European Union (EU)

QT ‘crucial’ if ECB is to tackle future crises, says Nagel

Bundesbank president says dollarisation by way of stablecoins could weaken European sovereignty

EU should ‘roll up its sleeves’ against China and US – BdF head

Villeroy de Galhau says Europe has ‘many cards to play’ in geopolitical game

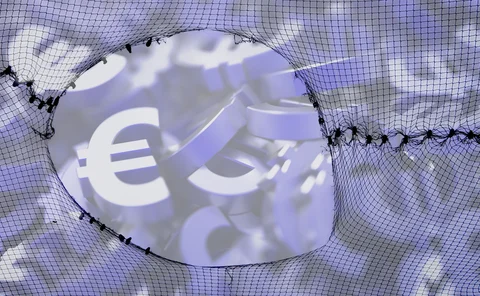

Academics call on European Parliament to back digital euro

Signatories of open letter say CBDC is vital to ensure Europe is not reliant on US payment providers

Baltics announce nominees for de Guindos’s position at ECB

Estonia proposes central bank governor, while Lithuania nominates finance minister

Bulgaria becomes 21st member of the eurozone

Joining currency bloc is a “sign of belonging”, says governor Radev, as peers offer welcome

National central banks hold rates across Europe

Albania, Czech Republic, Hungary, Norway and Sweden all leave policy unchanged

Russia’s Euroclear lawsuit ‘an empty gesture, but not meaningless’

Central bank will use Moscow courts to bolster claims for compensation in international forums, say experts

Eurozone bank uncompetitiveness a ‘myth’ – Schnabel

Regulations have made lenders better, says ECB board member

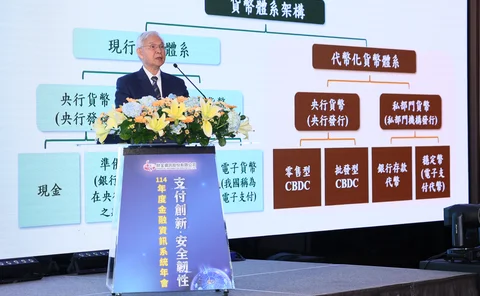

Taiwan’s Yang says central bank money remains global ‘anchor’

Governor says it is still ‘ultimate settlement asset’, notwithstanding development of tokenisation

Serbia says sanctions on Russia pose financial stability risks

Central bank sounds warning as government threatens to divest Russian stakes in domestic oil refiner

More independent central banks hold fewer dollars – research

De-dollarisation benefits Singaporean and Korean currencies, while Australia’s and China’s lose out

ECB finds holes in banks’ credit spread risk nets

Banks censured for insufficient evidence to support exclusion of products from CSRBB perimeter

Stress-test transparency: how much is too much?

The transparency drive to disclose bank stress-test results comes with costs

How EU supervisors react to interest rate risk outliers

Banks have faced no automatic penalties for breaching new NII test, but do come under microscope

Let risks stay in non-bank sector, says EU official

Regulators and experts discuss solutions to financial activities migrating outside banking system

Top officials weigh impact of trade war and AI

ECB president says impact of US tariffs has been “exact opposite” of expectations

Iceland, Romania and Serbia hold, while Poland cuts rates

High food inflation continues to affect eastern Europe

The ‘EuroLiber’ for depoliticised payments

Biagio Bossone explains how Europe could provide a neutral anchor to support international payments

European states announce improvements in payment systems

Denmark opts for back-ups, Sweden goes offline, Balkan states choose Sepa while Austria ups security

Book notes: Crisis cycle, by John H Cochrane, Luis Garicano and Klaus Masuch

This book ought to be read by anyone with an interest in or influence on the future development of the Emu

Merz backs using Bank of Russia funds to help Ukraine

Frozen central bank assets could collateralise €140bn interest-free loan, says German chancellor