Governor of the year: Andriy Pyshnyy

Pyshnyy kept Ukraine’s wartime economy stable and won vital foreign support under huge pressure

Andriy Pyshnyy became governor of the National Bank of Ukraine in October 2022 in exceptionally difficult circumstances. His predecessor had resigned unexpectedly, eight months after Ukraine had been invaded by Russian troops. Some observers were worried by president Volodymyr Zelensky’s nomination of Pyshnyy, the former head of a state-owned savings institution. The novice central banker had to run the NBU amid a massive economic contraction, finance hugely increased government spending and keep payments systems running despite Russian attacks.

To maintain stability, the NBU needed good relations with two sets of partners: foreign donors and the Ukraine government, especially the finance ministry. It had to prevent a collapse in the value of hryvnia-denominated assets, rampant inflation and shocks to financial institutions. Foreign donors had provided billions of dollars of budget support to Ukraine in 2022. But their payments had frequently been delayed, which put pressure on the hryvnia. The central bank and the finance ministry had sometimes struggled to co-ordinate fiscal and monetary policy.

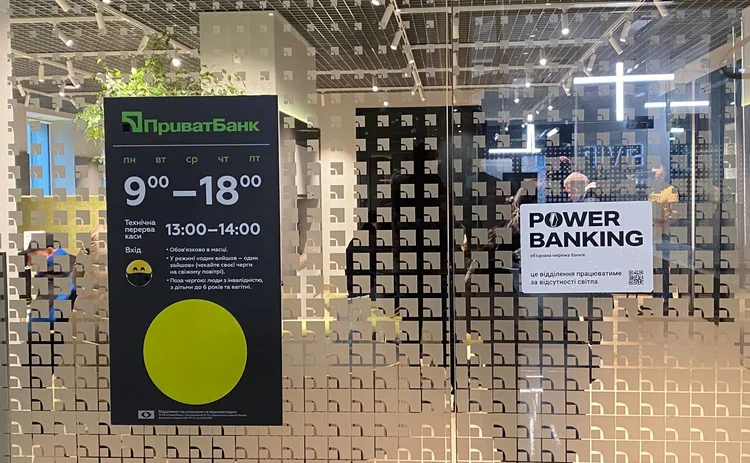

One immediate challenge came from significantly increased Russian missile and drone attacks on Ukraine’s energy infrastructure, threatening the ability of banks to function. Pyshnyy made it a priority to ensure banks could still operate. The NBU’s ‘power banking’ project provides lenders with access to standby energy sources and communication channels, better cash-collection capacity and extra staff. ‘Power banking’ now enables 2,350 branches to provide services to customers during prolonged electrical blackouts.

But the NBU faced other challenges. Pyshnyy saw his main goal as restoring confidence in the NBU. He instituted regular meetings with foreign donors, notably with the International Monetary Fund, and put considerable effort into meeting its targets. At home, the NBU governor used the national economic council to forge bonds with key policy-making institutions, especially the finance ministry.

Speaking in confidence, senior officials say Pyshnyy proved very effective in handling the NBU’s relationships with Ukrainian institutions and external donors. These efforts yielded significant results. In 2023, Ukraine received financial support worth $43 billion from foreign donors, 34% higher than the previous year’s figures. The donors also provided most of this aid on time and in the amounts they had pledged, which helped ease financial pressures. Ukraine signed the IMF’s first Program Monitoring agreement in late 2022, setting stringent targets for economic management and reform. The NBU played a lead role in meeting these targets, and Ukraine received an extremely positive IMF report. That in turn led to the IMF agreeing an Extended Fund Facility with Ukraine, and encouraged foreign governments to increase their financial support.

Increased budgetary support was one factor helping to strengthen Ukraine’s economy, which permitted the NBU to lift some of its emergency measures. In 2022, it had to carry out monetary financing of the government’s emergency spending worth 400 billion hryvnia ($10.5 billion). But, in 2023, it felt able to end this policy. In 2023, the Ukrainian government was able to issue 566 billion hryvnia worth of sovereign debt, compared with the 252 billion hryvnia it had raised in 2022.

After the February 2022 invasion, the NBU moved from a floating to a fixed currency regime. It devalued the hryvnia in February and again in July 2022, and then defended it with currency restrictions, rate rises and market interventions. But the NBU decided that it could not keep these restrictions in place for the entire war, fearing they would lose their effectiveness and create macroeconomic imbalances, Pyshnyy tells Central Banking. “The flexible exchange rate, inflation targeting – these were the achievements that created a safety margin for Ukraine before the full-scale Russian invasion,” he says.

We will not deviate from this objective, or the objective of resuming inflation targeting, but maintaining exchange rate sustainability will remain our important task for a long time

Andriy Pyshnyy, National Bank of Ukraine

The NBU decided it would gradually liberalise its currency regime. In October 2023, it moved to a regime with managed flexibility. To bolster stability, the NBU built up its highest-ever level of foreign exchange reserves, increasing them by 42% in 2023 to $40.5 billion. The hryvnia’s value against major foreign currencies weakened initially before largely stabilising, but Pyshnyy says the NBU was unperturbed. These movements, he says, “were not dramatic for us: we understand that foreign exchange should depend on market factors, including things like seasonality”. Under the new regime, the depth of FX markets for the hryvnia increased fourfold, he adds. The NBU has no intention of going back on its commitments, he tells Central Banking: “We will not deviate from this objective, or the objective of resuming inflation targeting, but maintaining exchange rate sustainability will remain our important task for a long time.”

There were fears domestic savers would abandon the currency for the dollar, but policy-makers helped keep hryvnia-denominated deposits attractive. Retail term deposits with banks in the domestic currency grew by 37% year on year in 2023, while more liquid demand deposits also grew rapidly. Banks are offering borrowers average interest rates of 11–12% after tax, above the expected inflation rate at the year’s end, protecting the value of households’ savings. The interest rates available on Ukraine’s sovereign debt securities ranged between 14% and 19%.

Inflation rose rapidly at the beginning of the invasion, reaching a peak of 26.6% in October-December 2022. But it fell to 5.1% a year later, and 4.7% in January 2024 – figures that many central banks not confronting a war might be glad of. Inflation is now back within the NBU’s last target range of 5%, plus or minus one percentage point. Pyshnyy says the NBU is determined to return to a formal inflation targeting regime.

The NBU raised policy rates by 100 basis points when war began and did so by an extraordinary 1,500bp in June 2022, when fears grew over the hryvnia. It then held rates for over a year. In 2023, with inflation falling, its monetary policy committee cut rates four times, for a total of 1,000bp. The NBU also sought to improve policy transmission by changing reserve requirements for banks. Restoring the domestic debt market, so that Ukraine can fund its defence without resorting to monetary financing, is a key NBU priority, Pyshnyy says. In 2023, domestic debt market borrowings more than doubled to UAH 566 billion ($15 billion).

Operational issues

Under Pyshnyy’s leadership, the NBU has also addressed many operational issues, including upgrading its procurement processes and tackling heightened fraud issues. Its ‘procurement armour process’ effectively digitized how the NBU procures goods and services. The NBU now conducts procurement via online platforms that allow participants to submit applications, take part in auctions and manage contracts electronically.

“We developed regulations and implemented digital solutions for different scenarios. These range from temporary lack of internet to full blackout, and even the full demolition of all our bank’s offices and extermination of all procurement personnel,” says Andriy Telupa, NBU procurement head. “We had to make the system fully decentralised and work across our 80 departments. We had very little time and had to be very fast about it.”

The NBU says more than 87% of its contract documents were signed in electronic form between September 2022 and September 2023 – a 60% increase on the previous 12 months.

Another operational challenge came as losses from payment card fraud increased by 46% in 2022. More than half of the losses (53%) occurring due to what the NBU terms ‘social engineering’ – or phishing. The NBU says it detected more than 4,500 such phishing sites that year. In 2023, the central bank claims it has detected and blocked about 100 such sites daily, with more than two-thirds of them originating from Russia. In response, from May to December 2023, the NBU and more than 70 partners ran a #GoodByeToFraud campaign, aiming to alert five million cardholders to the risks.

The job of Ukraine’s central bank governor is a difficult one at the best of times. But October 2022, when Pyshnyy started leading the National Bank of Ukraine, was a particularly daunting time. Some observers worried that Pyshnyy’s lack of central banking experience would hamper him, but the new governor brought distinctive strengths to the role. He rapidly identified key priorities for the NBU, and made sure it devoted resources to them. The ‘power banking’ scheme kept Ukrainian banks functioning despite widespread attacks on the country’s power grid. Following his exceptional leadership under extraordinary pressure, the NBU was able to begin to end monetary financing and to loosen its emergency FX restrictions. Perhaps most importantly, Pyshynyy forged close working relationships with the NBU’s domestic and foreign partners. This boosted trust in Ukraine’s economic policy-makers, which was vital to secure the budgetary support the country needed.

The Central Banking Awards 2024 were written by Christopher Jeffery, Daniel Hinge, Dan Hardie, Joasia Popowicz, Ben Margulies, Riley Steward, Jimmy Choi and Blake Evans-Pritchard.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com