Resolution

ECB tweaks collateral framework, ‘paves way’ for DLT-based assets

Bank clarifies ‘climate factor’ in securities pricing, introduces haircuts on sterling, dollar and yen assets

Nigeria revokes mortgage lenders’ licences

Central bank says closure of Aso and Union Homes due to poor compliance culture

New capital requirements will reduce borrowing costs – RBNZ

Lenders to hold substantially less than under previous recommendations

ECB looks to simplify bank regs, supervision and reporting

Recommendations include merged buffers, lesser reporting burdens and an easier life for smaller banks

Stress-test transparency: how much is too much?

The transparency drive to disclose bank stress-test results comes with costs

EBA’s Campa on simplifying EU regulations and supervising stablecoins

The departing pan-European supervision chief speaks about advancing the banking union, streamlining the implantation of new rules, financial resilience and why he is stepping down early

IMF to provide Sri Lanka with additional $347m in financing

Mission chief says central bank should continue to be independent and build reserves

ECB working to simplify banks’ annual health checks – Donnery

Srep will become more tailored to lenders, says supervisory board member

A not-so-stable Genius Act?

New stablecoin rules raise monetary sovereignty and financial stability concerns

Supervision Benchmarks 2025 – executive summary

Data reveals focus on digitalisation and widespread use of suptech tools

Boris Vujčić on Croatia’s economic journey, the digital euro and the Governing Council

The Croatian National Bank (HNB) governor speaks with Christopher Jeffery about managing financial risks, the pros and cons of euro adoption, payment system reform and the use of real-time data

Ex-OCC chief Michael Hsu on the impact of an America-first agenda

The former acting comptroller of the currency speaks with Christopher Jeffery about the future of the US Treasury market, Fed independence, financial de-regulation, the Genius Act and international co-operation

MREL cut must be paired with more external funding – BIS’s Restoy

Reforms to resolution regime might appear technical but entail political choices, FSI chair argues

Should the Fed mandate collateral pre-positioning at the discount window?

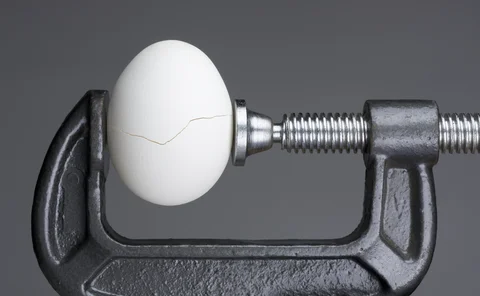

Supervisor wants lenders to be ready to access central bank facilities, but formalising pre-positioning has some drawbacks

Sweden moves to improve liquidity provision in resolution

Riksbank and debt office develop “joint approach” to clarify how lenders can source liquidity in crisis

Do central banks need more tools to regulate the financial system?

Policy-makers from Armenia, Thailand and New Zealand share perspectives on how to keep up with the ever-changing industry

‘Sandpile’ model makes case for supervisory intervention

IMF paper finds that arranging sales of failing banks is best policy, despite some side effects

FSB: big banks could be sidelined from future rescue deals

Exacerbation of too-big-to-fail means G-Sibs could already be too large to take extra assets

Central banks need to step up their crisis management plans

Patrick Honohan argues that robust preparation can better protect reputations in the event of a crisis

Banks should be operationally ready for liquidity support – BIS

Institution calls on authorities to improve lenders’ preparedness for central bank liquidity

Nandalal Weerasinghe on Sri Lanka’s IMF programme, central bank reforms and road to recovery

The Central Bank of Sri Lanka governor speaks about his return from retirement to aid Sri Lanka’s structural reforms and recapitalisation, reinforce central bank independence and develop financial resilience