in Europe with more than 5,000 staff members: “We use almost all the techniques listed above as they are all important in analysing big data.”

The second central bank was pleased with the resources available to them: “There is a significant analytial skillset available within the organisation.”

Visual analytics was the third most popular option. Just over one‑third of respondents said they made use of this. Developing and emerging‑market economies made up half of the result here. A central banker from the Americas said: “Since our first challenge is the development of the risk model, we are using pattern recognition and visual analytics.”

A respondent from a small European institution said the central bank has no need for big data analytics methods as “the central bank doesn’t actually analyse stock of data requiring the use of the previously mentioned technologies”.

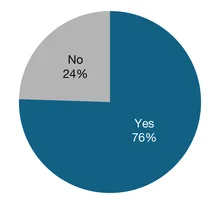

Does your central bank have a shared internal platform to enable different departments to access data resources?

Shared internal platforms are integral to working on big data, with three‑quarters of respondents using them to enable different areas of the central bank to access data resources. The same percentage gave this answer in 2016.

Thirty-seven respondents have a shared internal platform at their central bank. More than half were from developing and emerging-market economies, with only one-third from industrial economies. The comments made by respondents can be divided into two categories: central bankers using commercial software, and central bankers creating their own internal platforms. A central banker whose comments reflected the first category said: “We use commercial business intelligence and data storage software, such as Teradata and MicroStrategy.” A European respondent said their integrated reporting platforms used financial reporting. In the second category, central bankers were making use of internal systems.

A large central bank said: “We have a shared internal platform that allows all the members of our big data team to work on different projects based on big data.” A European central banker said: “Existing financial and statistical database is available for internal users from different units of the central bank.” Access to the internal platforms is restricted in some cases, as mentioned in this comment: “The information is in an institutional database management system so that employees with access privileges can consult the information. Our information policy is that the data must be available to all who require it for the fulfilment of their functions.” A similar sentiment was shared by a European central banker: “We apply a ‘sandbox’ environment that replicates production data and centralises it for organistional wide use where legally possible.”

A minority do not have a shared internal platform. Comments indicated that central banks were planning projects in this area. A respondent from Asia said: “The central bank plans to introduce a data warehouse to collect and store statistical data. As a result, we plan to concentrate all data in one place on a single platform.” A relatively large central bank said: “Information is shared internally on a need-to-know basis, but a single platform does not yet exist.”

Has your central bank launched any new cyber-security initiatives in light of developments in big data?

A considerable minority of central bankers have launched new cyber-security initiatives in light of developments in big data. However, this is an area in which more respondents are looking to invest further. Thirteen central banks said they have launched a new cyber-security initiative. Comments from central bankers tended to stress concern for the management of data and frameworks in place. One of the largest central banks that responded to the survey is restructuring its institution to alleviate concerns: “We are analysing the issues related to cyber security and are designing a computer emergency response team in the IT department.” A much smaller institution made a similar point: “We are in the process of defining and establishing new cyber-security frameworks for the bank, which will also include points of big data.” A European central banker said: “A number of initiatives have been launched, not solely in relation to big data but in relation to data management as a whole.”

Almost three-quarters of central bankers have not considered new cyber‑security initiatives at their institution. A majority were from European central banks; however, there was an equal spread between developing, emerging-market and industrial economies. There were very few comments here. A central banker from the Americas, however, gave a forward-looking comment: “In the next dates we will work with computer security specialists to design the necessary measures. In this first phase the server cluster will not be exposed.”

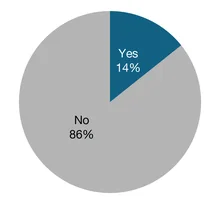

Does your central bank use external data storage, such as the cloud?

Central bankers tend to avoid external data storage – many view external data storage as a risk, particularly regarding security and confidentiality of data. All respondents from Asia and the Middle East were placed in this group, along with three-quarters of European respondents. Central banks from emerging‑market economies dominated, making up almost half the responses. Respondents’ comments revealed two key concerns over external data storage: conflict with central bank policy and the confidentiality of data.

Several central bankers said current IT or security policies prohibit the use of the cloud. Two central bankers expressed their concerns with confidentiality in external data storage – one of whom said their concern meant they would always store internally: “Even if external data storage can offer more flexibility and other advantages, it is better to develop big data platforms internally for confidentiality issues.”

An Asian central banker noted the conflict external data storage has with central bank policy: “Internal regulations restrict the use of external cloud resources.”

The other was looking to solve this issue for future use: “By the nature of our operation, there is sensitive or confidential information that we must safeguard; however, the possibility of information being stored in the cloud is being studied, if this favours collaboration with society.”

This view was shared by a central banker for the Americas: “We are studying the possibility of using the cloud as well as the roadmap to achieve this.” A European central banker did not feel the need for external data storage: “Internal storage is enough for existing databases.”

Seven central bankers said they use external storage. One European said this was introduced in 2017 for open data. A respondent from the Americas said: “We externally host non-confidential data for public use. Confidential data is only stored on servers owned and managed by the central bank.” Microsoft Azure, a cloud-computing software, proved popular as a storage facility to central bankers, with several making reference to it in their comments.

Notes

1. Emma Glass, ed., Central Bank Directory 2017, London; Risk Books 2016, xix.

2. A transition economy is an economy changing from a centrally planned economy to a market economy.

3. Administrative sources is the organisational unit responsible for implementing an administrative regulation (or group of regulations), for which the corresponding register of units and the transactions are viewed as a source of statistical data: OECD, Glossary of statistical terms, last updated on February 4, 2004, https://stats.oecd.org/glossary/detail.asp?ID=7

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com