News

BoE breaks ground with live Twitter Q&A

Bank of England chief economist Spencer Dale will answer questions on monetary policy and forward guidance through the central bank’s Twitter account tomorrow morning

Fiscal profligacy biggest threat to central bank independence, says Dudley

Netherlands Bank president Knot is concerned by the possibility of negative capital in central banks, but New York Fed's Dudley says the sustainability of national budgets is a bigger problem

China relaxes liquidity rules to fall in with Basel timeline

New approach to liquidity risk intended to reduce the regulation's pro-cyclicality; new rules come into effect on January 1, 2014

Cyprus finance minister says governor Demetriades is 'under scrutiny'

Harris Georgiades says expanded central bank board will improve governance; argues banks will succeed in raising equity as capital controls are lifted

RBA mulls further rate cuts as dollar keeps rising

Minutes of the latest monetary policy meeting show concerns remain over strong Australian dollar; new record low interest rate remains possible

Bank of Lithuania prepares for move into equities

Central bank announces plan to invest in riskier assets after returns on its foreign reserves drop close to zero; follows gradually increasing trend among central banks

BoE's Martin Weale still unsure over Carney's forward guidance by consensus

Bank of England's forward guidance dissenter explains ongoing qualms over how forward guidance works at the BoE, as he is re-appointed to a second term

Blanchard, Cecchetti, Frenkel and Taylor debate limits of central bank independence

Illustrious panel at Bank of Mexico conference debates pros and cons of central bank independence; Cecchetti says full independence is ‘at odds’ with democracy

G-20 inflation measure paves way for co-ordinating policy

New statistic aims to fill ‘data gap' identified in wake of the global financial crisis; follows growing calls for globally coordinated monetary policy as countries fret over effects of QE

European Council approves ECB's single supervisory mechanism

The SSM is a precondition for enabling the European Stability Mechanism to be able to directly recapitalise banks - breaking ‘the vicious circle' between banks and sovereigns, Council says

Riksbank hits back over ‘systematically inaccurate' inflation forecasts

Swedish central bank rebuffs claims from the National Institute of Economic Research, that it has overestimated inflation for more than a decade with implications for interest rates and growth

New BoE deputy says European banking union would benefit the UK

Jon Cunliffe says ECB has enough tricks up its sleeve to address any further shocks in the eurozone; believes the mutualisation of risk may prove a bridge too far for European banking union

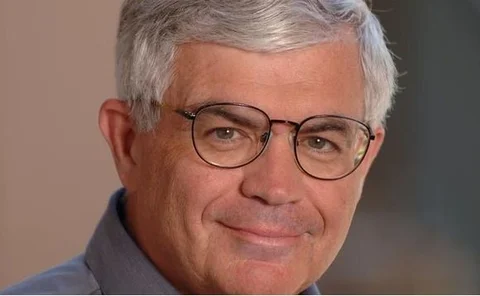

Economics Nobel goes to CBP board member Robert Shiller

Central Banking Publications advisory board member honored for work predicting long-term price trends; Eugene Fama and Lars Peter Hansen share the prize

Trichet sees 'conceptual convergence' among major central banks

Former ECB president flags ‘impressive' post-crisis consensus among major central banks over how to handle price and financial stability; says interest rates and QE should be handled separately

Progress of RMB internationalisation ‘spectacular’, says SFC official

Speaking at the FX Week Asia conference, deputy chief executive of Hong Kong regulator highlights the importance of continuing to internationalise China's currency

Clamour for action on IMF quotas as US continues to stall

Central bank governors and finance ministers unite to urge ratification of IMF quotas reform to boost emerging market representation; Alexandre Tombini tells US to take action

Fed’s Powell insists FOMC communication remains credible

Jerome Powell defends forward guidance on asset purchases after fellow FOMC member Plosser says September decision undermined its credibility; Eric Rosengren lays out communication challenges

RBI sets up mobile banking committee

Committee will examine the possibility of introducing a payment system allowing millions of unbanked Indians to make transfers using their handsets

Haldane dismisses talk of monetary and macro-prudential tensions

Bank of England’s Andrew Haldane says it is a ‘virtue’ that different tools can be used to meet conflicting objectives; backs central banks for macro-prudential responsibilities

EC's Pearson urges US and European regulators to ‘talk the same language'

European Commission's financial markets head tells US and European regulators to find common ground on the technical details of their reform programmes; Cyril Roux backs greater cooperation

BoE and IMF unveil changes in finance and fiscal departments

Bank of England appoints finance director and starts hunt for court of directors chair; IMF director of fiscal affairs stands down; Bank of Namibia assistant governor quits; and more

Big European companies reject third-party reporting for derivatives

Corporates fear they will still pay the penalty if mistakes are made by delegated reporting services

Central Bank of Brazil raises rates for fifth time in row

Unanimous vote hikes Selic rate to 9.5% – 2.25 percentage points higher than in April - in effort to combat inflation; Reserve Bank of India, meanwhile, provides financial system with more liquidity

Opposing Fed camps dig heels in on QE

Minutes from the FOMC’s September meeting highlight the deep and persistent divide between its participants; Obama points to Yellen’s ability to build consensus and personal strength