Research

Low oil prices reduce future supply

Bank of Canada says the dramatic reduction in global demand and the decline in the spot price of crude oil may have significant implications for the future supply of oil

Why hot money hounded China

Bank of Japan obtains a picture of the flow of short-term funds into and out of China

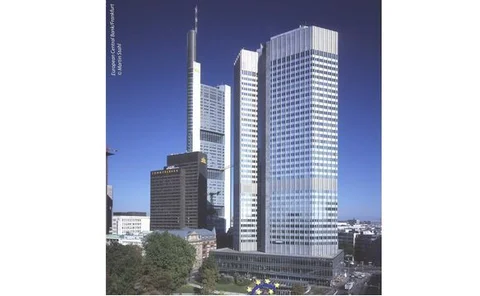

Pay cuts in Luxembourg rare

European Central Bank assesses the degree of wage flexibility in Luxembourg

Bagehot 's tenets needs to be revised

New York Federal Reserve investigates whether Bagehot’s 19th lender-of-last-resort doctrine still applies

Italy’s Visco : target global imbalances

Bank of Italy’s Ignazio Visco says that macroeconomic imbalances must be taken care of

Prices increases of manufactured goods low

Reserve Bank of Australia looks at price movement

Monetary policy for small economies

Bank of Albania publishes volume on monetary-policy strategies for small economies

No need for further euroisation in Cape Verde

International Monetary Fund finds that Cape Verde’s peg to the euro suits its economy just fine

Public-private partnerships affected by crisis

International Monetary Fund investigates the impact of the global financial crisis on public-private partnerships

Lender recourse increases the likelihood of default

Richmond Federal Reserve shows the impact of lender recourse on mortgage defaults

Labour productivity fosters booms

New York Federal Reserve shows labour productivity helps create bubbles

National Bank of Austria – Research Update newsletter

National Bank of Austria publishes latest Research Update newsletter

China’s international balance sheet to triple in ten years

Bank for International Settlements shows that China’s role as a creditor nation will increase in the future

Exchange-rate hedging reason for home-bias in equity holding

International Monetary Fund shows that households hold a disproportionate share of their equity portfolios in their own country’s equities due to exchange-rate hedging

US policymakers should implement Brady Plan-like measures

Boston Federal Reserve shows that lessons from the Latin American debt crisis can be applied to the US credit securitisation markets

Counterparty risk drives foreign-exchange swap market

Bank for International Settlements investigates dislocations in the foreign-exchange swap market between the dollar and three major European currencies

Banks’ capitalisation matters for monetary policy

Bank of Finland looks at the role of the banking sector in the monetary-policy transmission mechanism in an emerging economy with a rapidly developing financial system

Hong Kong’s markets mirror US in turbulent times

Hong Kong Monetary Authority looks at financial market interactions with the US and mainland China

Institutions key for China’s growth

Bank of Finland analyses whether institutions matter for China’s economic performance

Banks benefit more in bank-firm relationships

European Central Bank analyses the effects of bank-firm governance links on the global syndicated loan market

A fifth of prices change each month in Belgium

National Bank of Belgium examines how frequently prices change in Belgium

East Asia-Pacific central banks softened US shocks

Hong Kong Monetary Authority research finds East Asia-Pacific monetary authorities dampened shock from United States money market

Euro-area acceleration cycle industry driven

Banque de France provides quantitative assessment methods for euro-area business cycle analyses

High oil prices lift output of exporting economies

Bank of Finland research finds that for Iran, Kazakhstan, Venezuela, and Russia oil price positively affects output growth