Europe

Markets rejoice as Beijing reverts to managed float

Investor risk appetite soars as China drops the renminbi’s rigid dollar peg; analysts say Beijing’s policy shift sparked by potential benefits, rather than international pressure

Draghi backs EU move on stress tests

Bank of Italy governor Mario Draghi sees publication of results of stress tests of Europe’s biggest banks as key to calming market jitters; EU move follows Spanish decision to publish results of its stress tests earlier this week

Sri Lanka's Cabraal gets second term

Sri Lankan central bank governor Ajith Nivard Cabraal gets a further six years at the helm; credited with bringing inflation back under control

RBA minutes show central kept rates unchanged over euro fears

The Reserve Bank of Australia’s board kept rates on hold at 4.5% amid uncertainty over Europe’s fiscal position

Bank of England - Quarterly Bulletin (Q2 2010)

Bank's Quarterly Bulletin says yields on UK gilts fell in the last quarter due to lower expected future interest rates

US must clarify degree of Basel III implementation: Bini Smaghi

ECB executive board member Lorenzo Bini Smaghi says US needs to clarify its implementation of Basel III proposals

Market tensions prevail, Trichet warns

ECB president says financial sector still shows signs of stress despite the success of the central bank’s bond purchase program

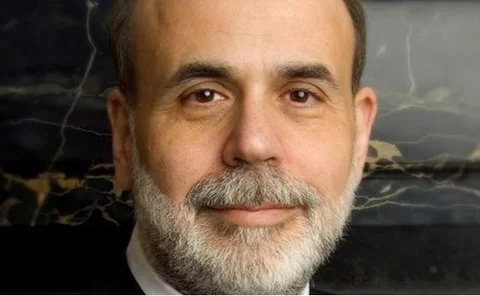

Bernanke: US should not rely on safe haven status of dollar

Federal Reserve chairman Ben Bernanke said country should take measures to cut deficit despite unique role in global currency markets

Shilling weakened after Kenya bought euros, say analysts

Analysts link recent weakness in Kenya’s shilling to euro purchases by the central bank

Asian economies not autonomous from Europe: IMF's Shinohara

Fund deputy managing director Naoyuki Shinohara touches on lessons from the crisis and how shocks in Europe reverberated in Asia

Ten legal gaps Europe’s regulators must close

René Smits identifies ten key issues that European financial legislators must consider when constructing the post-crisis regulatory framework

Mix of bad luck and policy fuelled credit boom in Eastern Europe

IMF research finds both bad luck and poor policymaking led to credit boom in new EU member states

Brussels calls for European ratings supervisor

European Commission proposes new body to oversee all credit ratings agencies operating in the European Union; security issuers must provide information to all agencies to boost competition

Barroso moots European ratings agency

European Commission president's calls echo those of Michel Barnier; says proposals will be released in September

Portugal's Constâncio: markets cannot self regulate

Bank of Portugal governor Vítor Constâncio discusses new vision of European regulation

Brussels backs bank tax to fund new resolution network

European Commission calls for a network of resolution funds to bear cost of winding down firms; cost covered through levy on lenders

Eurozone crisis weighs on Swiss exit plans: SNB's Jordan

Swiss National Bank deputy head Thomas Jordan says normalisation of monetary policy hampered by eurozone debt crisis

Trichet lays first stone at ECB’s new HQ

ECB president marks the start of building work at a ceremony in Frankfurt

Italy amends laws on capital gains to ease sovereign debt pressure

New laws imposed on capital losses by the Bank of Italy signals continued fragility in European markets

Europe to place CDS markets under spotlight: Barnier

European commissioner Michel Barnier says legislation in works requiring credit default swaps to be registered and made fully transparent; follows criticism of investors from European leaders

Ten issues for regulators to consider

René Smits devises ten key issues that European financial legislators must consider when constructing the post-crisis regulatory framework

Interview: Peter Praet

Fortis’s collapse all too well illustrated the difficulties in saving cross-border European banks. But the ideal solution, a European crisis resolution authority, remains a distant dream. However, there is an existing, yet perhaps unusual, candidate from…

NBB’s Praet backs DG Competition for EU resolution authority

National Bank of Belgium’s Peter Praet says Directorate General for Competition could play credible role in resolving failed banks

Banks should not rely on CDS spreads for credit risk

National Bank of Belgium study highlights a number of shortfalls in policymakers’ use of CDS spreads as an indicator for bank risk