Research

ECB paper explores fiscal adjustment in stressed countries

Fiscal corrections have been ‘more costly’ in contractionary times in Greece, Ireland, Portugal and Spain over the past 50 years, paper suggests

Heterogeneous beliefs may weaken effect of forward guidance, paper argues

Fixed-date and state-contingent guidance by the Federal Reserve led some market expectations to converge, but heterogeneous beliefs about inflation and consumption persisted

RBI economists attempt to pin down India’s natural rate

Researchers lend support to monetary policy by estimating natural interest rate; results imply the policy rate is now set more appropriately for tackling inflation

Turkish paper explores productivity differentials

Countries caught in middle-income trap suffered lower productivity gains than others that had ‘graduated’ from it, finds research focused on period from 1950-2005

Eurosystem’s asset purchase programme should increase growth by 1% annually, paper says

The Eurosystem’s asset purchase programme could increase growth and inflation by 1% annually for two years, a working paper from the Bank of Italy predicts

BoE paper explores money and credit at sectoral level

Working paper models sectors separately before ‘knitting’ them together; authors use framework to examine financial shock and use of quantitative easing to tackle it

Chinese slowdown could be harder than many economists think, paper argues

Chinese potential growth could be lower and its coming slowdown harder than many think; growth could slow to 5% annually by 2020, says French working paper

BIS paper offers method of overcoming time inconsistency in macro-prudential policies

Macro-prudential policies are necessary to prevent finance amplifying imbalances, but regulators struggle to credibly commit to policies, authors warn

European real effective exchange rates are hugely misaligned, paper argues

Real effective exchange rates for European Union countries do not correspond to national economic fundamentals, a working paper from the Bank of Lithuania argues

Emerging markets appear less susceptible to global contagion than advanced economies – BIS paper

Working paper explores whether central banks can still manage domestic financial conditions despite globalisation; isolates ‘contagion’ component in bond yield dynamics

Bundesbank paper explores why banks may lend too much

A limited number of banks may engage in excessive lending, and those that do are more likely to rely upon capital support, says Bundesbank paper

Increases in securitisation may lead to under-pricing of risk, study argues

Increased asset securitisation reduces premia on bonds and equities, Bank of Spain working paper says; decrease in cost of risk may not be related to an actual fall in risk

CCPs’ initial margins ‘significantly’ raise cost of repo funding, study argues

Initial margins charged by central clearing counterparties (CCPs) can increase the cost of funds raised in repo markets, a Bank of Italy paper argues

IMF working paper explores spillovers between United States and eurozone

Spillovers from the eurozone to the US have been ‘considerable’ since 2014, reflecting policy easing in Europe, IMF paper notes

BoE paper explores link between mortgage debt and consumption

Tighter credit conditions and concern over debt repayments may have led to a 2% drop in aggregate private consumption following the crisis, working paper says

BoE committee sees benefits of moving CCB in small steps

The Bank of England's Financial Policy Committee leaves the CCB at 0% but notes the system is ‘moving into a normal phase of the credit cycle’ and sees potential advantages in using smaller increments when the time comes

Fed policy has ‘little impact’ on labour market, paper says

Paper published by Minneapolis Fed argues there is little the Fed can do to restore the level of employment relative to the population that prevailed before the crisis

Credit growth has had significant impact on EM growth, IMF paper says

IMF paper explores relationship between the level and composition of credit growth and real GDP growth across 31 emerging market economies

Economists expected lower inflation under Yellen than Bernanke, SNB paper finds

Sample of economists from ‘reputable academic and policy institutions’ on aggregate expected slightly lower inflation under Yellen compared to if Bernanke had stayed on

Global factors harming domestic policy transmission in Asia, IMF research finds

Authors find global factors help to explain why bank funding in Asian economies has such a limited role in transmitting monetary policy

BoE paper extracts inflation expectations from market rates

Market rates are an imperfect measure of expected future inflation, say economists, who break them down into constituent parts, stripping out risk premia and the ‘wedge’ between RPI and CPI

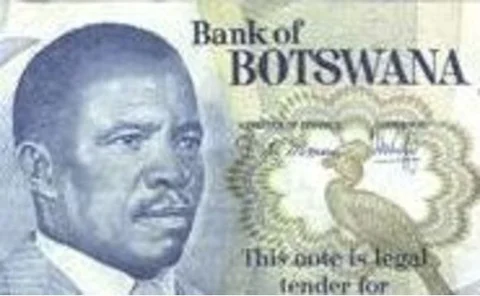

Botswana research weighs impact of various instruments on credit

While interest rates may be more effective at influencing credit than reserve requirements, more ‘direct’ macro-prudential measures could be even better, Botswana article finds

Global indicators can boost inflation forecasts in short term, paper finds

Author uses global inflation indicators and Brent oil price to augment domestic inflation forecasts in 523 countries, finding both improve accuracy

Lithuanian paper explores macroeconomic imbalances

Working paper advocates a more refined analysis of the misalignments in current accounts and real effective exchange rates for the macroeconomic imbalance procedure