Conduct

RBNZ welcomes external probe into Covid-era monetary policy

Finance minister says bank’s easing and asset purchases caused ‘decades-high inflation’

Full ‘postmortem’ on QE yet to be written – Klaas Knot

Former DNB governor expects Fed to continue international monetary diplomacy under Warsh

Weak yen prompted BoJ’s December rate hike, minutes show

Japan likely to continue tightening, though board said it had ‘no specific pace in mind’

ECB tweaks collateral framework, ‘paves way’ for DLT-based assets

Bank clarifies ‘climate factor’ in securities pricing, introduces haircuts on sterling, dollar and yen assets

BoK debuts bespoke AI for central bank use

Technology trained on Korean language inputs will aid research and compliance, Bank of Korea says

China’s interest-bearing CBDC a world first, experts say

E-CNY now more integrated with commercial banking, thus solidifying country’s two-tier system

Renato Gomes on Pix, Drex and digital asset regulation

Brazil’s deputy governor speaks with Christopher Jeffery about pros and pitfalls of open finance, financial inclusion and crime on Pix, and the need to sideline DLT for Drex phase 3

2025: The year in central banking

A look back at the biggest and most popular stories of the year

Richard Doornbosch on central banking in a tempestuous climate

The president of the Central Bank of Curaçao and Sint Maarten speaks to Christopher Jeffery about addressing legacy financial scandals, transition to a Caribbean guilder, tapping gold holdings and managing a currency peg at a time of US policy uncertainty

MNB puts sectoral buffers in place as real estate pressure mounts

Subsidised loans have increased demand for property eightfold, central bank finds

Market interaction key to effective FX interventions – panel

Central bankers from the Americas say data and communication help to reduce volatility

BSP remains cautious about stablecoins as proposals roll in

Deputy governor says most submissions are for dollar-backed assets focused on retail use

Experts see Japan’s PM having limited impact on BoJ independence

Takaichi’s hints on policy direction have precedent in Abenomics, former bank officials say

Is independence compatible with climate action?

Lessons from China indicate relationship between governments and central banks may need to change, argues Mathias Larsen

Stress-test transparency: how much is too much?

The transparency drive to disclose bank stress-test results comes with costs

RBNZ plans to relax lending restrictions for home purchases

New Zealand central bank says moves will make borrowing easier for first-time buyers

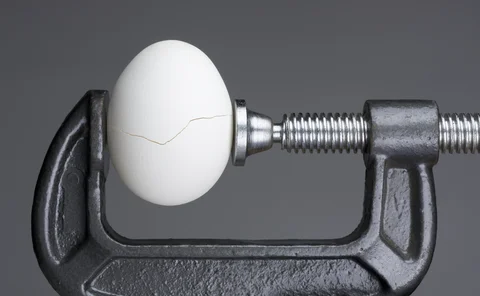

Central bankers’ compromised immunity

Just how much legal protection should officials have from spurious lawsuits or wrongful dismissal?

Lagarde says US-EU deal lowered uncertainty ‘considerably’

ECB president voices concern over Fed independence, French debt

Supervisors to work with tech sector on AI transparency project

HKMA, FCA and BIS will also engage with the banking industry over the next 12 months

Economists lambast Cook’s ‘firing’ for lack of due process

Expert says if Trump succeeds it will be the end of Fed independence; governor sues to void presidential order

Climate risks still on the fringe of monetary policy in Asia

Notwithstanding efforts by the PBoC and BoJ, there is still a need to observe persistent and measurable impacts on inflation and output before climate change truly influences interest rate policy, argues Sayuri Shirai