Financial Stability

Lambert will not take up seat on Bank’s FPC

Former Monetary Policy Committee member Sir Richard Lambert says he no longer wishes to become one of four external members of macroprudential body

Basel Committee unveils final proposals on pay

Basel Committee on Banking Supervision reveals risk-adjusted remuneration report; urges large firms to move away from remunerating employees based purely on their profits

Funding pressures influencing rate votes: BoE’s King

Bank of England governor Mervyn King notes gap between rates and funding costs “enormous”; says “big picture not changed much”

BoE’s Haldane calls for policy action on short-termism

Bank of England’s Andrew Haldane says public policy intervention may be needed to correct capital market myopia

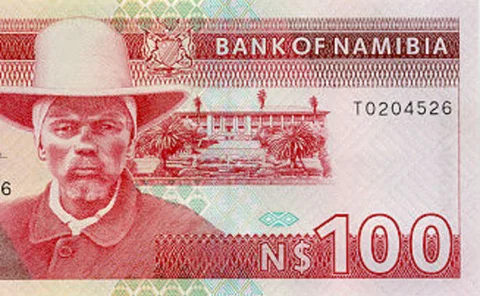

Bank of Namibia to issue new banknotes in 2012

New security features will be added to notes; old notes will still be legal tender

Turkey releases latest inflation report

Central Bank of Turkey April 2011 Inflation Report covers new policy strategy

IIF: cross-border resolution regime an ‘absolute priority’

Global trade body for banking industry calls on G-20 to set up task force; calls on banks to identify “critical functions” that need to be preserved in the event of failure

Yellen defends IMF proposals on capital controls

Federal Reserve vice-chair takes Fund line on framework to tackle capital inflows; follows criticism of framework from Indian, Brazilian officials

Elderfield details Ireland's new risk assessment model

Matthew Elderfield, head of financial regulation at the Central Bank of Ireland, reveals details of new ‘Prism’ risk assessment model

Too big to fail must end; FDIC chair Bair

Being labelled a Sifi will not mean being anointed too big to fail, leading to automatic bailouts, Federal Deposit Insurance Corporation chairman, Sheila Bair warns

EU governance reform falls short of quantum leap: Trichet

European Central Bank president Jean-Claude Trichet calls for less discretion to application of Stability and Growth Pact

Phasing in Basel III rules eases economic costs: IMF paper

Fund study shows that implementing higher capital and liquidity requirements over a lengthy period of time can help reduce the macroeconomic costs of enforcing such rules

Cash has a future: Sweden’s Nyberg

Riksbank deputy governor Lars Nyberg predicts cash will continue to be used for payment despite decline in usage

Indonesia issues tough sanctions for Citibank

Bank Indonesia bans Citi from opening branches for a year

Bernanke sheds light on new macroprudential approach

Federal Reserve chairman Ben Bernanke touches on benefits of new macroprudential approach in the United States under the Dodd-Frank Act

Mersch on Basel III liquidity proposals

Central Bank of Luxembourg governor Yves Mersch says Basel III bank liquidity proposals will prevent build-up in liquidity risk

ECB’s Tumpel-Gugerell on cost of ex-post crisis measures

European Central Bank executive board member Gertrude Tumpel-Gugerell says large costs to clean up asset-price bubbles should lend support to more preemptive policies

Bank of England keep rates at record low

Bank holds for fourteenth month in a row

Sarb’s Mminele on policymaking in volatile markets

South African Reserve Bank deputy governor Daniel Mminele discusses challenges for policymakers in uncertain financial markets

ADB discusses stability, inflation and the dollar at AGM

Annual general meeting of the Asian Development Bank touches on core issues for the region; stability, inflation and reforming the international monetary system

Draghi calls for EU law to govern bail-in powers

Financial Stability Board chairman Mario Draghi says measures to enable bondholders to receive haircuts before the collapse of a financial institution should be placed in European Union legislation

Wellink clarifies position on Greece restructuring

Media reports suggest Netherlands Bank president Nout Wellink is open to a debt restructuring for Greece; central bank spokesperson denies suggestions, says president’s views remain in line with European Central Bank

SNB turns profit in first quarter following steep loss in 2010

First quarter profits likely to come as relief after criticism that greeted $20.7 billion loss in 2010

Turkey’s Yilmaz explains motivation behind policy strategy

Central Bank of Turkey governor Durmuş Yilmaz says combination of liquidity management facilities, reserve requirements and policy rates will help achieve price and financial stability in Turkey